AtriCure Leads Three Undervalued Small Caps With Insider Actions In United States

The U.S. stock market recently experienced a notable uplift, with the S&P 500 reaching an all-time high, influenced by dovish remarks from Federal Reserve Chairman Jerome Powell and positive performance indicators like Tesla's earnings beat. In such a buoyant market environment, identifying undervalued small-cap stocks can offer potential opportunities for discerning investors looking for growth potential beyond the headline-grabbing giants.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Columbus McKinnon | 20.9x | 1.0x | 46.09% | ★★★★★☆ |

PCB Bancorp | 9.0x | 2.4x | 43.79% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 30.50% | ★★★★★☆ |

AtriCure | NA | 2.6x | 49.50% | ★★★★★☆ |

Titan Machinery | 3.6x | 0.1x | 30.49% | ★★★★★☆ |

Chatham Lodging Trust | NA | 1.3x | 17.37% | ★★★★☆☆ |

Papa John's International | 20.1x | 0.7x | 36.35% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -151.75% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -144.21% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

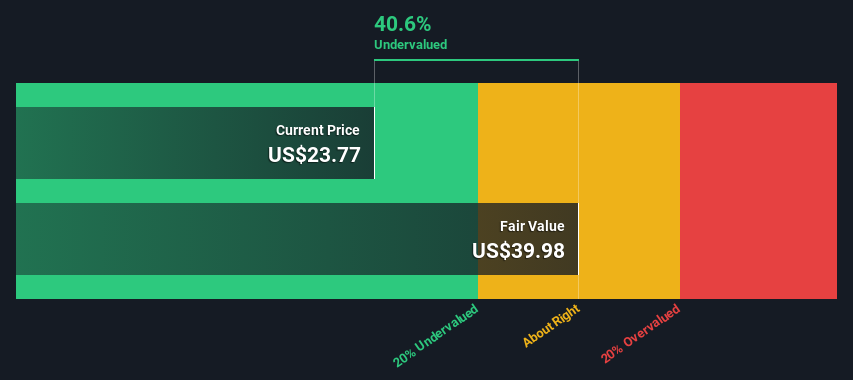

AtriCure

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.47 billion.

Operations: Surgical & Medical Equipment generated $414.60 million in revenue, with a gross profit margin consistently above 70%, peaking at 75.26% in the latest period. This segment has seen an upward trend in gross profit despite fluctuations in net income margins, which have been negative across all reported periods.

PE: -29.1x

AtriCure, a lesser-known entity in the healthcare sector, recently projected a robust 15-17% revenue growth for 2024, aiming for $459 to $466 million. This follows a significant first-quarter sales increase to $108.85 million from $93.49 million year-over-year, despite widening net losses. The company's innovation shines with the launch of cryoSPHERE+, enhancing surgical efficiency by reducing freeze times—a key advancement given its widespread use in over 60,000 procedures. While currently unprofitable and not expected to reach profitability soon, their strategic moves suggest they're positioning for impactful market presence.

Take a closer look at AtriCure's potential here in our valuation report.

Review our historical performance report to gain insights into AtriCure's's past performance.

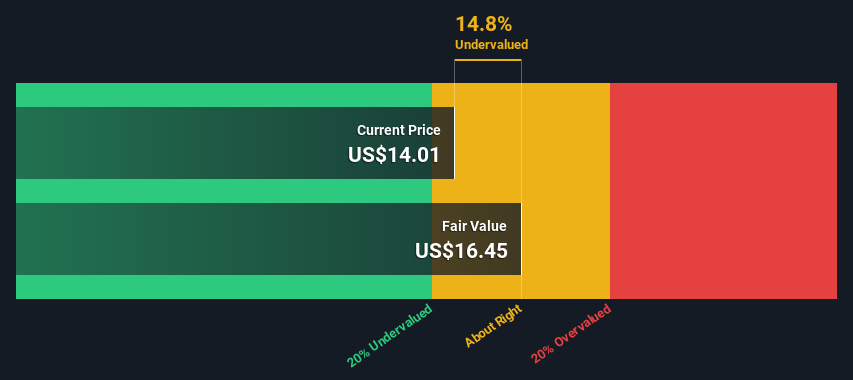

Ramaco Resources

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ramaco Resources is a company engaged in the coal mining industry, with a market capitalization of approximately $699.84 million.

Operations: In its Metals & Mining - Coal segment, the company generated a revenue of $699.84 million. Gross profit margin stood at 25.27%, reflecting the cost management relative to sales revenue.

PE: 13.3x

Ramaco Resources, reflecting its potential in the market, recently saw insiders increasing their stakes, signaling confidence. This move aligns with a robust first quarter production increase of 13% year-over-year and an expansion in credit facilities to US$275 million to bolster further growth. Despite a dip in net income this quarter, the company's strategic leadership reshuffles and operational expansions indicate a proactive approach to scaling operations and enhancing shareholder value.

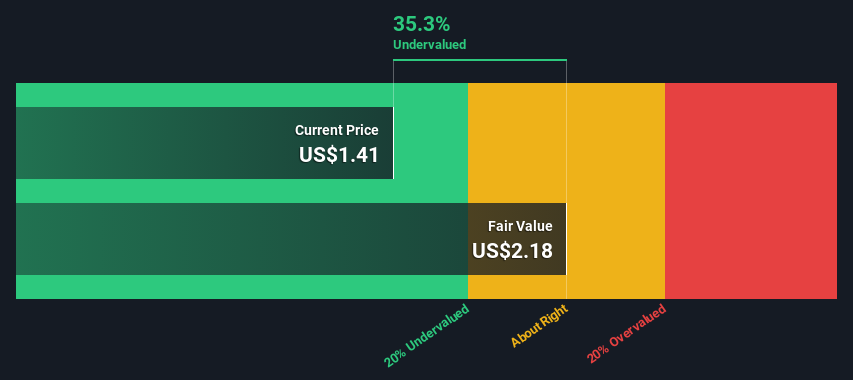

Clear Channel Outdoor Holdings

Simply Wall St Value Rating: ★★★★★☆

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations segmented into Europe-north, America (excluding airports), and airports, with a market capitalization of approximately $0.65 billion.

Operations: The company generates revenue primarily from America (excluding airports) with $1.11 billion, followed by Europe-north at $630.45 million, and airports contributing $334.74 million. The gross profit margin has shown fluctuations over the periods analyzed, most recently recorded at 48.15% as of mid-2024, indicating the proportion of revenue exceeding the cost of goods sold before accounting for other operating expenses.

PE: -4.9x

Despite recent financial challenges, including a net loss in Q1 2024, Clear Channel Outdoor Holdings demonstrates potential for recovery with a projected increase in revenue up to US$2.26 billion by year-end. Insider confidence is evident as they recently purchased shares, signaling belief in the company's future. With significant exposure at high-profile conferences and strategic amendments to its bylaws enhancing governance, this entity stands out as an intriguing prospect within the undervalued segment of the market.

Summing It All Up

Click here to access our complete index of 61 Undervalued Small Caps With Insider Buying.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:ATRC NasdaqGS:METC and NYSE:CCO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance