Asia ex-Japan ESG bonds to remain flattish from all-time high in 2021: J. P. Morgan

Year-to-date, China issued nearly half (49%) of all ESG bonds in Asia ex-Japan.

Financial markets are generally down but investors’ appetite for environmental, social and corporate governance (ESG) bonds is set to hold steady this year, says J. P. Morgan in its ESG Financing Outlook 2023.

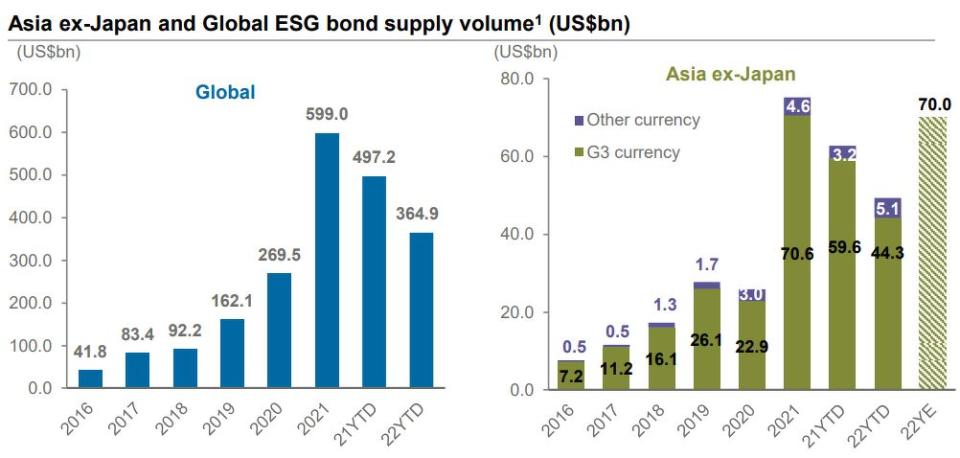

As of Oct 17, global ESG bond supply volume for 2022 stood at US$364.9 billion ($518.97 billion), down from US$497.2 billion this time last year and an all-time high of US$599.0 billion for the full year 2021.

Within Asia ex-Japan, ESG bonds totalled US$49.4 billion as of Oct 17, of which US$44.3 billion was issued in the G3 currencies: the US dollar, the Japanese yen and the euro. J. P. Morgan projects this to reach US$70.0 billion at the end of 2022, largely flat y-o-y from the all-time high of US$75.2 billion issued last year.

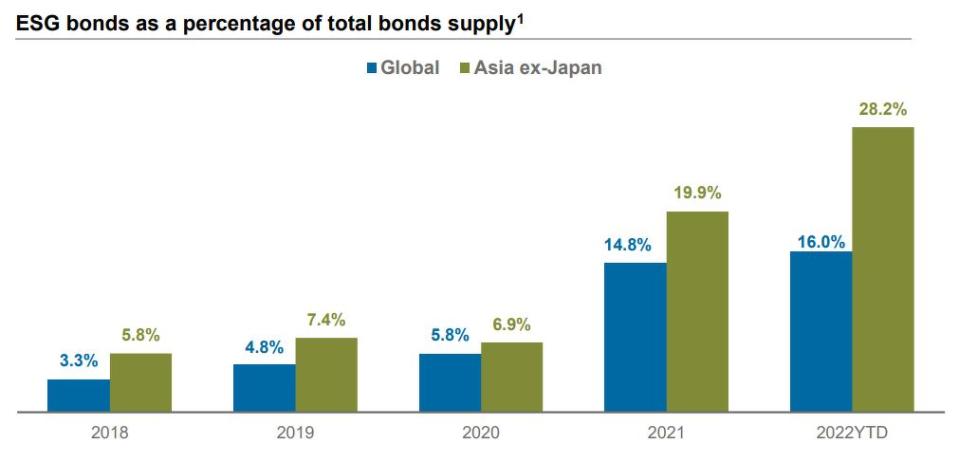

As a percentage of total bond supply, ESG bonds made up 16.0% for global issuances year-to-date as of Oct 17. Within Asia ex-Japan, ESG bonds made up a much larger proportion, at 28.2%.

ESG bonds include green, social, sustainability bonds and sustainability-linked bonds (SLB). The data includes all the international market issuances and excludes private placements, money market, asset backed, covered and mortgage-backed securities.

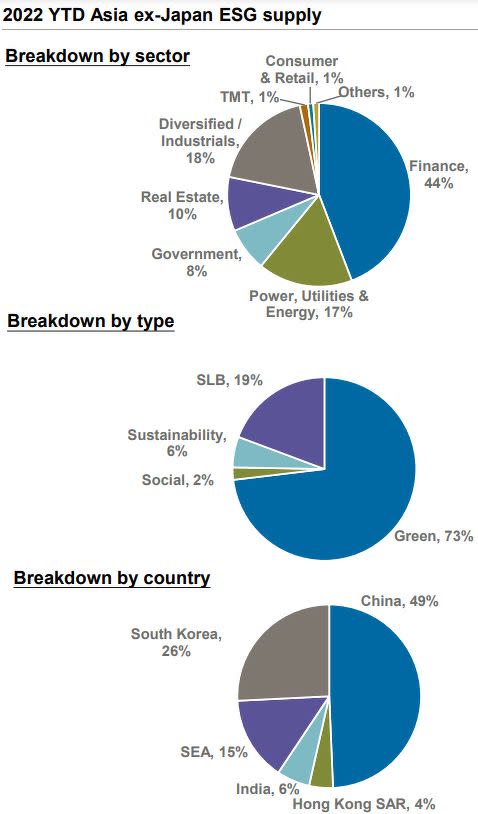

Green bonds made up the lion’s share of ESG bonds in Asia ex-Japan, says J .P. Morgan. As of Oct 17, green bonds made up 73% of ESG bond supply, followed by SLB (19%), sustainability (6%) and social bonds (2%).

Year-to-date, China issued nearly half (49%) of all ESG bonds in Asia ex-Japan, followed by South Korea (26%), Southeast Asia (15%), India (6%) and Hong Kong (4%). J. P. Morgan defines Southeast Asia as the Philippines, Indonesia, Malaysia, Thailand, Pakistan, Singapore and Vietnam.

Growing Asian market

China’s ESG bond market dominance at 49% is up from some 46% last year. Banks dominated issuance volume as they focus on transmitting China’s transition plans, while issuers from industrial and utility sectors also accessed the market, according to an Oct 19 presentation by Madhur Agarwal, head of debt capital markets (DCM) origination, Asia ex-Japan; Puja Shah, head of ESG DCM, Asia ex-Japan; and Jessica Chen, head of China DCM.

Chinese onshore ESG bond issuance volume reached RMB1,206.5 billion ($237.48 billion) as of Oct 17, up 21.7% up from RMB991.5bn this time last year.

Over the same period, Chinese offshore ESG bond issuance volume shrank 10.8% y-o-y to US$25.7 billion.

Southeast Asia bond supply remained stable, they add. “Sovereigns such as the Philippines and Indonesia dominated volume in US dollar space. The Singapore dollar was a currency of choice in the ESG space for several issuers including the Singapore sovereign.”

Sovereign issuances

The ESG market has grown as demand outweighs supply, says J. P. Morgan. “The global green bond universe has reached US$2.26 trillion in size, with sovereign issuances being the fastest growing segment.”

In US dollar-denominated bonds globally, the average oversubscription was 3.8x for green bonds and 2.7x for vanilla equivalents, says J .P. Morgan. The spread compression averaged 29.3 bps for green bonds and 22.5 bps for vanilla bonds.

Sovereigns are leading the way. 2022 has so far seen the debut ESG bond issuances by the Philippines and Singapore, along with the sixth ESG bond by Indonesia.

Elsewhere, Mongolia set up its green bond issuance regulations, while the Republic of Chile, Hungary, Mexico, Paris, UK, Italy, Federal Republic of Germany, Austria, City of Gothenburg and “many other sovereigns” have marked ESG bond issuances in 2022.

‘ESG is mainstream’

The capital markets’ focus on ESG is set to stay, says J. P. Morgan. Global investments in energy transition reached a new record at US$755 billion in 2021, up 26.9% from 2020. Energy and transportation accounted for more than 80% of total investment.

The ESG market will continue to grow as a proportion of the Asia bond market. J. P. Morgan expects the 2023 ESG market to make up 35%-40% of bond issuances, up from 28% today, driven primarily by investment grade-rated issuers.

“ESG is mainstream. While overall volumes have dropped, focus on ESG especially among financial institutions remains strong,” says J. P. Morgan.

Sovereigns are driving the push on investments, which will translate to financing markets, adds J. P. Morgan. “China topped in investment in energy transition in 2021 at US$266 billion. Most of the investment made in China was spent in renewable energy and transport sectors.”

Central banks are now focusing on developing climate stress testing, while ESG rating agencies face calls for transparency with regards to how they collect, analyse and calculate sovereign and corporate ESG metrics, says J. P. Morgan.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Recession warnings are hard to find in Wall Street bank earnings

HDB to issue $800 mil in five-year green senior bonds with 4.09% p.a. coupon

Maybank lowers ST Engineering's TP, net profit forecasts amid rising interest rates

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance