Apple Is Positioned for Growth

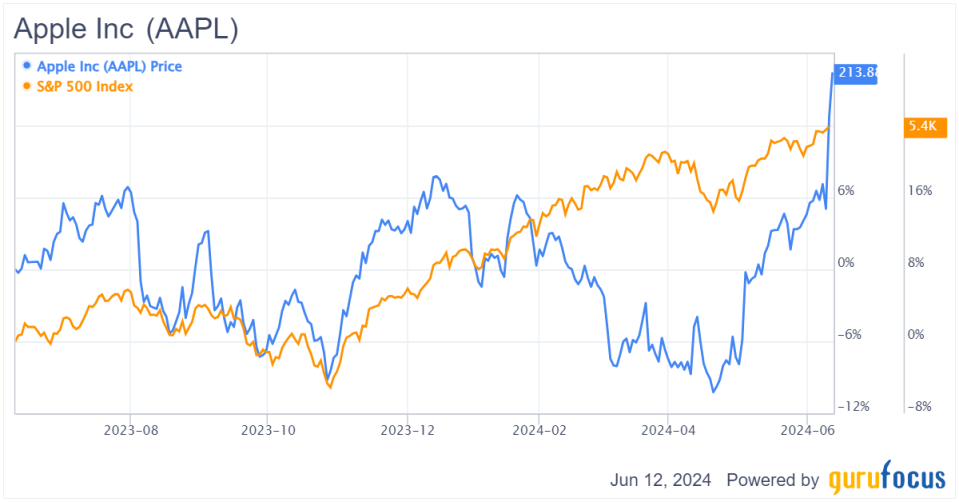

Apple Inc. (NASDAQ:AAPL) has seen its shares pick up since March, after significantly trailing behind the rest of the big tech sector. Despite a sharp recovery, the stock is currently 2% below its all-time high. Comparatively, shares are underperforming the market by about 6% in a year that has generally been very favorable for other major tech companies.

Figure 1: Apple shares sharply recover following lackluster performance

This underperformance can be attributed to Apple's lackluster growth since 2021, with declining revenue in five of the last six quarters on a year-over-year basis and several quarters of declining net income. This revenue slump has been primarily driven by poor macroeconomic conditions. However, the overall industry environment for smartphones and PCs is improving, which should support the company's product sales in 2024 and 2025. Looking ahead to the second half of 2024, several catalysts could drive Apple's performance. These include the upcoming Worldwide Developers Conference (WWDC), the reveal of Apple's generative artificial intelligence initiatives, new product launches (such as the iPad and Mac) and the iPhone 16 product cycle.

I will explore these factors in more detail as I explain why I believe Apple is an appealing option, contrary to current investor sentiment.

A resilient tech titan poised for growth

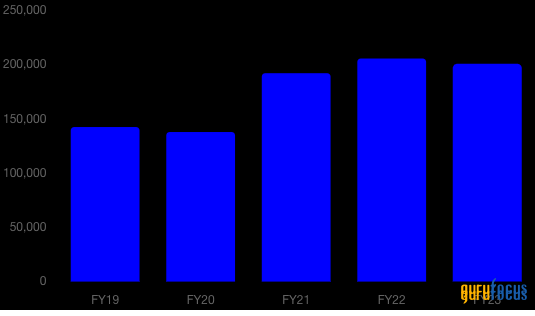

Figure 2: iPhone revenue stagnation since 2021, substantial update incoming

Source: Apple Investor Relations

Apple is no longer a legacy tech play that's falling behind, but rather a company with an incredible moat that should be relatively immune from disruption at the hands of new AI tools and applications. Plus, with continued services growth and a potentially improved upgrade cycle with the iPhone 16, I think the stock could be ready to move higher in the coming months. It is true that growth has slowed over the last few years, but the revenue stagnation since 2021 was largely due to incremental updates in iPhone models, which have not driven substantial upgrade cycles.

As such, many are expecting this coming year's update to be more substantial, between the potential for iPhone 16 to outperform and continued organic growth in services, I believe that Apple's revenue and net income should continue trending up and to the right over the medium term. Being more than three years away from the last strong release positions, the company is pretty well ahead of the iPhone 16, and that's even without the generative AI contribution. So a potential OpenAI partnership, improvements to Siri and other exciting AI features in photo editing, writing, music and more should be more than enough to create a strong iPhone 16 cycle.

Strategic advantage

While it is still uncertain who the ultimate winners and losers of the generative AI opportunity will be, one thing is clear: even a decade from now, users will likely access these apps through Apple's hardware and devices. This is exemplified by Alphabet Inc. (NASDAQ:GOOGL) paying Apple $20 billion in 2022 for Google to be the default search engine in the Safari browser. This stability and competitive advantage present a highly attractive opportunity for Apple. Moreover, the company is well-positioned to benefit from new AI market entrants monetizing their apps through the App Store. As these entrants scale and seek a broad audience, the App Store remains one of the best platforms for it. With its monetization model, Apple is perfectly positioned to take a fee in return for providing this reach. As AI apps grow and monetize, this could significantly bolster services revenue growth. Apple is set to capitalize on the AI revolution, potentially unlocking a robust new revenue driver for its subscription ecosystem.

At the very least, we believe Apple will not experience material downside from being perceived as lagging in AI. All eyes are on the 2024 Worldwide Developers Conference, which started on June 10. Meeting expectations, the tech giant introduced its AI plans, which include a suite of tools it calls Apple Intelligence. In addition to the anticipated rollout of iOS 18, these generative AI capabilities could serve as a robust positive catalyst for the company going forward.

Financials

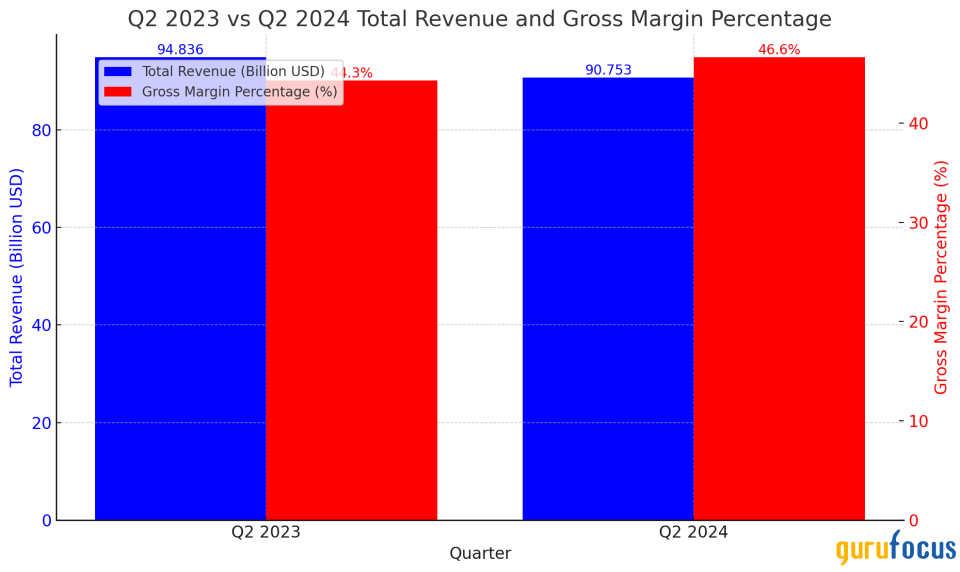

In the second quarter of 2024, Apple reported revenue of $90.80 billion, down 4% from the prior year but meeting the consensus expectations of $90.40 billion, which assured investors. Product revenue was $66.90 billion, a 10% decrease year over year primarily due to the one-time impact of iPhone channel inventory replenishment from the previous year. Last year, Apple managed to fulfill significant pent-up demand from the December quarter's Covid-19 supply disruptions for the iPhone 14 Pro and 14 Pro Max. Excluding this one-time impact, revenue would have been up 1% from the prior year, with iPhone revenue remaining flat. iPhone revenue was $46 billion, down 10% and aligning with consensus expectations.

The challenges faced by Apple's product segment are likely temporary, influenced by the harsh macroeconomic environment. Households across the developed world are contending with elevated inflation and high interest rates, which impact discretionary spending. However, demand for its products is expected to rebound as monetary policies across developed countries begin to ease. The April consumer price index showed a downtrend in the U.S. after a one-off spike in March.

Figure 3: Second-quarter 2024 revenue and margin performance

Source: Apple Investor Relations

Additionally, Apple's gross margin improved, with the total gross margin percentage increasing to 46.60% from 44.30% in the prior-year quarter, driven primarily by a different services mix and cost savings. This improvement underscores the company's ability to manage costs effectively even in a challenging environment.

Revenue and margin outlook

I have bullish expectations for Apple's revenue outlook, driven by several key factors. The company's strategic push into AI, including the anticipated launch of iOS 18 with generative AI capabilities, is expected to significantly enhance its product offerings. This integration will likely boost demand for new devices and applications, driving overall revenue growth. Additionally, I expect the upcoming product launches to stimulate substantial consumer interest and drive higher sales. With improving macroeconomic conditions, including easing inflation and lower interest rates, I expect a recovery in consumer discretionary spending, further supporting revenue growth.

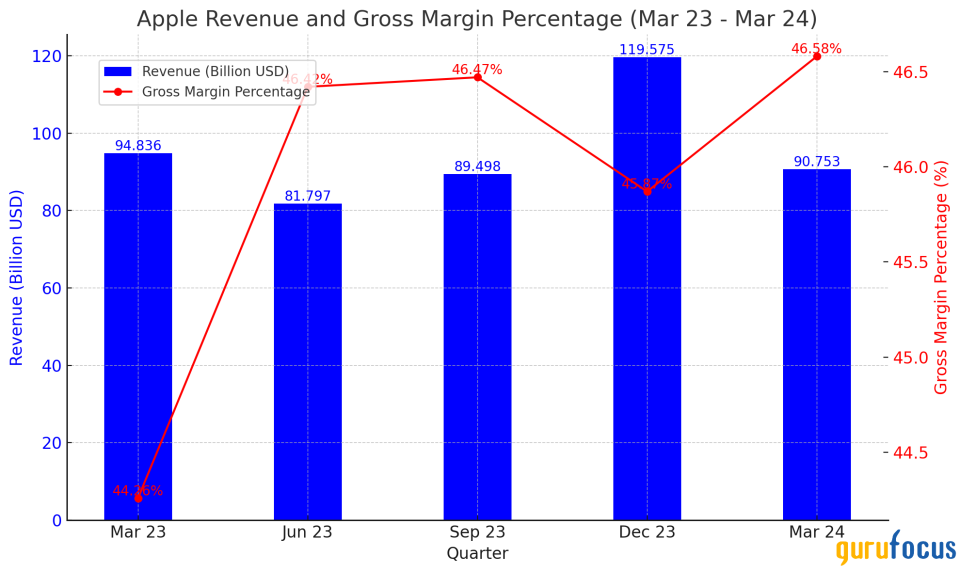

Figure 4: Strong margins despite weak macro conditions

Source: Apple Investor Relations

In terms of margins, I expect strong growth, driven by Apple's expanding services segment. The services revenue increased by 14% year over year in the second quarter, contributing significantly to the company's overall margins. The high margins associated with services like the App Store, Apple Music and iCloud, compared to hardware sales, are expected to continue driving overall gross margin expansion as the Apple ecosystem expands through products like the Vision Pro. Further, as AI applications scale and monetize, services revenue will see exponential growth, contributing to higher margins. For the third quarter of 2024, I expect revenue to grow in low single digits year over year (in line with consensus and management expectations), with gross margins projected between 45.50% and 46.50%.

Financial strength and strategic opportunities

Apple boasts an unrivaled ecosystem and a balance sheet loaded with cash, giving it the ability to develop or acquire virtually any product. This combination of a strong ecosystem and a significant cash reserve presents substantial opportunities for the company. While Apple has not introduced a groundbreaking product recently, its potential to create another must-have item remains high.

There is ongoing speculation about potential deals, such as a partnership with Rivian (NASDAQ:RIVN) or an acquisition of Disney (NYSE:DIS). Although these transactions may or may not materialize, Apple's financial strength makes such moves plausible. Recently, Apple announced a $110 billion buyback, which aligns with its history of significant share repurchases, including previous authorizations of $90 billion and $100 billion. This marks the sixth consecutive year with buybacks exceeding $70 billion. Additionally, Apple has consistently increased its dividends annually for the past 12 years, recently raising the dividend by 4% to 25 cents per share for the current quarter. These actions underscore the company's commitment to returning value to shareholders while maintaining the flexibility to pursue strategic acquisitions and innovations.

Valuation perspective

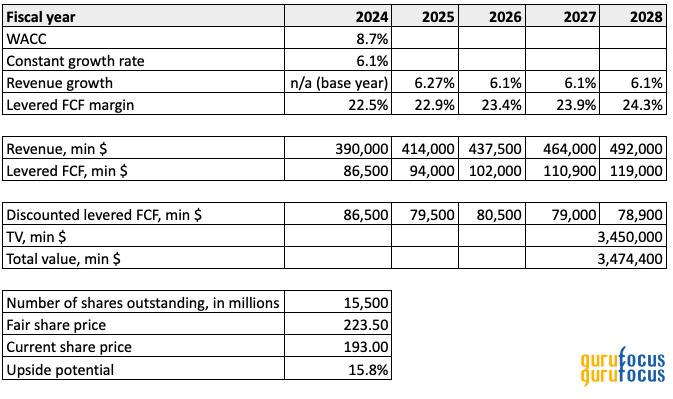

Figure 5: Discounted cash flow valuation

Source: Author's calculations

In evaluating Apple's future potential, we can consider several key drivers that contribute to its positive outlook. The anticipated product launches are expected to drive substantial consumer interest and sales. The growth in services revenue, fueled by the integration of AI capabilities into offerings like the App Store, Apple Music and iCloud, will further bolster the company's financial performance. As AI applications scale, they will significantly enhance user experiences and engagement, contributing to a robust and profitable services ecosystem. Moreover, the improving macroeconomic conditions, such as easing inflation and lower interest rates, are expected to revive consumer discretionary spending, further supporting revenue growth. The expanding Apple ecosystem, characterized by the seamless integration of hardware, software and services, will continue to attract and retain a large user base, driving sustained revenue growth.

The valuation model indicates a fair share price of $223.50, representing an upside potential of 15.80% from the current share price of $193. This projection is underpinned by a constant growth rate of 6.10%, which is supported by Apple's historical compound annual growth rate over the last three decades. The company's ability to leverage its strong operating history and financial flexibility to integrate AI capabilities positions it well to capitalize on the AI revolution. This revolution is expected to add trillions of dollars to the global economy through increased productivity, and Apple is poised to be a significant beneficiary. My confidence in the company's ability to improve its FCF margin, projected to rise to 24.30% by 2028, is based on its historically strong operating leverage and efficient cost management. Given these factors, I believe Apple presents an attractive opportunity with significant upside potential.

Final thoughts

Apple is well-positioned for sustained growth and profitability, driven by its strategic integration of AI capabilities, robust product pipeline and expanding services ecosystem. The company's financial strength and operational efficiency provide a solid foundation for navigating economic fluctuations and capitalizing on emerging market opportunities. With a proven track record of innovation and shareholder value creation, Apple remains a compelling investment opportunity. Given the anticipated revenue and margin growth, alongside improving macroeconomic conditions, I am confident if will continue to deliver strong financial performance and drive long-term value for shareholders.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance