AmEx (AXP), Emburse Enhance Offerings for Commercial Cardholders

American Express Company AXP recently partnered with Emburse to provide card reconciliation, end-to-end virtual card issuance and expense management to its customers through Emburse Spend. This new offering is specially designed for American Express Business, Corporate Purchasing and Corporate card customers. This move is expected to enhance AmEx’s offerings for commercial customers.

This move bodes well for AmEx as partnering with distinguished companies helps to enhance the value proposition for its existing customers and attract new customers. This is a time opportune move on AXP’s part as most of its revenues in the Commercial Services segment are derived from U.S. Small and Medium Enterprises, whose billed business only grew 1% year over year in the first quarter. The company is working on engaging and providing them more as they return.

Users can integrate their American Express Card in Emburse Spend and can also enroll for virtual cards on demand. This would ease the process of reconciliation, expense submissions and approvals for businesses. Categorization of expenses will become easy and reduce administrative burden. Businesses will be able to manage their budgets and expenses effectively with pre-set parameters for each card. Moreover, per-transaction limits on cards will prevent fraud and unauthorized transactions. Businesses are expected to better optimize their expenses in different payment methods and reduce out-of-policy transactions.

Moves like these are expected to aid AXP in achieving its targeted revenue growth between 9% and 11% in 2024. Moreover, its Commercial Services segment is likely to benefit as a result of enhanced offerings leading to improved retention and new acquisitions.

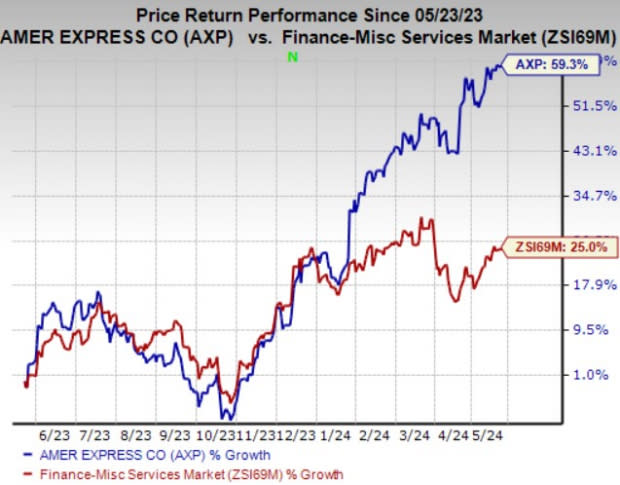

Price Performances

Shares of American Express have gained 59.3% in the past year compared with 25% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

American Express currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Finance space are Jackson Financial Inc. JXN, Euronet Worldwide, Inc. EEFT and CleanSpark, Inc. CLSK. While Jackson Financial sports a Zacks Rank #1 (Strong Buy), Euronet and CleanSpark carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Jackson Financial’s current-year earnings indicates 32.2% year-over-year growth. JXN beat earnings estimates twice in the past four quarters and missed on the other two occasions. The consensus mark for current-year revenues implies a 115.1% jump from a year ago.

The Zacks Consensus Estimate for Euronet Worldwide’s 2024 earnings indicates 15.8% year-over-year growth. During the past month, EEFT has witnessed three upward estimate revisions against none in the opposite direction. It beat earnings estimates in each of the past four quarters with an average surprise of 9.3%.

The Zacks Consensus Estimate for CleanSpark’s current-year earnings suggests a 140.3% year-over-year improvement. During the past month, CLSK has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current-year revenues implies a 183.6% surge from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Jackson Financial Inc. (JXN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance