ASX Growth Companies With Insider Ownership As High As 28%

Following a week of mixed performances, the ASX200 is poised for a modest uptick, reflecting broader market reactions to global economic signals and specific updates from key sectors. In this context, understanding the significance of insider ownership in growth companies becomes particularly relevant, as it often indicates confidence in long-term prospects amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

Plenti Group (ASX:PLT) | 12.6% | 106.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Here we highlight a subset of our preferred stocks from the screener.

Bell Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bell Financial Group Limited, operating in Australia, offers broking, online broking, corporate finance, and financial advisory services with a market capitalization of approximately A$416.97 million.

Operations: The company generates revenue through four primary segments: Retail (A$103.58 million), Institutional (A$50.36 million), Products & Services (A$48.10 million), and Technology & Platforms (A$26.20 million).

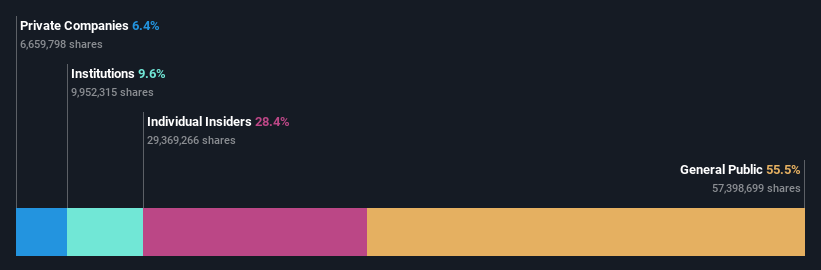

Insider Ownership: 10.7%

Bell Financial Group, a growth-oriented company with high insider ownership in Australia, is trading at 26.5% below its estimated fair value. While the dividend coverage is weak, BFG's earnings are poised for significant expansion, with an expected annual increase of 26.9%, outpacing the Australian market's forecast of 13.8%. Revenue growth is also robust at 5.6% per year, slightly above the national average of 5.1%. However, its projected Return on Equity of 16.3% suggests moderate efficiency in generating profit from shareholder equity.

IPD Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: IPD Group Limited, operating in Australia, specializes in the distribution of electrical equipment and has a market capitalization of approximately A$454.87 million.

Operations: The company generates revenue through its Products Division, which brought in A$215.98 million, and its Services Division, which contributed A$20.79 million.

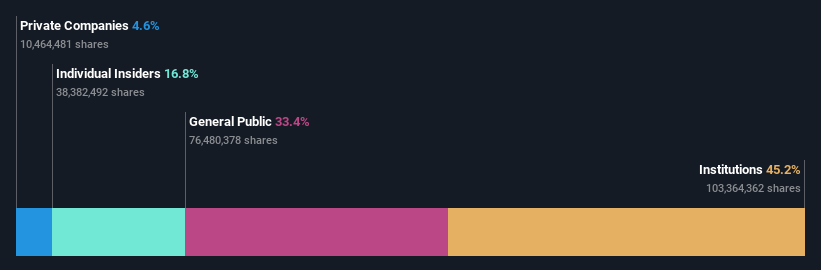

Insider Ownership: 28.4%

IPD Group, an Australian growth company with high insider ownership, is poised for substantial growth. Its earnings and revenue are forecast to expand by 25.88% and 23.6% per year respectively, significantly outstripping the broader Australian market forecasts of 13.8% for earnings and 5.1% for revenue growth. Currently trading at a 9.8% discount to its fair value, IPD also presented at the Bell Potter Emerging Leaders Conference on May-29-2024, underscoring its active engagement with investors.

Get an in-depth perspective on IPD Group's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility IPD Group's shares may be trading at a premium.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$589.65 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.2%

IperionX, despite generating less than US$1m in revenue, is positioned for significant growth with revenue and earnings expected to increase by 76.4% and 47.36% per year respectively. Recently valued at 79% below its estimated fair value, the company has also engaged in strategic partnerships and equity offerings—raising A$50 million at A$1.91 per share—to bolster its innovative titanium production capabilities for diverse high-performance sectors including defense and aerospace.

Unlock comprehensive insights into our analysis of IperionX stock in this growth report.

Upon reviewing our latest valuation report, IperionX's share price might be too optimistic.

Taking Advantage

Access the full spectrum of 90 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BFG ASX:IPG and ASX:IPX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance