Ares Management Corp's Dividend Analysis

Exploring the Sustainability and Growth of Ares Management Corp's Dividends

Introduction to Ares Management Corp's Dividend Announcement

Ares Management Corp (NYSE:ARES) has recently declared a dividend of $0.93 per share, scheduled for payment on June 28, 2024, with an ex-dividend date of June 14, 2024. This upcoming dividend has prompted investors to examine the company's history of dividend payments, its yield, and growth rates. Utilizing data from GuruFocus, we will delve into the performance and sustainability of Ares Management Corp's dividends.

What Does Ares Management Corp Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

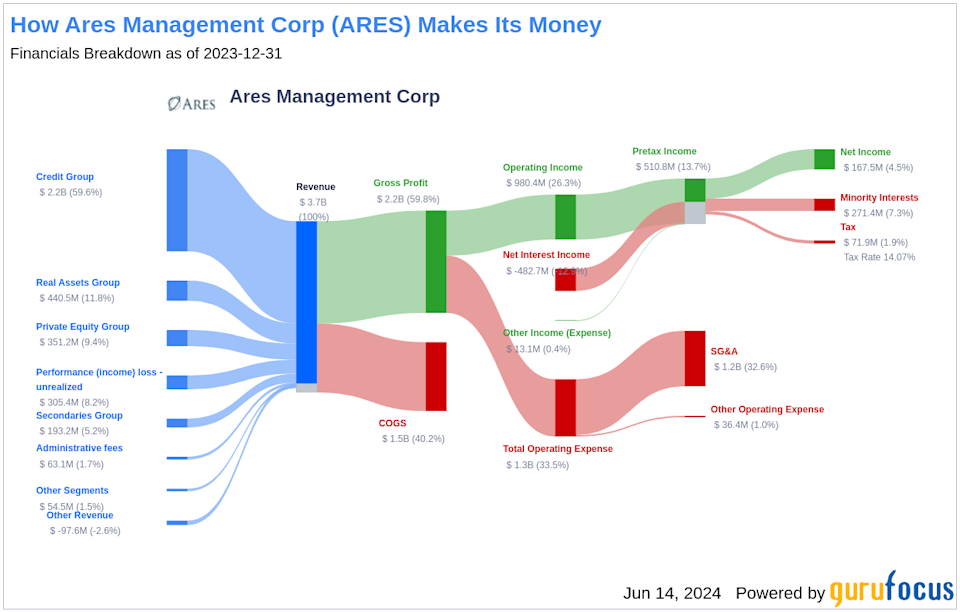

Ares Management Corp is a diversified asset management firm providing investment advisory and capital growth strategies across multiple segments. These include the Credit Group, which is the largest revenue generator, managing both liquid and illiquid credit strategies. The Private Equity Group oversees corporate equity, infrastructure, and special opportunities. The Real Assets and Secondaries Groups focus on real estate, infrastructure investments, and secondary market strategies across various alternative assets.

A Glimpse at Ares Management Corp's Dividend History

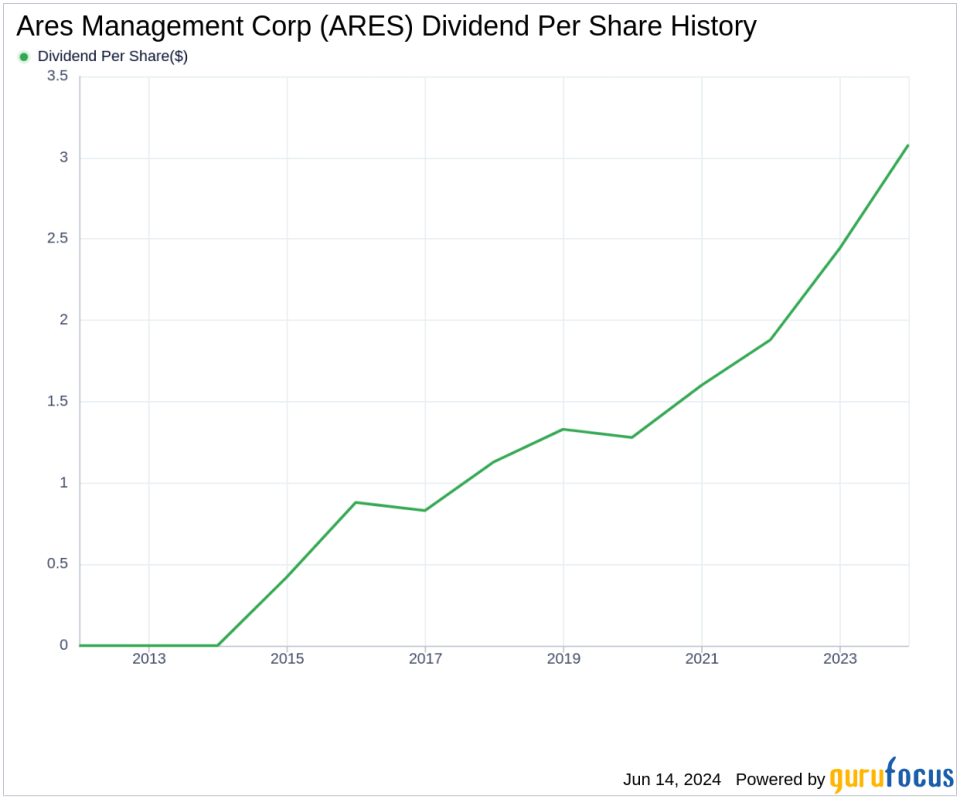

Ares Management Corp has consistently paid dividends since 2014, with distributions occurring quarterly. Below is a chart illustrating the annual Dividends Per Share, which provides insight into historical trends.

Breaking Down Ares Management Corp's Dividend Yield and Growth

Ares Management Corp currently boasts a trailing dividend yield of 2.40% and a forward dividend yield of 2.80%, indicating an expected increase in dividend payments over the next year. Over the past three years, the annual dividend growth rate was a robust 24.40%, although it moderated to 19.70% over a five-year period. The 5-year yield on cost for Ares Management Corp's stock is approximately 5.90%.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of dividends is often gauged by the dividend payout ratio, which for Ares Management Corp stands at 1.45 as of March 31, 2024. This ratio suggests that the company retains a substantial portion of its earnings, which supports future growth and stability. Additionally, Ares Management Corp's profitability rank is impressive at 8 out of 10, supported by a decade of consistent net income, indicating strong profitability relative to its peers.

Growth Metrics: The Future Outlook

Ares Management Corp's growth rank is also favorable at 8 out of 10, reflecting a positive growth trajectory. The company's revenue per share and 3-year revenue growth rate of 21.40% annually outperform 67.6% of global competitors. Moreover, its 3-year EPS growth rate of 40.60% and a 5-year EBITDA growth rate of 36.00% further underscore its growth potential and ability to sustain dividend payments.

Conclusion: Evaluating Ares Management Corp's Dividend Prospects

Considering Ares Management Corp's strong dividend history, growth rates, and low payout ratio, the company appears well-positioned to sustain and potentially increase its dividend payouts. The robust profitability and growth metrics not only support the current dividend levels but also suggest a favorable outlook for long-term investment returns. For investors seeking dividend growth stocks, Ares Management Corp represents a compelling opportunity. For more insights and tools, GuruFocus Premium users can utilize the High Dividend Yield Screener to discover other high-yielding investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance