ASX Growth Companies With High Insider Ownership And At Least 26% Earnings Growth

Amidst a generally downward trend in the ASX200, with notable dips in sectors like materials and utilities, there are still segments showing resilience, such as industrials. In this context, identifying growth companies with high insider ownership can offer investors potential stability and commitment from those who know the companies best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

Plenti Group (ASX:PLT) | 12.6% | 106.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Here we highlight a subset of our preferred stocks from the screener.

IPD Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: IPD Group Limited, operating in Australia, specializes in the distribution of electrical equipment and has a market capitalization of approximately A$468.31 million.

Operations: The company generates revenue primarily through its Products Division, which brought in A$215.98 million, and its Services Division, which contributed A$20.79 million.

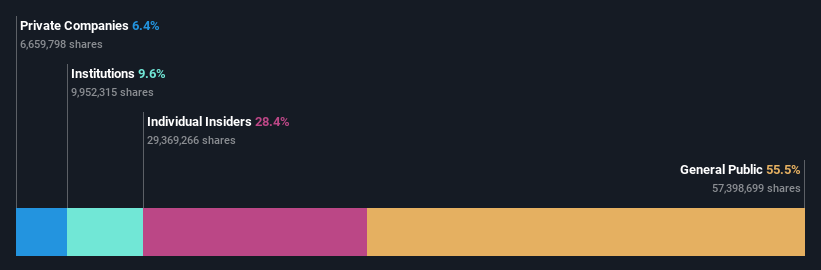

Insider Ownership: 28.4%

Earnings Growth Forecast: 26% p.a.

IPD Group, presenting at the Bell Potter Emerging Leaders Conference on May 29, 2024, is recognized for its robust growth metrics. The company's earnings are expected to surge by a significant 26% annually, outpacing the Australian market's average. Additionally, IPD's revenue growth forecast at 23.8% annually also exceeds market expectations. Despite these strong growth indicators and trading below its fair value by 11.9%, concerns include a forecasted low return on equity of 19% in three years and recent shareholder dilution.

Navigate through the intricacies of IPD Group with our comprehensive analyst estimates report here.

Our valuation report unveils the possibility IPD Group's shares may be trading at a premium.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$602.31 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

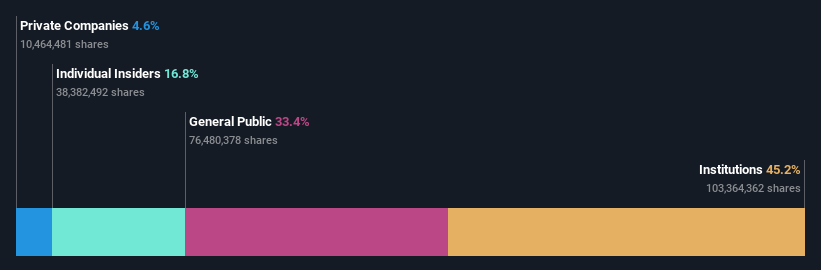

Insider Ownership: 15.2%

Earnings Growth Forecast: 47.4% p.a.

IperionX, despite its modest revenue, is poised for significant growth with a forecasted annual revenue increase of 76.4%, notably outpacing the Australian market. Recently, it secured a partnership with Vegas Fastener Manufacturing to supply titanium alloy components for U.S. Army vehicles and other sectors, highlighting its expanding influence in critical industries. However, challenges such as recent shareholder dilution and a substantial net loss of US$10.5 million as of December 2023 underscore financial vulnerabilities amidst its expansion efforts.

Mesoblast

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is a biotechnology company focused on developing regenerative medicine products, operating in Australia, the United States, Singapore, and Switzerland, with a market capitalization of approximately A$1.40 billion.

Operations: The company generates revenue primarily through its development of adult stem cell technology platform, totaling A$7.47 million.

Insider Ownership: 22.2%

Earnings Growth Forecast: 56.8% p.a.

Mesoblast, an Australian biotech firm, is navigating a transformative phase with high insider buying and strategic leadership changes, including the appointment of Jane Bell as non-executive Chair. Despite a volatile share price and recent shareholder dilution, Mesoblast is on track for significant revenue growth (55.3% per year) and anticipates profitability within three years. The company's promising pipeline includes therapies like remestemcel-L for acute graft versus host disease with a potential accelerated approval pathway highlighted by recent FDA interactions.

Get an in-depth perspective on Mesoblast's performance by reading our analyst estimates report here.

Make It Happen

Gain an insight into the universe of 90 Fast Growing ASX Companies With High Insider Ownership by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:IPG ASX:IPX and ASX:MSB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance