ASX Growth Companies With High Insider Ownership And Revenue Increases Up To 76%

Amidst a challenging session on the ASX, with the broader market trending downward and only the energy sector showing resilience, investors might find solace in exploring growth companies that not only demonstrate robust revenue increases but also feature high insider ownership. Such characteristics can be particularly appealing in volatile markets, as they often suggest that company leaders have significant skin in the game, aligning their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Plenti Group (ASX:PLT) | 12.6% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

DUG Technology (ASX:DUG) | 28.3% | 43.3% |

Let's take a closer look at a couple of our picks from the screened companies.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$543.31 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.3%

Revenue Growth Forecast: 76.5% p.a.

IperionX, an Australian growth company with high insider ownership, is navigating a transformative phase. Despite recent shareholder dilution and a net loss reported for the half-year ending December 2023, IperionX is poised for significant revenue growth (76.5% annually), outpacing the broader Australian market's 5% growth rate. Strategic partnerships in the U.S., including a deal to supply titanium products for military and industrial applications, underscore its potential in niche markets. The company's move towards profitability within three years aligns with its innovative approach to titanium production, leveraging advanced technologies for enhanced sustainability and efficiency.

Mesoblast

Simply Wall St Growth Rating: ★★★★★☆

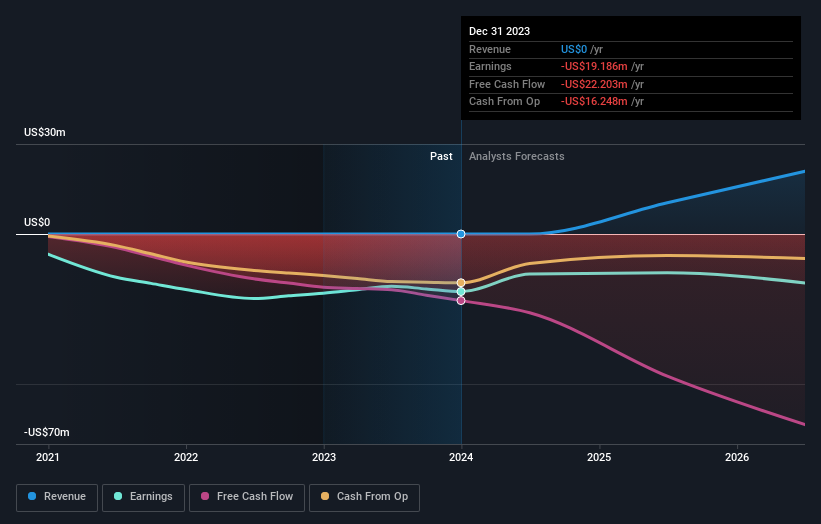

Overview: Mesoblast Limited, operating in Australia, the United States, Singapore, and Switzerland, focuses on developing regenerative medicine products with a market capitalization of approximately A$1.35 billion.

Operations: The company generates revenue primarily from its development of adult stem cell technology, totaling $7.47 million.

Insider Ownership: 22.2%

Revenue Growth Forecast: 55.3% p.a.

Mesoblast, an Australian biotech firm with significant insider ownership, is currently trading at a substantial discount to its estimated fair value. Despite a slight earnings growth over the past five years, it's set for rapid revenue and profit expansion, projected at 55.3% and 56.75% per annum respectively. This growth is bolstered by robust insider buying in recent months and promising clinical advancements, including potential accelerated FDA approval pathways for its heart failure treatment. However, shareholder dilution over the past year and high share price volatility may raise concerns among investors.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally, with a market capitalization of approximately A$5.79 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services at A$83.83 million, and consulting services amounting to A$68.13 million.

Insider Ownership: 12.3%

Revenue Growth Forecast: 11.1% p.a.

Technology One, an Australian software company with high insider ownership, shows a promising financial trajectory despite not leading in growth metrics. Its earnings have increased by 13.1% over the past year with revenue rising from A$201.01 million to A$240.83 million in the latest half-year report. The company's Price-To-Earnings ratio stands at 52.8x, below the industry average of 61.1x, indicating potential value relative to peers. While its annual earnings growth forecast of 13.8% slightly surpasses the Australian market average, it remains below more aggressive growth benchmarks.

Next Steps

Unlock our comprehensive list of 89 Fast Growing ASX Companies With High Insider Ownership by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:IPX ASX:MSB and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance