Amid Skydance Offer, Paramount Global CEO Trio Trumpet 14 Billion Dollar Brands, Plans To Explore Streaming Joint Ventures

As Paramount Global controlling shareholder Shari Redstone mulls the terms of a merger between her conglom and Skydance, the network/studio/streaming service trotted out their best and brightest CEO troika this early AM in annual global stockholders meet to tout their hit parade of 14 billion dollar revenue earning franchises across all mediums, their assurance to cut $500 million in overhead, and maximize shareholder value and profits.

With Skydance’s David Ellison knocking on Paramount Global’s door with former NBCUniversal CEO Jeff Shell in tow to execute their own strategy, today’s presentation by Brian Robbins, President & CEO of Paramount Pictures and Nickelodeon; George Cheeks, President & CEO of CBS; and Chris McCarthy, President & CEO Showtime/MTV Entertainment Studios and Paramount Media Networks, was a bullhorn to shareholders that this administration has their stuff together, to prevent any possible nosediving of the stock currently, but also an underscoring that the trio have a keen sensibility when it comes to running a worldwide entertainment conglomerate. It’s all about windowing, licensing content, and merchandising, one example being, as Robbins pointed out, how they took Teenage Mutant Ninja Turtles, a dormant IP they acquired back in 2009 and revived it last summer with a $180.5M global grossing animated movie which triggered $1 billion in retail sales.

More from Deadline

Paramount Nears Finish Line With Skydance On Eve Of Shareholder Meeting And Town Hall - Update

Chris Hemsworth In Talks To Star In Paramount's Transformers/G.I. Joe Crossover Movie

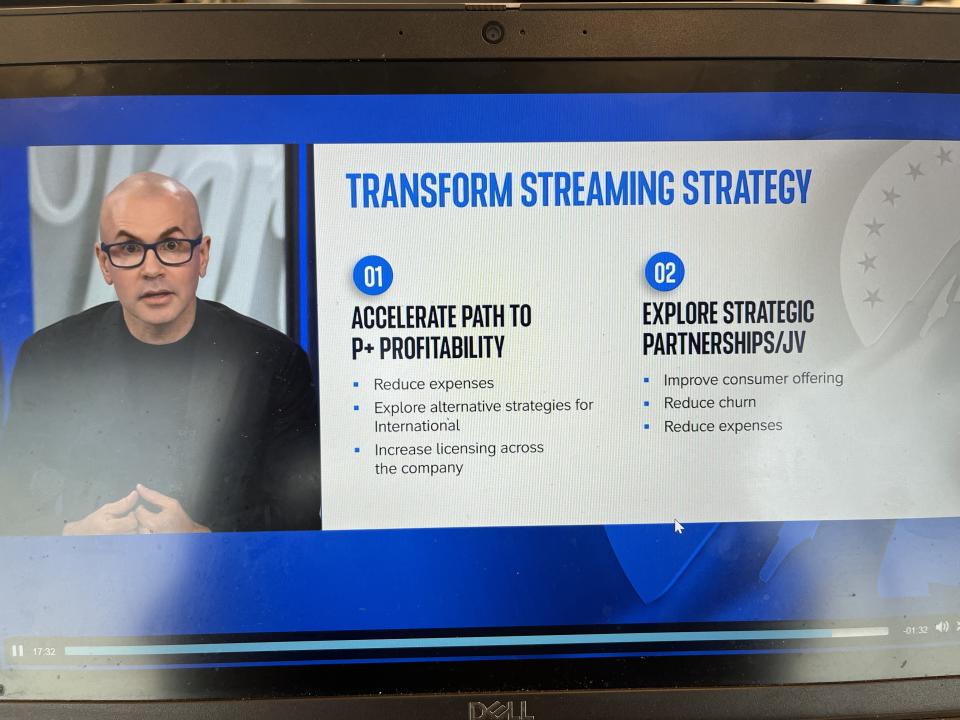

Of course, the investment in streaming has taken major studios for a ride, Paramount Global alone getting hit with a $490M loss due to the sector in Q4, despite subs hitting 67.5M. While there wasn’t any mention of the Skydance merger on today’s presentation, McCarthy, outlined a streaming strategy that called for exploring strategic partnership or a joint venture in accelerating Paramount+’s path to profitability. Another interpretation: Here’s how the company can survive if they were to go it alone; a theory that has been floated out there in ether should Redstone pass on the Skydance offer.

To prevent any cockeyed reactions on the splitting of the CEO office, the troika emphasized on a video presentation which mirrored CBS Mornings that they’ve continually been working together for years, and were the think tank that assembled Paramount+.

The trio’s “billion dollar brand strategy” across TV series and films stemmed from not betting on one genre, such as superhero movies (which was called out, winking at that feature type’s fatigue). That $14 billion brand strategy which was flashed up in a placard included such properties as NCIS, SpongeBob, Yellowstone, South Park, each generating a $1 billion across ads, licensing content, and retail.

McCarthy emphasized that “steaming is key to the company as audiences migrate from linear to streaming,” while Cheeks said “We’re prepared to move quickly on cost reductions by adjusting to the realities of the environment” and that includes cutting duplications across the already job-cut conglom in marketing, real estate for “long-term sustainable growth.”

Exclaimed during the presentation was how Paramount owns 100% of their content.

Added Robbins, “Windowing content is core to our business and has always existed in film and TV, and in domestic and international markets. Defining these windows to optimize return on investment…maximize first run on our own channels…we need to figure out how to grow our vast revenue of our library and we do this by thoughtful licensing” and that means licensing outside the Paramount ecosystem. In sum, as Robbins said it’s about “owning our future.”

Before Ellison considers overhauling the movie studio’s administration, what should be considered is how the current feature development team on the Melrose Ave lot will go eight for eight this year in regards to No. 1 ranking films. With Mean Girls, IF, and Bob Marley: One Love already notching No. 1, on deck for the studio is Quiet Place: Day One (June 28), Transformers One (Sept 20), Smile 2 (Oct. 18), Gladiator 2 (Nov. 22) and Sonic the Hedgehog 3 (Dec. 20).

Best of Deadline

Hollywood & Media Deaths In 2024: Photo Gallery & Obituaries

2024-25 Awards Season Calendar - Dates For Oscars, Tonys, Grammys, Guilds, BAFTAs, Spirits & More

'Knives Out 3': Everything We Know About The Second Rian Johnson Sequel

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance