Andreas Halvorsen's Viking Global Investors LP Acquires New Stake in ORIC Pharmaceuticals Inc

Introduction to the Transaction

Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors LP has recently expanded its investment portfolio with a significant acquisition of shares in ORIC Pharmaceuticals Inc. On January 20, 2024, the firm purchased 4,000,000 shares of ORIC Pharmaceuticals at a price of $10.02 per share. This transaction marks a new holding for Viking Global Investors, reflecting a 0.16% impact on the portfolio and establishing a 5.90% ownership stake in the biopharmaceutical company.

Profile of Andreas Halvorsen (Trades, Portfolio)

Andreas Halvorsen (Trades, Portfolio), a founding partner of Viking Global Investors LP, has a storied career in the investment world. The firm, now under the leadership of CIO Ning Jin, was established in 1999 and is headquartered in Greenwich, Connecticut. Viking Global Investors is known for managing two hedge funds with a focus on global equities. Halvorsen's prior experience includes a role as a senior managing director at Tiger Management (Trades, Portfolio) LLC and an investment banker at Morgan Stanley. Viking's investment philosophy is centered around a research-intensive, long-term approach, utilizing fundamental analysis to select investments across various industries and geographies. The firm's current equity stands at $24.57 billion, with a portfolio comprising 80 stocks, and a strong inclination towards the healthcare and technology sectors. Its top holdings include Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), and Visa Inc (NYSE:V).

Overview of ORIC Pharmaceuticals Inc

ORIC Pharmaceuticals Inc, with its stock symbol ORIC, operates within the USA as a clinical-stage biopharmaceutical company. Since its IPO on April 24, 2020, ORIC has been dedicated to developing therapies designed to overcome resistance mechanisms in cancer. The company's product pipeline includes candidates like ORIC-944 and ORIC-114, focusing on hormone-dependent cancers, precision oncology, and key tumor dependencies. With a market capitalization of $775.122 million and a current stock price of $11.56, ORIC Pharmaceuticals is navigating the competitive biotechnology industry.

Analysis of the Trade Impact

The acquisition of ORIC shares by Viking Global Investors LP has introduced a new dynamic to the firm's diverse portfolio. The 0.16% portfolio impact signifies a strategic investment in the biotechnology sector, which aligns with the firm's top sectoral focus. The 5.90% stake in ORIC Pharmaceuticals Inc indicates a significant level of confidence in the company's potential and future prospects.

ORIC Pharmaceuticals Inc's Financial Health

ORIC Pharmaceuticals Inc's financial health is reflected in its strong Financial Strength with a Balance Sheet Rank of 10/10. The company boasts an impressive interest coverage ratio of 10,000.00, indicating its ability to cover any debt obligations with ease. However, the company's Profitability Rank stands at a low 1/10, and it has a Growth Rank of 0/10, suggesting challenges in profitability and growth. The Piotroski F-Score of 2 further indicates a weak financial position, which is corroborated by a negative Return on Equity (ROE) of -40.31% and Return on Assets (ROA) of -36.47%.

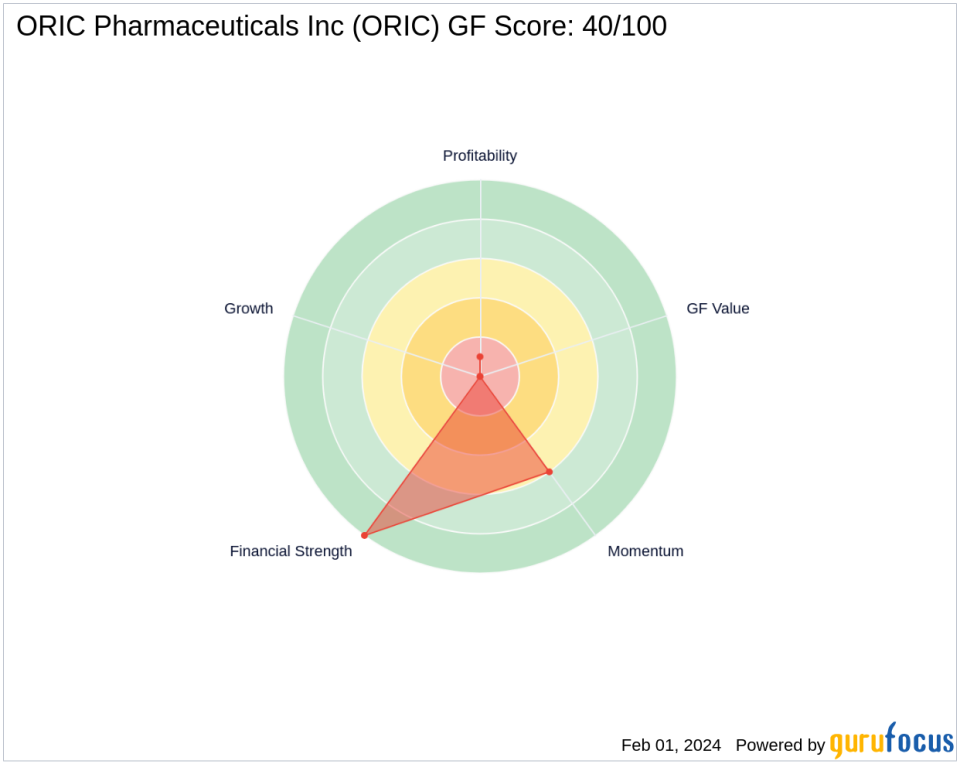

Market Performance and Valuation Metrics

Since its IPO, ORIC Pharmaceuticals Inc's stock has experienced a decline of 55.54%, but it has shown signs of recovery with a year-to-date increase of 26.48%. The stock's GF Score of 40/100 indicates potential challenges in future performance. The company's valuation metrics, such as PE Percentage and GF Value, are not applicable due to the absence of profitability, as indicated by a PE Percentage of 0.00.

Sector and Industry Context

Andreas Halvorsen (Trades, Portfolio)'s investment in ORIC Pharmaceuticals Inc is consistent with Viking Global Investors LP's strategic focus on the healthcare sector. The firm's decision to invest in ORIC aligns with its philosophy of selecting companies with strong business models and potential for long-term growth, despite the current financial challenges faced by the biotechnology industry.

Conclusion

In summary, Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors LP has taken a notable position in ORIC Pharmaceuticals Inc, reflecting a belief in the company's long-term potential within the biotechnology sector. While ORIC's financial health shows a strong balance sheet and excellent interest coverage, its profitability and growth metrics suggest areas for improvement. The investment by a firm with a keen eye for value and growth prospects could signal a positive outlook for ORIC Pharmaceuticals Inc, as it continues to develop innovative cancer therapies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance