Avangrid (AGR) Places First Solar Panels at Powell Creek Project

Avangrid Inc. AGR announced that it has installed the first solar panels (Golden Row) at its Powell Creek solar project in Putnam County, OH, near Miller City.

The Golden Row signifies the initial row of solar panels that will serve as the blueprint for the remainder of the construction. Since the installation of Golden Row, Avangrid has proceeded with construction activities on-site. It has also successfully added more than 1,000 panels so far.

Powell Creek is located on a property that is directly rented from the owner. It is expected to contain approximately 300,000 solar panels, capable of producing sufficient power to supply energy to at least 30,000 households annually.

The construction work at Powell Creek started in the latter part of 2023, marking Avangrid's second renewable energy endeavor in Ohio. Avangrid completed the Blue Creek wind farm in 2012, boasting a capacity of 304 megawatts (MW) and producing sufficient power for nearly 76,000 homes annually.

Focus on Renewable Energy

Avangrid is the third largest solar and wind generator in the United States, with $44 billion of assets. It has reached 8.7 gigawatts (GW) of installed capacity. In addition, a total of 990 MW is currently under construction. This includes 472 MW of renegotiated power purchase agreements (PPAs) and 526 MW of new PPAs signed in 2023. Nearly 700 MW of these projects are to support data centers with clean energy from onshore wind and solar. AGR has plans to repower more than 4,600 MW of its existing portfolio in the coming years.

The company plans to create a clean generation portfolio and achieve Scope 1 and Scope 2 carbon neutrality goals by 2035. Also, it aims to reduce Scope 1 greenhouse gas emissions by 35% within 2025 (from the 2015 baseline). To meet its carbon neutrality goal, AGR is focused on adding wind and solar projects to its portfolio.

These initiatives can help the company to eventually lower its cost of operations by focusing on new and advanced assets. New products and services may lead to added revenue streams.

Renewable Energy Generation is on the Rise

Per the U.S. Energy Information Administration (“EIA”), the annual share of U.S. electricity generation from renewable energy sources should be 23% and 25% in 2024 and 2025, respectively. Solar power is the fastest growing source of electricity in the United States. EIA expects 36 billion kilowatthours (BkWh) of more electricity in the United States (from solar) in the second half of 2024 compared with the prior-year level. This represents a year-over-year increase of 42%.

Along with AGR, some other electric power industry companies like Duke Energy DUK, NextEra Energy, Inc. NEE and Dominion Energy, Inc. D are also adopting measures to meet clean-energy targets.

Duke Energy is focused on reducing Scope 2 and certain Scope 3 emissions by 50% (below 2021 levels) by 2035. The company currently operates 1,200 MW of solar in Florida, with plans to continue adding approximately 300 MW in 2024. With this, DUK remains on track to bring 1,500 MW of solar in service by 2024-end and 6,500 MW by 2031-end.

DUK’s long-term (three- to-five year) earnings growth rate is 6.1%. The Zacks Consensus Estimate for 2024 EPS indicates a year-over-year increase of 7.4%.

NextEra Energy is aiming to reduce total carbon emissions by 67% within 2025 from the 2005 level. During the first quarter of 2024, it placed into service nearly 1,640 MW of new, cost-effective solar projects in operation and expanded its contracted renewables backlog by adding 2,765 MW of renewable projects. It expects to add 33-42 GW of new renewables to the generation portfolio via clean energy investments in the 2023-2026 period.

NEE’s long-term earnings growth rate is 8.6%. The Zacks Consensus Estimate for 2024 EPS indicates a year-over-year increase of 7.3%.

D aims to cut emissions by 70-80% within 2035 from the 2005 level. Its long-term objective is to add 24 GW of battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 and increase the renewable energy capacity by more than 15% per year, on average, over the next 15 years.

D’s long-term earnings growth rate is 13.6%. The Zacks Consensus Estimate for 2024 EPS indicates a year-over-year increase of 38.2%.

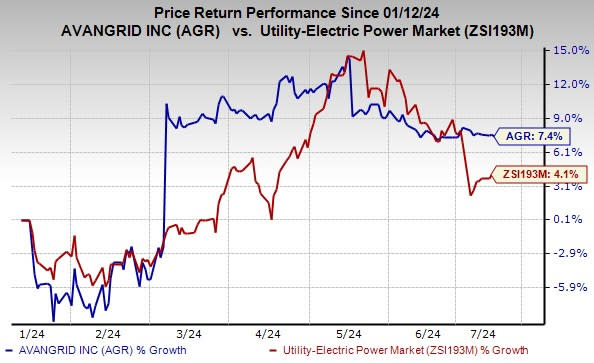

Price Performance

In the past six months, shares of AGR have risen 7.4% compared with the industry’s 4.1% growth.

Image Source: Zacks Investment Research

Zacks Rank

AGR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance