ASX Growth Companies With High Insider Ownership To Watch

Amidst a backdrop of fluctuating commodity prices and mixed global market performances, the Australian Securities Exchange (ASX) is experiencing varied dynamics, notably influenced by a recent slump in iron ore prices. In such an environment, growth companies with high insider ownership on the ASX offer a unique proposition, potentially aligning closely with shareholder interests and demonstrating confidence in their business models during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.6% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 59.8% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

BlueBet Holdings (ASX:BBT) | 25.2% | 85.1% |

Chrysos (ASX:C79) | 21.3% | 63.5% |

Here's a peek at a few of the choices from the screener.

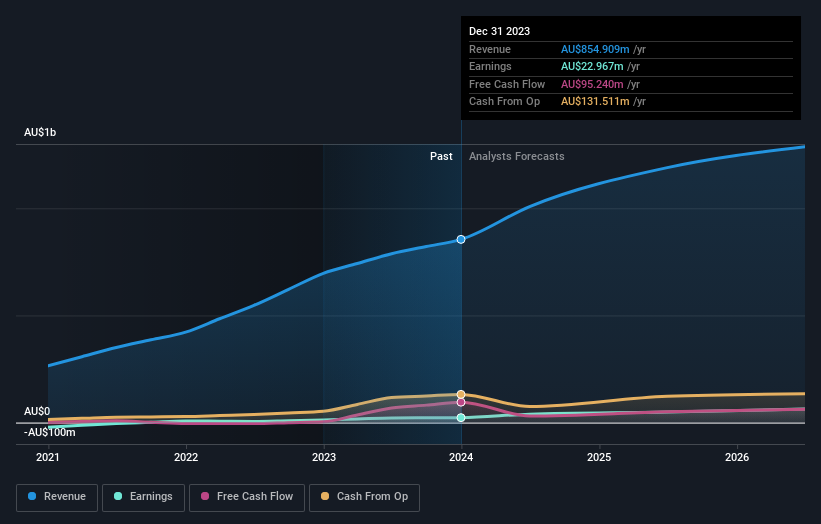

Aussie Broadband

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited offers telecommunications services to both residential and business customers across Australia, with a market capitalization of approximately A$1.03 billion.

Operations: The company generates revenue through its telecommunications services, with segments including Residential at A$549.59 million, Business at A$94.21 million, Wholesale at A$125.25 million, and Enterprise and Government at A$85.85 million.

Insider Ownership: 10.8%

Earnings Growth Forecast: 26.4% p.a.

Aussie Broadband, a company with high insider ownership, is navigating a growth trajectory with its earnings expected to increase by 26.4% annually. Despite recent insider selling and shareholder dilution over the past year, the firm is actively pursuing acquisitions to enhance its fibre assets and maintain dominance in residential revenues. Trading at a substantial discount to fair value, Aussie Broadband's revenue is also set to outpace the Australian market average significantly.

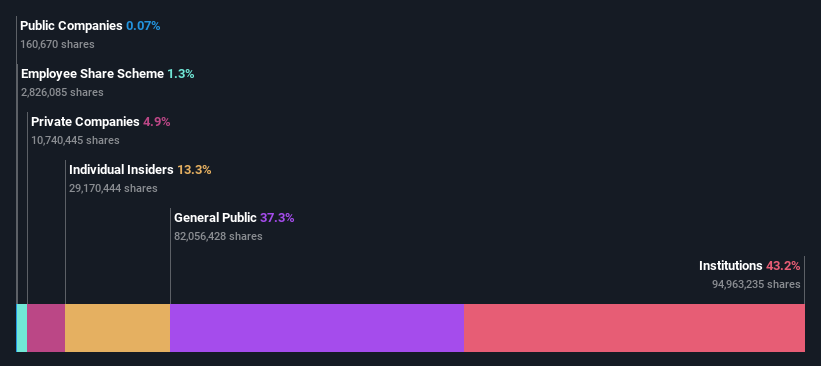

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of approximately A$4.73 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel segments, with A$1.28 billion from leisure and A$1.06 billion from corporate services.

Insider Ownership: 13.3%

Earnings Growth Forecast: 18.8% p.a.

Flight Centre Travel Group, with high insider ownership, is currently trading at 16.6% below its estimated fair value. The company's revenue growth at 9.7% per year is expected to outperform the Australian market's 5.3%. Although its earnings growth of 18.8% per year isn't considered very large, it remains above the market average of 13.1%. Recently becoming profitable, Flight Centre also anticipates a strong return on equity of 21.8% in three years.

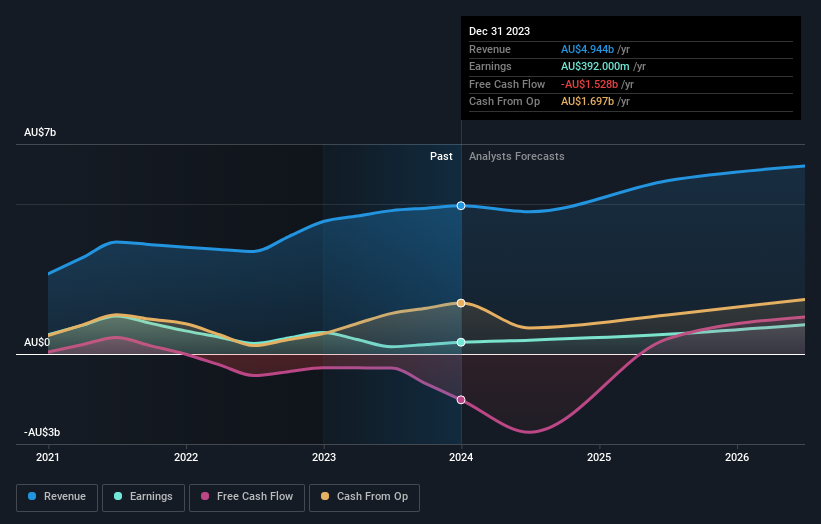

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited, with its subsidiaries, serves as a mining services company operating in Australia, Asia, and internationally, boasting a market capitalization of A$11.38 billion.

Operations: The company generates revenue from several key segments: Lithium (A$1.60 billion), Iron Ore (A$2.50 billion), and Mining Services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 27.5% p.a.

Mineral Resources, characterized by high insider ownership, is trading at a significant discount of 39.1% below its estimated fair value. While its profit margins have declined from 16.3% to 7.9%, earnings are projected to grow robustly at 27.5% annually, outpacing the Australian market forecast of 13.1%. Revenue growth is also strong at 12.1% per year, exceeding the market's expectation of 5.3%. The company's return on equity is expected to be high at 25.8% in three years.

Turning Ideas Into Actions

Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 89 more companies for you to explore.Click here to unveil our expertly curated list of 92 Fast Growing ASX Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:ABB ASX:FLT and ASX:MIN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance