Arm lifts SoftBank—with AI’s helping hand

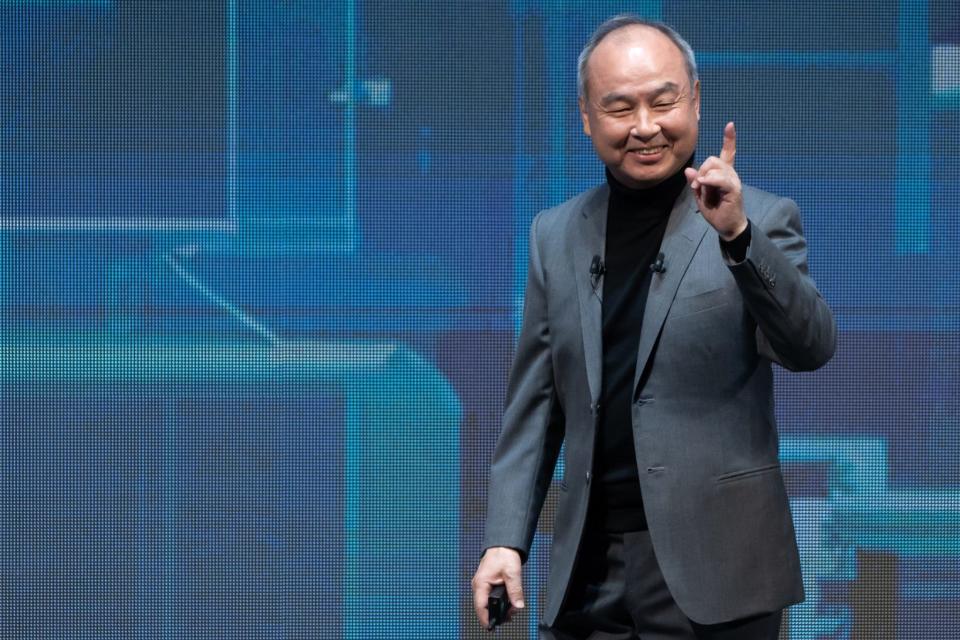

SoftBank CEO Masayoshi Son just had a really good midweek. He got to announce the Japanese tech investor’s first quarterly profit in an otherwise disastrous year. The latest upbeat news was all thanks to strong performances from Vision Fund I holdings like DoorDash and TikTok-owner ByteDance, and a windfall related to T-Mobile U.S.’s 2020 Sprint purchase. Now, SoftBank’s share price has been taken even further skywards by Arm’s good fortunes.

Despite Arm’s IPO last August, SoftBank still owns 90% of the chip-design legend. So when Arm’s share price climbed by around 40% in the fourth quarter, that firmed up SoftBank’s ability to finance new investments. And Arm just took another mighty leap, today rising by over 37% after yesterday shocking Wall Street with a killer forecast for its first quarter of this year. SoftBank’s stock soared by 11% in Tokyo.

Why’s Arm doing so well? All together now: A! I!

AI applications have demanding hardware needs, in terms of both power and energy efficiency, and this is leading many chipmakers to adopt the relatively shiny-new Armv9 instruction set architecture in their products, all the way from data-center monsters like Nvidia’s Grace server CPU (which looks like a serious contender in high-performance computing as well as AI) down to the processors in Apple’s iPhone 15 and Samsung's Galaxy S24, as well as in cars and wearables.

Happily for Arm, the company is able to set its Armv9 royalty rates at least twice as high as those for its last-gen Armv8 architecture (which, interestingly, is still what’s underpinning Qualcomm’s big incoming desktop-AI hope, the Snapdragon X Elite chipset). Result: Ka-ching. “More customers moving to higher-value Armv9 technology combined with market share gains in cloud server and automotive resulted in strong royalty growth,” crowed Arm CEO Rene Haas in yesterday’s letter to shareholders. “The AI wave drove licensing growth as these new devices require Arm’s performant and power-efficient compute platform.”

Speaking of Nvidia, it looks like the AI-chip leader, which is currently worth around $1.715 trillion, will soon become a more valuable company than Amazon for the first time in two decades. According to London Stock Exchange Group data, it’s even closing in on Alphabet. That old line about selling shovels in a gold rush may be hoary as heck, but it remains true.

As for SoftBank, whose profitability spent the last year in the toilet due to bad Vision Fund I bets on the likes of WeWork, Vision Fund II remains a dire proposition—down $19 billion since it began life in 2019 (Vision Fund I is now up $16.7 billion since it commenced investments two years previously). But let's let Son enjoy his successes. More news below.

David Meyer

Want to send thoughts or suggestions to Data Sheet? Drop a line here.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance