ANSYS' (ANSS) Simulation Solutions Continue to Gain Traction

ANSYS ANSS announced that its simulation solutions are being leveraged by Flexium to enhance the design process and test antenna modules for high-frequency signal transceiver applications in advanced driver assistance systems (ADAS) and autonomous vehicles (AVs).

ANSYS’s solutions will allow Flexium to assess the durability, reliability and performance of PCB boards. It can also experiment with different layouts and materials at a reduced cost, enabling the exploration of new design ideas.

There are several flexible printed circuits (FPCs) within Flexium's PCB layouts, which are responsible for connections that facilitate 5G communication in ADAS and AV applications. As a result, any shortcomings in these layouts can affect the FPC transmission characteristics, which are essential for vehicle perception, added ANSYS.

ANSYS, Inc. Price and Consensus

ANSYS, Inc. price-consensus-chart | ANSYS, Inc. Quote

Flexium will leverage ANSYS’s simulation software for electromagnetic, thermal and mechanical optimization of their FPC designs. Flexium has been able to make efficient layouts and material changes using Ansys tools, which allow them to set specific parameters for board layouts and materials. Additionally, Flexium creates a reference library for future mmWave design verification with the help of ANSYS tools.

ANSS develops and globally markets engineering simulation software and services widely used by engineers, designers, researchers and students across a spectrum of industries and academia.

In July, ANSS and Altium joined forces to enhance the process of electronic design and development. The partnership will involve connecting Ansys Electronics Desktop with Altium's electronic computer-aided design tools to create a higher level of digital continuity and improve efficiency.

Prior to that, ANSYS expanded the capabilities of its Ansys Discovery platform by incorporating high-frequency electromagnetics modeling for antennas. This development allows engineering teams to conduct virtual exploration of multiple design areas simultaneously, minimizing the need for costly physical prototyping and testing.

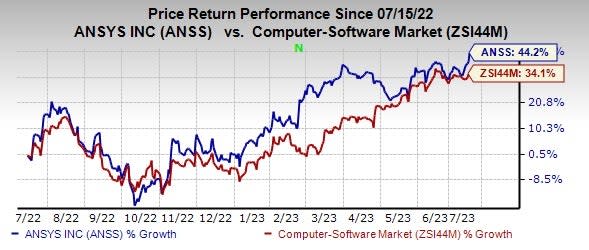

ANSS currently carries a Zacks Rank #4 (Sell). Shares of ANSYS have gained 44.2% in the past year compared with the sub-industry’s growth of 34.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are InterDigital IDCC, Badger Meter BMI and Woodward WWD. InterDigital and Woodward sport a Zacks Rank #1 (Strong Buy), while Badger Meter carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for InterDigital’s 2023 earnings per share (EPS) has increased 62.6% in the past 60 days to $8.08. The company’s long-term earnings growth rate is 13.9%.

InterDigital’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 170.9%. Shares of IDCC have rallied 52% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 1.1% in the past 60 days to $2.72.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have surged 81.3% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 3.8% in the past 60 days to $3.58.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 12% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance