Ashtead Technology Holdings And Two More UK Stocks That Could Be Trading Below Their Estimated True Value

The United Kingdom stock market has shown resilience, rising 7.4% over the past year with earnings expected to grow by 13% annually. In such a promising environment, identifying stocks that may be trading below their true value could offer attractive opportunities for investors looking for potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £25.40 | £48.57 | 47.7% |

Morgan Advanced Materials (LSE:MGAM) | £3.145 | £6.11 | 48.5% |

Mercia Asset Management (AIM:MERC) | £0.30 | £0.58 | 48.5% |

WPP (LSE:WPP) | £7.394 | £13.84 | 46.6% |

LSL Property Services (LSE:LSL) | £3.23 | £6.03 | 46.4% |

Loungers (AIM:LGRS) | £2.66 | £5.23 | 49.1% |

Deliveroo (LSE:ROO) | £1.29 | £2.47 | 47.7% |

Ricardo (LSE:RCDO) | £4.88 | £9.02 | 45.9% |

Elementis (LSE:ELM) | £1.492 | £2.82 | 47.1% |

Aston Martin Lagonda Global Holdings (LSE:AML) | £1.507 | £2.95 | 48.8% |

Let's explore several standout options from the results in the screener

Ashtead Technology Holdings

Overview: Ashtead Technology Holdings Plc specializes in renting subsea equipment for the offshore energy industry across Europe, the Americas, Asia-Pacific, and the Middle East, with a market capitalization of approximately £595.69 million.

Operations: The company generates £110.47 million in revenue from its oil well equipment and services segment.

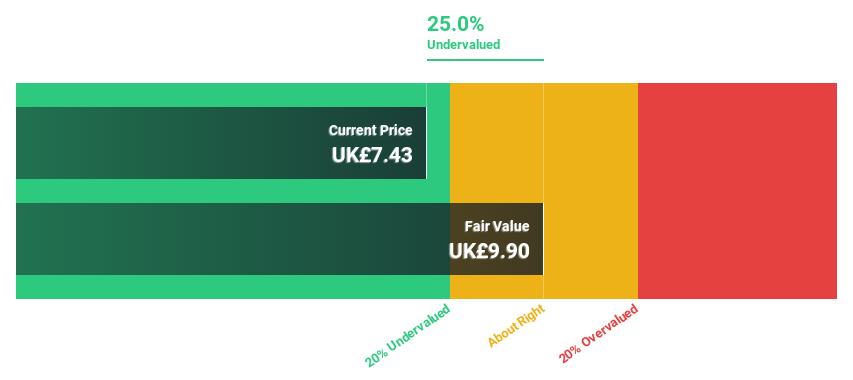

Estimated Discount To Fair Value: 25%

Ashtead Technology Holdings, valued at £7.43, trades below its estimated fair value of £9.90, reflecting a 25% undervaluation. Despite a high level of debt, the company's earnings have grown by 74.4% over the past year with forecasts suggesting further growth at 15.39% annually, outpacing the UK market's expected 12.5%. Additionally, significant insider selling has occurred in the last three months which could indicate caution among those closest to company operations.

Barratt Developments

Overview: Barratt Developments plc is a UK-based housebuilder with a market capitalization of approximately £4.57 billion.

Operations: The primary revenue stream, generating £4.39 billion, comes from its residential construction activities in the UK.

Estimated Discount To Fair Value: 21.9%

Barratt Developments, priced at £4.72, is undervalued by over 20%, with its fair value estimated at £6.04. Despite a drop in profit margins from 9.4% to 5% over the past year and dividends not well covered by earnings or cash flows, the company's earnings are expected to grow significantly, surpassing UK market averages with an annual forecast of 20.1%. Additionally, revenue is projected to increase at a rate of 6.2% annually, outperforming the UK market growth expectation of 3.5%.

Foxtons Group

Overview: Foxtons Group plc is a UK-based estate agency specializing in residential property services, with a market capitalization of approximately £206.60 million.

Operations: The company generates revenue through three primary segments: sales (£37.16 million), lettings (£101.19 million), and financial services (£8.78 million).

Estimated Discount To Fair Value: 32.9%

Foxtons Group, priced at £0.68, is considered undervalued, trading 32.9% below its calculated fair value of £1.02. While its revenue growth at 5.9% annually is modestly above the UK market average of 3.5%, its earnings are expected to surge by 32.42% annually over the next three years, significantly outpacing the UK market's forecasted growth of 12.5%. However, it faces challenges with a declining profit margin, now at 3.7% compared to last year's 6.8%.

Next Steps

Get an in-depth perspective on all 63 Undervalued UK Stocks Based On Cash Flows by using our screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:AT.LSE:BDEV LSE:FOXT and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance