Apellis (APLS) Stock Surges 62% in 6 Months: Here's Why

Apellis APLS stock uptick in the last six months can be significantly attributed to the FDA’s approval of Syfovre (pegcetacoplan injection) to treat geographic atrophy (GA) secondary to age-related macular degeneration.

The drug is the first and only approved therapy for GA. Syfovre is designed to provide comprehensive control of the complement cascade, part of the body’s immune system.

The commercial launch of the drug began in March 2023. Syfovre reported encouraging first-quarter 2023 sales of $18.4 million. The trend is expected to continue in the coming quarters.

A marketing authorization application seeking approval of intravitreal pegcetacoplan for treating GA is currently under review by the European Medicines Agency. A decision regarding the same is expected in early 2024. A successful approval in additional geographies should boost the company’s sales in the coming years.

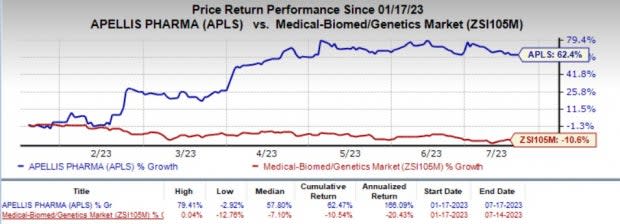

Apellis’ shares have rallied almost 62.4% in the past six months against the industry's 10.6% decline.

Image Source: Zacks Investment Research

The encouraging uptrend in APLS’ first marketed product, Empaveli, also contributed to its growth. The drug is approved as a monotherapy treatment for adults suffering from paroxysmal nocturnal hemoglobinuria (PNH). Empaveli recorded sales of $20.4 million in the first quarter of 2023, up 69% from that reported in the year-ago quarter.

In February 2023, the FDA approved the supplemental new drug application (sNDA), seeking approval of Empaveli for treatment-naive PNH patients. The approval was based on results from the phase III PRINCE and the 48-week phase III PEGASUS studies.

Apellis’ Empaveli Injector sNDA is also currently under review. However, in March, the FDA notified APLS that it would miss the PDUFA target action date of Mar 15, 2023, for the sNDA application. The company is awaiting further timing information.

Empaveli injector is an on-body drug delivery system capable of self-administering pegcetacoplan through subcutaneous infusion. A potential approval for any of the above indications will significantly boost APLS’ performance.

The company has broad pipeline candidates, focused on developing therapies for rare diseases, ophthalmology and neurology. APLS, in collaboration with Sobi, is co-developing systemic pegcetacoplan for five indications in addition to PNH.

The companies are evaluating pegcetacoplan in the phase III VALIANT study to treat primary immune-complex membranoproliferative glomerulonephritis (IC-MPGN) and C3 glomerulopathy (C3G) — two rare and debilitating kidney diseases.

Apellis Pharmaceuticals, Inc. Price and Consensus

Apellis Pharmaceuticals, Inc. price-consensus-chart | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Omega Therapeutics OMGA, Akero Therapeutics AKRO and ImmunoGen IMGN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Omega Therapeutics has narrowed from a loss of $2.49 per share to a loss of $2.05 for 2023 in the past 90 days. Shares of the company have lost 38.9% in the past six months.

OMGA’s earnings beat estimates in two of the trailing four quarters, met the mark in one and missed in another, delivering an average surprise of 8.24%.

The consensus estimate for Akero Therapeutics has narrowed from a loss of $2.97 per share to a loss of $2.80 for 2023 in the past 90 days. The company's shares have nosedived 5.1% in the past six months.

AKRO’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.96%.

The consensus mark for ImmunoGen has narrowed from a loss of 81 cents per share to a loss of 53 cents for 2023 in the past 90 days. Shares of the company have rallied 333.4% in the past six months.

IMGN’s earnings beat estimates in two of the trailing four quarter and missed the mark in the other two, delivering an average surprise of 7.09%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance