Analysts overall pleased with UMS Holdings following 3QFY2023 results

UMS’s earnings stood in-line or above expectations.

Analysts from UOB Kay Hian, CGS-CIMB Research, Maybank Securities and DBS Group Research are keeping their “add” and “buy” calls after UMS reported a quarterly improvement for its set of results for the 3QFY2023 ended Sept 30.

For the 3QFY2023, UMS reported earnings of $15 million, 64% lower y-o-y and 32% higher q-o-q. 9MFY2023 earnings fell by 46% y-o-y to $44 million. The group has also kept its interim dividend of 1.2 cents during the period. The dividend was raised from 1 cent to 1.2 cents in the 2QFY2023.

UMS’s earnings stood in line with UOB Kay Hian and Maybank’s expectations; it stood above CGS-CIMB’s full-year estimates while coming in below DBS’s expectations.

UOB Kay Hian analyst John Cheong sees a “buoyant outlook” supported by the “sanguine guidance” of key semiconductor makers expecting to deliver sustainable outperformance going forward.

For the group’s 3QFY2023 earnings, the analyst notes that it benefited from improved material margins which grew to 51.2% in 3QFY2022 from 50.5%, mainly due to higher US dollar (USD)/Singapore dollar (SGD) exchange rates and better margins arising from the renewal of its integrated system contract with its key customer.

In the 3QFY2023, UMS’s revenue continued to show signs of stabilisation in 3QFY2023, falling 29% y-o-y but only declining 4% q-o-q.

Revenue in the semiconductor segment fell 30% y-o-y due to slower global semiconductor demand while revenue in UMS’s other segments plunged 55%, mainly due to the weaker material and tooling distribution business affected by the general business slowdown.

“The decline in semiconductor revenue was due to a 34% drop in component sales, from $45 million in 3QFY2022 to $30 million in 3QFY2023, and a 25% y-o-y decline in the group’s Semiconductor Integrated System (SIS) sales from $45 million in 2QFY2022 to $33 million in 3QFY2023,” notes Cheong.

All the key geographical markets of UMS posted lower sales this year, with revenue in Singapore falling 28% y-o-y, US sales decreasing 12% due to lower component sales for new equipment and revenue in Taiwan declining 37% as a result of lower component sales.

Despite this, the group expects its performance in the coming months to be supported by the positive guidance of some major semiconductor equipment makers expecting to deliver a sustainable outperformance moving forward.

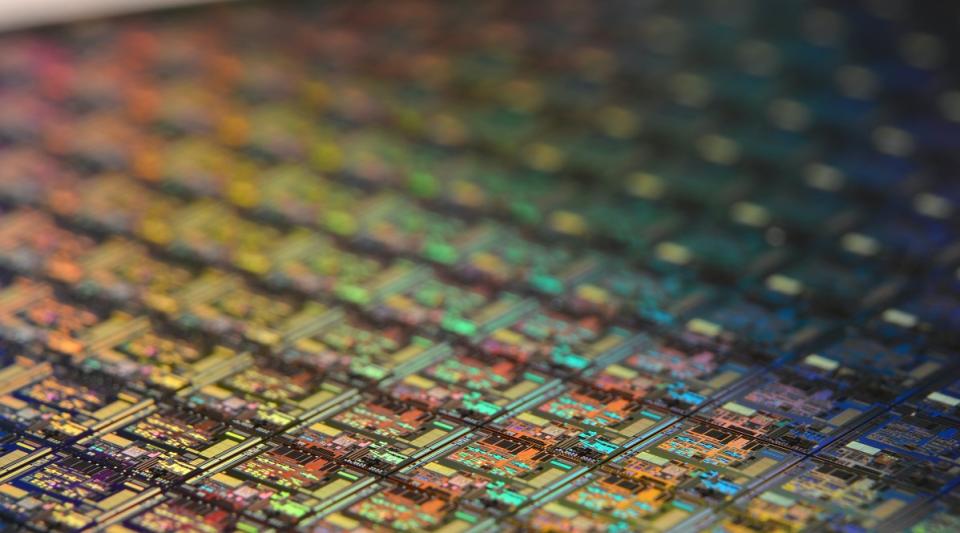

According to Semiconductor Equipment and Materials International (SEMI), an FY2024 rebound is expected to continue through FY2026, with wafer shipments setting new highs as silicon demand increases to support artificial intelligence (AI), high-performance computing (HPC), 5G, automotive and industrial applications.

SEMI also predicts fab equipment spending to recover to US$97 billion ($130 billion), representing a 15.5% y-o-y rise, and total foundry capacity, consisting of foundry as well as integrated device manufacturers, is set to increase 7% in 2024.

Cheong adds: “Investments into fab construction projects which hit a historical high in FY2023 are expected to continue at a higher level in FY2024.”

Furthermore, he notes that UMS has also secured an in-principle agreement with its new customer for a new renewable three-year contract.

“This new customer contract win will boost UMS’s buoyant outlook as its new Penang facilities will be ready for volume production by September. The production ramp-up will enable it to take on new orders from its new customer which is estimated to reach at least US$30 million next year,” writes Cheong.

Cheong’s unchanged target price of $1.56 is based on a P/E valuation of 13.5 times of UMS’s FY2024 earnings per share (EPS), pegged at 0.5 standard deviation (s.d.) above its historical mean P/E.

CGS-CIMB analyst William Tng has kept his target price unchanged at $1.49, which is still based on 12.0 times UMS’s calendar year (CY) P/E and 1.0 s.d. above its 10-year average P/E, given the potential upswing in UMS’s net profit.

As UMS’s profit was better than expected, Tng has raised his FY2023 earnings per share (EPS) forecast by 4.0% to factor in the better gross material margin and lower tax rate.

Though UMS’s 3QFY2023 results stood below the expectations of DBS analyst Ling Lee Keng, the analyst notes that it was still a “strong performance” with UMS’s 2HFY2023 recovery remaining “intact”. As such, she has increased her target price to $1.55 from $1.51 previously, pegged to a higher P/E of 13x, near the 1 s.d. Level from its four-year average and up from 12 times as she expects UMS’s outlook to improve.

To her, UMS's new Penang facilities put the group in a good position to benefit from the trade diversification trend.

Ling writes: “On the back of the China-US trade tensions, which have worsened with the further tightening by the US on exports to China, more companies are looking to diversify their manufacturing footprints. The completion of the new plant in Penang offers new growth opportunities.”

Maybank Securities’ Jarick Seet also likes UMS’s brighter prospects due to the anticipated recovery in the semicon industry in FY2024. Noting the raised dividends during the 2QFY2023, the analyst expects UMS to continue its dividend of 1.2 cents per share for the 4QFY2024, bringing its total yield for FY2024 to 4.3%.

Shares in UMS Holdings 558 closed three cents lower or 2.34% down at $1.25 on Nov 17.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Analysts mostly lift TPs on ComfortDelGro after further earnings recovery

Analysts see record year for Food Empire, expect higher dividend

UOB Kay Hian upgrades Valuetronics to ‘buy’ with TP of 72 cents; PhillipCapital ups TP to 70 cents

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance