American Express Shares Remain Undervalued Despite Surge

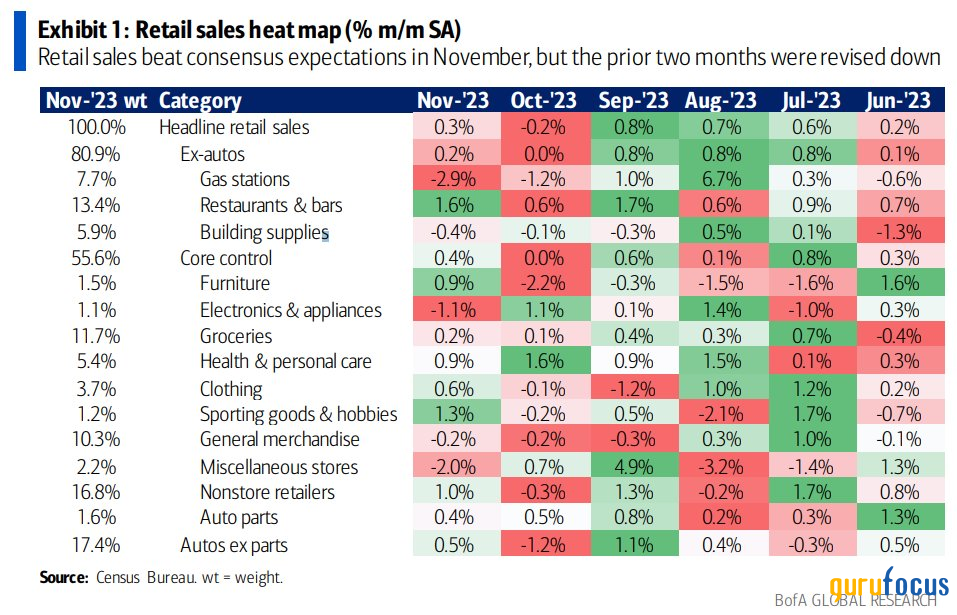

Consumers keep doing what they do best. The November Retail Sales report blew past expectations and followed an upwardly revised 0.2% decline in October. The writing was on the wall after record post-Thanksgiving holiday spending was reported by Adobe Analytics and other industry reporting entities. What's more, company-level clues were generally strong, capped by an impressive quarterly report by Costco (NASDAQ:COST). Robust consumption trends are seen not only in solid fourth-quarter gross domestic product growth estimates (see the Atlanta Fed's GDPnow tool), but also in the stock prices of the major credit card companies.

As such, I see shares of American Express Co. (NYSE:AXP) as modestly undervalued today, and the technical situation is encouraging.

A November consumer spending rebound

Company description

According to Bank of America Global Research, American Express is a fully integrated credit card processing company. It issues cards, hosts a large payment network worldwide and is a merchant acquirer. Amex provides credit card and charge card services to consumers and businesses globally and partners with companies on reward programs, including travel-related services. It operates in three segments: Global Consumer Services Group, Global Commercial Services and Global Merchant and Network Services.

Key data

With a $130 billion market cap, the New York-based consumer finance company within the financials sector trades at a somewhat low 15.9 forward 12-month non-GAAP price-earnings ratio and pays a below-market 1.3% forward dividend yield. Ahead of its January earnings release, shares trade with a modest 19% implied volatility percentage while short interest on the stock is low at 1.2% as of Dec. 14.

Color on the quarter

Back in October, American Express reported a very strong third quarter. GAAP earnings per share verified at $3.30, topping analysts' estimates by 36 cents while $15.4 billion of quarterly sales incrased by more than 13% from a year earlier, a modest beat. The company reported healthy card member spending trends, up 7% from the same period last year on a constant-currency basis. Strength was seen, not surprisingly, among its U.S. geographical segment, but its International Card Services area reported a very high 15% increase, too.

November update

Then, in its November business update, American Express reported positive monthly metrics. Loan growth was steady and loss rates improved compared to October's rate. Loan balances were up 16.8% year over year while U.S. consumer loan growth jumped 15.5%. An encouraging sign for the macro picture, domestic small business growth accelerated to 21% versus November 2022. Finally, its net write-off rate improved to 1.77%, down 15 basis points from the previous month. All in all, everything appears on track.

Given the positive numbers, earnings per share revisions have been stout with American Express there have been 10 analyst upgrades and just a single downgrade in the last handful of weeks, according to Option Research & Technology Services. While you can find cheaper valuations from some of its peers who cater to the lower-end part of the consumer market, the company's growth and steady profitability trends are sanguine characteristics.

Risks

Key risks for the company include a slowdown in high-end consumer spending trends and a decline in travel spending. A weaker macro landscape in 2024 is also a danger, including slower loan growth trends if a mild recession strikes in the first half. Finally, new regulatory hurdles are always a possible downside for American Express' fundamentals.

Valuation

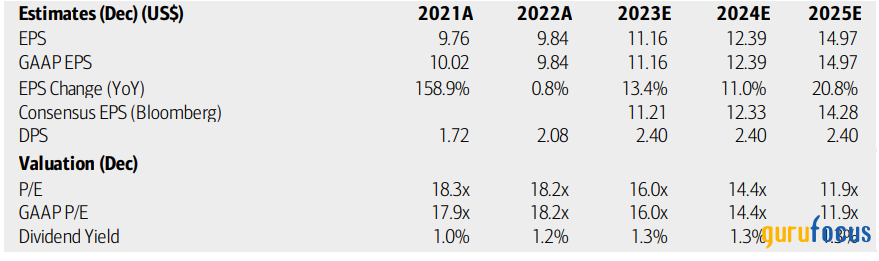

On valuation, analysts at Bank of America see earnings rising at a low-teens percentage clip this year before per-share profit growth ebbs to around a 10% pace according to the latest consensus figures. By 2025, however, a reacceleration of earnings growth is seen, perhaps approaching $15 per share. Sales growth has been solid this year, and it is expected to ease to a high-single-digit percentage pace over the out years. Dividends, meanwhile, are forecast to hold at a 60 cents per quarter trend over the next several quarters. Free cash flow is strong American Express has produced more than $25 of free cash flow per share in the last 12 months.

The stock historically traded with an 18.5 forward non-GAAP earnings multiple. Today, the ratio is significantly under that mark. If we assume a price-earnings ratio of 17 and $12.10 of operating earnings per share over the next 12 months, then shares should trade near $205, making the stock modestly undervalued today. Also consider the company sells for 2.15 times forward sales today a 10% discount to its 2.37 five-year average.

American Express: Earnings, valuation, dividend yield forecasts

Source: Bank of America Global Research

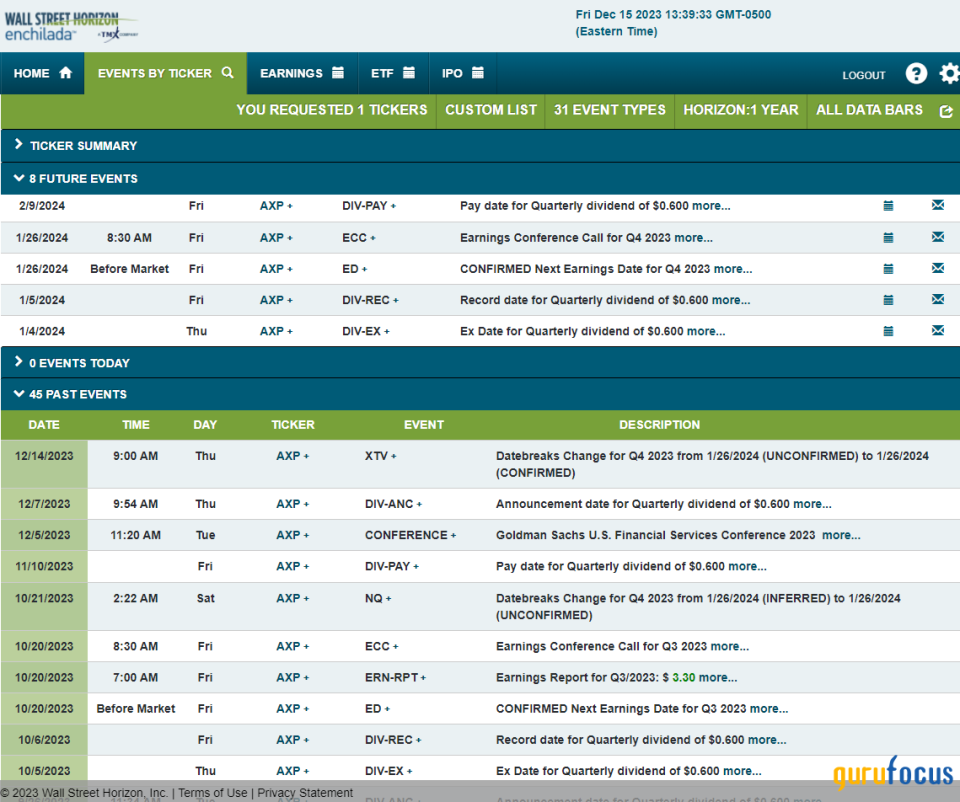

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed fourth-quarter 2023 earnings date of Friday, Jan. 26. Before that, shares trade ex-dividend of 60 cents on Thursday, Jan. 4.

Corporate Event Risk Calendar

Source: Wall Street Horizon

The technical take

American Express shares have seen a remarkable rally off their October low. Notice in the chart below that the stock dipped to about $140 during the third quarter-fourth quarter correction, but has since launched toward key resistance around the $180 mark. That level has been a point of selling twice so far this year the first taking place around the Groundhog Day peak in the S&P 500 and the next coming immediately before the August swoon. Still, shares have risen above a downtrend resistance line drawn on the graph, which is a positive sign. If American Express can rally about $182, then a test of its all-time high just shy of $200 is in play.

Also take a look at where key support is seen. The $130 to $135 zone has been met with buying pressure on multiple occasions over the last three years. Of course, that is a long way down from where shares trade at today. For better risk management, keep your eye on the 200-day moving average. That trend identifier is flat in its slope, suggesting the bulls are not quite in total control yet. But with a positive RSI divergence taking place at its October nadir, there is a solid case that a multi-month low is in place. Finally, a high amount of volume by price is seen from $175 all the way down to $130, so there should be cushion on pullbacks.

Overall, American Express may just be breaking out from a downtrend after holding key support in October. Near-term overbought conditions may spark a pullback, but there should be a fair amount of dip-buyers on such a move.

Shares rising above a key downtrend resistance line, testing the $180 mark

Source: GuruFocus

The bottom line

I see shares of American Express as modestly undervalued today while the technical situation leans more bullish than bearish.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance