Apellis' (APLS) Syfovre Boost Sales, Regulatory Setbacks a Woe

Apellis Pharmaceuticals’ APLS marketed portfolio comprises two drugs — Empaveli (pegcetacoplan) and Syfovre (pegcetacoplan injection).

In 2023, the FDA approved Syfovre (pegcetacoplan injection) as the first and only treatment for geographic atrophy secondary to age-related macular degeneration, or GA. Syfovre has the potential to be a best-in-class treatment for patients with GA, a disease that affects more than one million people in the United States and five million people worldwide. The drug has witnessed robust initial uptake since its commercial launch in March 2023 and is the major contributor to Apellis’ top line.

Syfovre recorded sales of $275.2 million in 2023. In first-quarter 2024, the drug recorded sales worth $137.5 million, which increased 20.3% sequentially, owing to continued strong demand, thereby driving revenues for the company. Apellis delivered more than 72,000 commercial vials and nearly 5,000 samples of Syfovre to doctors in the first quarter. As of Mar 31, 2024, the total number of doses of the drug delivered since launch was 250,000.

A marketing authorization application (MAA) seeking approval of intravitreal pegcetacoplan for the treatment of GA is currently under review in the EU and several other countries. Decisions regarding the same from the European Medicines Agency (EMA) as well as from regulatory bodies in other countries are expected by the end of 2024.

Potential approval of pegcetacoplan in additional geographies will increase patient access, in turn boosting sales further.

Empaveli was approved in 2021 for treating Paroxysmal Nocturnal Hemoglobinuria (PNH). In the EU, Empaveli is approved under the brand name Aspaveli for the treatment of adult patients with PNH who are anemic following treatment with a C5 inhibitor for at least three months.

In late 2023, the FDA approved Empaveli Injector, an on-body drug delivery system capable of self-administering pegcetacoplan through subcutaneous infusion, for the treatment of PNH. This has increased ease of use for the patients, thereby ensuring continued uptake of the drug. Empaveli recorded sales of $91 million in 2023. In the first quarter of 2024, the drug recorded sales of $25.6 million, up 25.5% from the year-ago quarter’s figure.

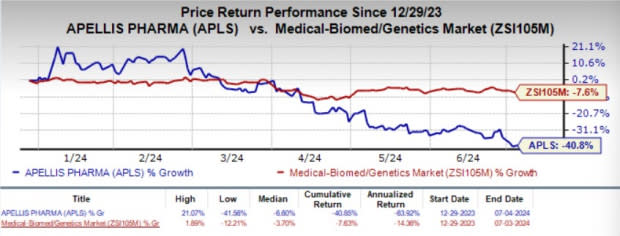

Year to date, shares of APLS have plunged 40.8% compared with the industry’s 7.6% decline.

Image Source: Zacks Investment Research

Apellis, in collaboration with Sobi, is also looking to expand pegcetacoplan’s indication to treat several other rare diseases across hematology and nephrology. The companies are evaluating pegcetacoplan to treat primary immune-complex membranoproliferative glomerulonephritis (IC-MPGN) and C3 glomerulopathy (C3G) — two rare and debilitating kidney diseases. Apellis is currently enrolling patients in the phase III VALIANT study evaluating systemic pegcetacoplan for treating IC-MPGN and C3G.

In May 2024, Apellis reported positive long-term (one year) data from the phase II NOBLE study evaluating pegcetacoplan for the above indications. The consistent long-term improvement seen in patients treated with the candidate in the mid-stage study suggests a potentially favorable outcome for the late-stage VALIENT study for the same indications, with results expected later this year.

Also, Sobi is evaluating the safety and efficacy of systemic pegcetacoplan to treat patients with hematopoietic stem cell transplantation-associated thrombotic microangiopathy in a phase II study.

Potential approval and successful commercialization for any of the above indications will be a significant boost to Apellis.

However, the absence of other candidates in the company’s pipeline remains an overhang. Due to the lack of a strong pipeline, APLS is heavily dependent on Syfovre and Empaveli for growth.

Apellis faces significant competition from Soliris (eculizumab) and Ultomiris (ravulizumab), C5 complement inhibitors, developed and marketed by AstraZeneca for the PNH indication. Alnylam is conducting clinical studies to develop cemdisiran, an RNAi therapeutic targeting C5 for the treatment of complement-mediated diseases. Several other companies are also developing their pipeline candidates using complement inhibition for the treatment of PNH.

Apellis has also encountered its fair share of setbacks, both pipeline and regulatory, in 2024 that do not bode well for the company. In January, Sobi and Apellis discontinued the phase III CASCADE study evaluating systemic pegcetacoplan in patients with cold agglutinin disease (CAD) due to the decreased medical need in CAD and the limited number of patients eligible for the CASCADE study.

More recently, Apellis announced that the EMA’s advisory body has issued a negative opinion for the second time on the MAA for intravitreal pegcetacoplan to treat GA in the EU. The negative opinion followed an Ad Hoc Expert Group meeting, where experts agreed that the size of GA lesions is an acceptable primary outcome measure for GA studies and microperimetry is the best available functional measure for GA.

Although Apellis is seeking a re-examination of the opinion, there is no guarantee that the company will eventually be able to clinch a nod in the EU. If the company fails to do so, it will be detrimental to the stock. Even if the company succeeds in gaining approval for intravitreal pegcetacoplan, this undesirable development has significantly delayed the launch of the medicine in the EU, causing a loss of potential sales from this region for the GA indication.

Zacks Rank and Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks from the drug/biotech industryare ALX Oncology Holdings ALXO, Aligos Therapeutics, Inc. ALGS and Compugen CGEN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73. Year to date, shares of ALXO have plunged 61.6%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Aligos Therapeutics’ 2024 loss per share has remained constant at 73 cents. During the same period, the consensus estimate for 2025 loss per share has remained constant at 71 cents. Year to date, shares of ALGS have plunged 39.8%.

ALGS’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has remained constant at 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have lost 14.6%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance