Ascott Residence Trust meets 'pent up' demand, plans higher distribution of 2.33 cents per unit

With a gearing of 37.5% as at June 30, ART has a debt headroom of $1.8 billion

Ascott Residence Trust will be paying a distribution per unit of 2.33 cents for 1HFY2022, up 14% y-o-y, with improvements in its operations taking hold with “pent up demand” from both corporate and leisure users.

The distribution will go ex on Aug 7 and be paid on Aug 29.

Revenue per available unit for 1HFY2022 increased by 60% from $60 to $96, and average occupancy improved from 50% to 70%. For 2QFY2022, the corresponding figure was $124, up 91% over 2QFY2021 – marking the highest level since

Total revenue was up 45% y-oy to $267.4 million. Total distribution increased by 20% y-o-y to $76.7 million. This amount includes realised exchange gains.

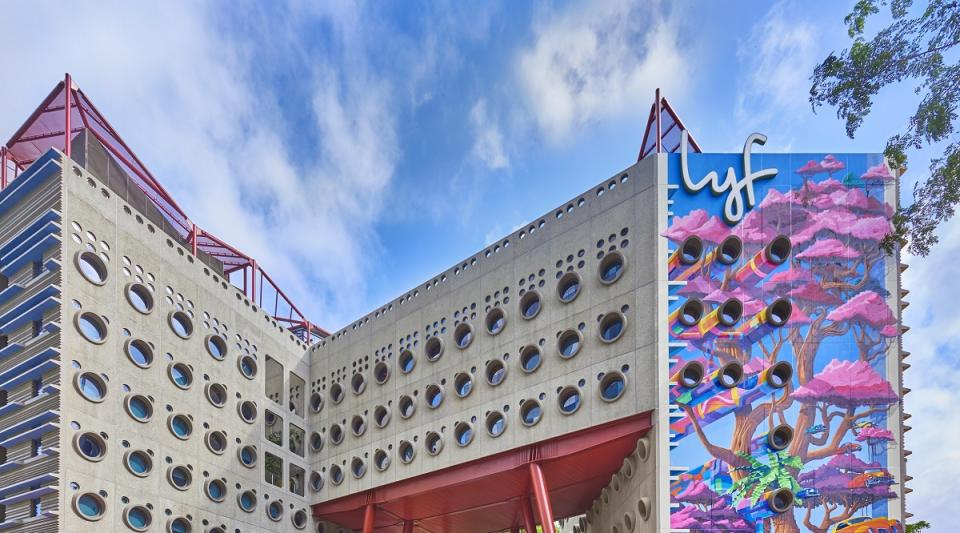

ART notes that the better performance can be attributed to its bigger proportion of so-called longer stay assets, namely student accommodation and rental housing properties. It was also able to book contributions from other new assets such as the newly-opened lyf one-north in Singapore (picture).

“As the global travel recovery continues, our serviced residences and hotels have contributed more growth income,” says Bob Tan, chairman of the REIT’s manager.

“This builds upon the steady income stream from our strong foundation of longer-stay assets. ART’s diversified and resilient portfolio remains poised for further growth,” he adds.

“We are seeing strong forward bookings at our properties and we expect this demand to sustain,” says Serena Teo, CEO of the REIT manager.

“As our properties cater mainly to long-stay guests, we have lower manning requirements and leaner cost structures. ART’s stable income base is expected to cushion the impact from recessionary concerns, rising inflation and macroeconomic uncertainties,” she adds.

As at June 30, ART had some $1.12 billion in cash on-hand plus available credit facilities. Its gearing was 37.5% - below the 50% regulated cap – giving it a debt headroom of $1.8 billion.

As at June 30, 79% of its debt are on fixed rates with a weighted average debt to maturity of about three years. Its effective borrowing cost remains at 1.7% per annum.

ART shares closed on July 28 at $1.17, up 1.74% for the day, and up 12.5% year to date.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Ascott Residence Trust is first hospitality trust to issue $200 mil sustainability-linked bond

UOBKH sees possible US recession due to inverted yield curve, but still overweight S-REITs

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance