Analysts lower target prices on Suntec REIT as rising interest rates weigh on costs

_0.jpg)

The REIT’s 3QFY2022 results have left sentiments generally mixed, with mostly “buy” calls and a “sell” call.

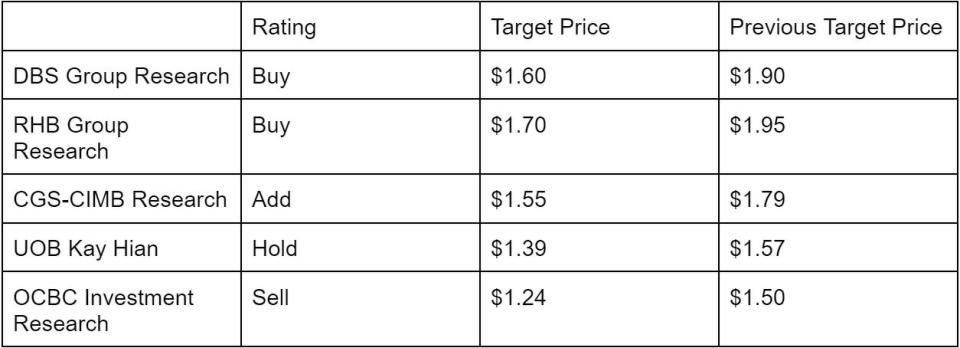

Analysts from five brokerages have given differing calls on Suntec REIT following the REIT’s business update for the 3QFY2022 ended Sept 30. Despite the mixed sentiments, the analysts have lowered their target prices across the board (see table below).

DBS Group Research, RHB Group Research and CGS-CIMB Research have all handed Suntec REIT a “buy” or “add” call, with target prices of $1.60, $1.70 and $1.55 respectively, down from their previous target prices of $1.90, $1.95 and $1.79.

Their optimism stems from the fact that Suntec’s 3QFY2022 results have shown “positive operational momentum accelerating” across the Singapore office, retail, and convention portfolios, according to RHB analyst Vijay Natarajan.

In its update, Suntec REIT reported that its Singapore office occupancy rose 1.6 percentage points (ppt) to 99.4% with improvements seen across all of its assets.

Suntec City’s offices are now at near full occupancy of 99.6%, with rent reversion in 3QFY2022 strengthening by 5.9%.

Natarajan says this is expected to remain positive as expiring rents in FY2023 are about 10% below market levels.

Suntec City’s mall occupancy also rose 0.6 ppt q-o-q to 96.7% with rent reversions of +4.8%, with the analyst adding that “this was backed by healthy tenant sales that, year-to-date (ytd), are [around] 20% above [its] pre-Covid-19 levels.”

The convention segment performed strongly too, with the REIT’s net property income (NPI) turning around on the back of increased events.

RHB’s Natarajan also notes that performances across Suntec’s overseas assets in the UK and Australia remain relatively stable, benefitting from their high quality due to the flight-to-quality trend.

Despite the street’s concerns of Suntec’s gearing of 43.1% and a low interest cover of 2.5x, RHB’s Natarajan does not see any threat of the REIT breaching the 45% gearing threshold, considering its strong Singapore portfolio performance.

He also points out that its management is evaluating divestment opportunities closely, and does not see a need for dilutive equity fund-raising.

Suntec’s debt hedge increased slightly to 58% from 2QFY2022’s 56%, though this remains among the lowest amongst other Singapore REITs (S-REITs).

In his report dated Oct 26, Natarajan has lowered his distribution per unit (DPU) estimates for the FY2023 - FY2024 by 5%-6% mainly due to the higher interest costs factored in. He has also raised our cost of equity (COE) assumption by 60 basis points (bps), resulting in a lower target price.

In their Oct 27 report, DBS’s Rachel Tan and Derek Tan say they “see value emerging at 0.7x P/B, trading below to -1 standard deviation (s.d.) of [the REIT’s] historical range” with catalysts emerging from better than expected performance of its office portfolio, and the continued recovery of its convention business driving upside to earnings

Like their counterpart, the DBS analysts cut their FY2023 DPU assumptions due to higher interest rate assumptions, although they think that their estimates are “conservative and below consensus.”

The manager is looking at opportunities to recycle capital through divestment of non-core properties which will address its gearing concerns over time.

At its current price, the analysts say they are “heartened” that the REIT’s management are not considering conducting an equity fund raising (EFR) as part of their balance sheet recapitalisation.

In addition, the analysts deem Suntec as an attractive target for acquisitions or privatisations, as its new sponsor, ESR Group, has a focus on new economy assets.

Suntec, being a non-new economy REIT, could be seen as attractive given its current low valuation level of trading well below P/NAV, the analysts note.

Like their peers above, CGS-CIMB’s Lock Mun Yee and Natalie Ong have remained positive on Suntec REIT, although they have also lowered their FY2022-2024 DPU estimates by 4.5%-10.9% as they factor in a higher interest cost and management’s guidance for higher utilities cost in FY2023.

Their trimmed target price comes on the back of lower earnings from Suntec REIT and higher COE of 7.61%.

The way they see it, faster-than-expected recovery of Suntec REIT’s retail and convention business is a catalyst to its unit price while sharper-than-expected interest rate hikes and a slowdown in consumption that could affect tenant sales at its malls are downside risks.

UOB KH calls ‘hold’, says results below expectations

As for UOB Kay Hian’s Jonathan Koh, he has maintained a “hold” call on Suntec REIT, albeit with a lower target price of $1.39, down from his previous figure of $1.57.

He says this was because Suntec’s results were “below expectations”, referring to the drop in distributable income of 5.8% y-o-y to $60 million and the corresponding DPU decline to 2.084 cents, down 6.6% y-o-y.

Furthermore, Suntec REIT’s manager has elected to receive 50% of asset management fees in units, compared to the previous 80% last year, reducing distributable income, Koh points out.

More notably, while he does acknowledge that the Singapore portfolio remains strong, Suntec’s NPI for its overseas portfolio has been affected by adverse movement in exchange rates.

NPI from Australia office properties declined 17.2% y-o-y to $19.3 million in 3QFY2022 due to lower occupancy, as well as a 6.3% depreciation of the Australian dollar (AUD) against the Singapore dollar (SGD).

In the UK, contributions from Minster Building grew 59.1% y-o-y in British pounds (GBP), but came up to only 36.6% y-o-y due to a “massive depreciation of GBP of 12.3% against SGD.”

The same case occurred for Nova Properties, which grew 9.1% y-o-y in GBP, but came up to a 3.7% loss when reported in SGD.

Koh, like Natarajan also highlights Suntec’s “elevated” leverage at 43.1%, adding that the cost of debt has increased 0.9 ppt y-o-y to 3.2% in 3QFY2022, and is expected to reach about 3.5% in 4QFY2022. Management estimated that every 50 bps increase in interest rates will reduce distributable income by 5.1%.

Koh concludes, “We cut our 2023 DPU forecasts by 13% due to higher cost of debts, steep depreciation of GBP against the SGD and the paying 50% of asset management fees in units. We expect cost of debt to hit 3.7% by 2HFY2023.”

OCBC points out ICR limit

Finally, the research team at OCBC Investment Research (OCBC) holds the most bearish view, with a “sell” rating and a fair value estimate of $1.24, down from their previous figure of $1.50.

OCBC also says that Suntec’s results fell below their expectations, also pointing out the 6.6% decline in DPU.

The team writes “the decline would have been worse if not for capital distributions amounting to $5.8 million in 3QFY2022, or 0.2 cents per unit. Excluding this, Suntec REIT’s DPU from operations would have fallen by 15.6% y-o-y.”

This drag came from higher financing costs and a higher proportion of asset management fees paid in cash rather than units.

Notably, OCBC also highlights Suntec’s leverage of 43.1%, saying that a “concerning metric” is the decline in its adjusted interest coverage ratio (ICR) from 2.7x as at June 30 to 2.5x.

The ICR threshold set by the Monetary Authority of Singapore (MAS) for S-REITs to have a leverage limit of 50% is at 2.5x.

As such, OCBC says that given Suntec’s “relatively weak” balance sheet, it may have to expedite asset divestments to lower its gearing.

However, the current climate offers less leeway for value-adding divestment opportunities as compared to the past, amid risks of cap rate expansion and weaker buyers’ sentiment.

They add “we also cannot fully rule out the risks of an equity fundraising exercise by Suntec REIT to reduce its debt, although this would probably be done as a last resort, in our view.”

Due to this, the brokerage cuts their FY2022 and FY2023 DPU forecasts by 5.7% and 14.1%, respectively, on higher interest costs, and lower GBP and AUD inputs in their model.

It also bumps its cost of equity assumption from 7.2% to 7.4%, and lowers its terminal growth rate by 25 bps to 1%, due to its house view that the US will enter a mild recession in 2023.

As at 4.25pm, shares of Suntec REIT were trading at $1.30, with an FY2022 P/NAV ratio of 0.7 and a dividend yield of 6.3%, according to DBS’s estimates.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Analysts maintain 'buy' on E-LOG REIT with lower TP amid portfolio rejuvenation

Analysts positive on FCT amid improving portfolio performance

FY2023 DPUs for S-REITs could see up to 9.0% downside amid interest rate hikes: DBS

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance