Andrew Peller's (TSE:ADW.A) Dividend Will Be CA$0.0615

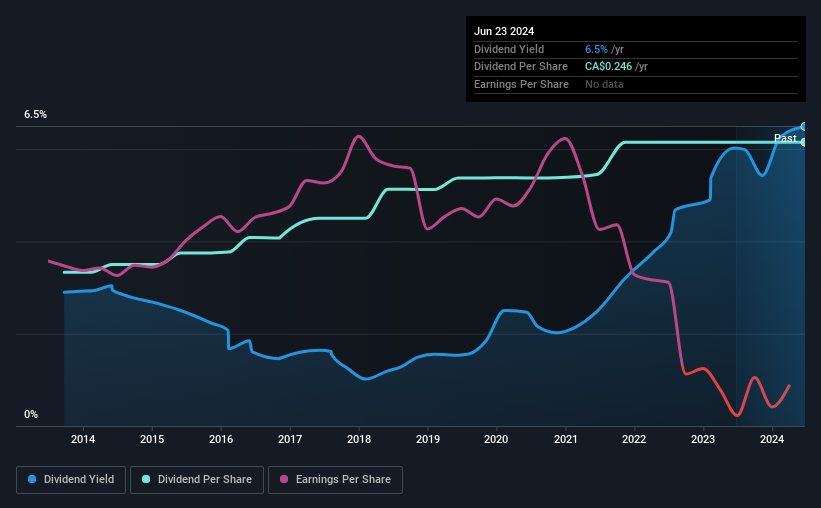

Andrew Peller Limited (TSE:ADW.A) will pay a dividend of CA$0.0615 on the 12th of July. Based on this payment, the dividend yield on the company's stock will be 6.5%, which is an attractive boost to shareholder returns.

See our latest analysis for Andrew Peller

Andrew Peller's Distributions May Be Difficult To Sustain

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Andrew Peller is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

EPS has fallen by an average of 47.0% in the past, so this could continue over the next year. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

Andrew Peller Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2014, the annual payment back then was CA$0.133, compared to the most recent full-year payment of CA$0.246. This works out to be a compound annual growth rate (CAGR) of approximately 6.3% a year over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Andrew Peller's EPS has fallen by approximately 47% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Our Thoughts On Andrew Peller's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. To that end, Andrew Peller has 3 warning signs (and 2 which don't sit too well with us) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance