AM Alpha to sell freehold office building 112 Robinson for $346.7 mil

112 Robinson has a total net lettable area (NLA) of 91,238 sq ft, and the indicative guide price is $3,800 psf on the NLA. (Picture: Cushman & Wakefield)

Munich-based family office AM alpha is offering to sell 112 Robinson, a prime freehold office building in the Central Business District, for $346.7 million or about $3,800 psf based on the net lettable area of 91,238 sq ft, according to a source. The property is jointly marketed by Cushman & Wakefield and CBRE. The sale of 112 Robinson will be conducted through an Expression of Interest that will close on July 18.

The divestment of the office building is less than three years after the family office acquired the property for $269.7 million, or $2,925 psf on the nett lettable area, in December 2021. It was the family office's first direct real estate acquisition in Singapore back then.

112 Robinson is a 14-storey commercial building along Robinson Road. Comprising an F&B unit on the ground floor and office spaces on the second to 14 floors, the building has a total net lettable area (NLA) of 91,238 sq ft.

Read also: AM alpha buys historic Edwardian-style office building in Manchester

The property underwent a major refurbishment that was completed in 3Q2023, according to a press release. The asset enhancement initiatives (AEI) included an overhaul of the street level facade, the five-footway, the main entrance, and retail space on the ground floor lobby, as well as refurbishment of the common areas such as office lift lobbies, toilets, and the addition of a nursing room.

The property has a BCA Green Mark Platinum Super Low Energy rating, and the AEI incorporated end-of-trip facilities like bike racks and shower facilities, as well as upgrading the existing air-conditioning system.

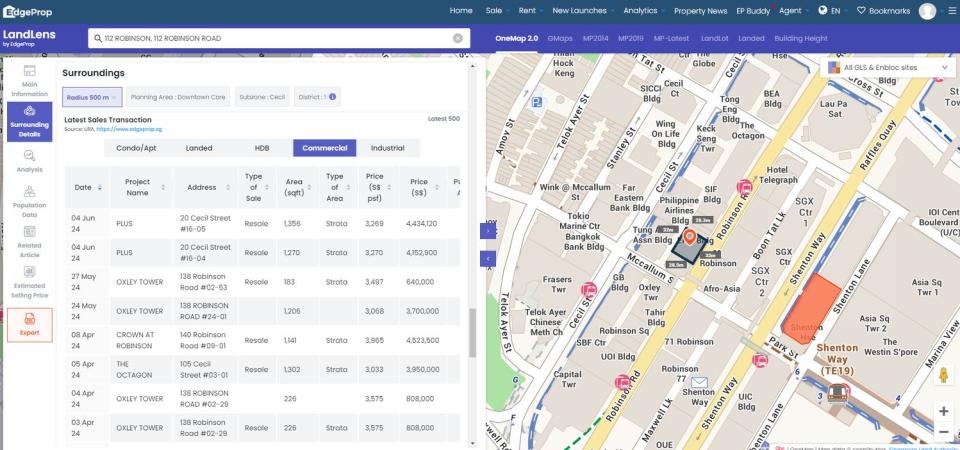

The latest commercial transactions around 112 Robinson, displayed using EdgeProp's analytics tool, Landlens. (Map: EdgeProp Singapore)

"112 Robinson offers a highly coveted opportunity to acquire a freehold institutional grade office asset in the tightly held Tanjong Pagar/Robinson Road precinct. Freehold assets in CBD are always highly sought after by investors for their value appreciation and preservation. The refurbishment works have given the Property a breath of fresh air, and the almost full occupancy is a strong testament to the appeal of the building to tenants," says Shaun Poh, executive director of capital markets at Cushman & Wakefield.

The property is more than 90% occupied. With 33m of frontage along Robinson Road, the asset offers branding and signage opportunities for prospective purchasers. "With a well-staggered lease expiry profile at 112 Robinson, the incoming investor is well-positioned to capitalize on upward rental reversions and ride on the stellar performance of the Singapore office market," says Michael Tay, head of capital markets at CBRE.

Tay adds: "Singapore’s prime office market is expected to outperform over the next few years due to the tightening of new supply in the CBD. The Government’s initiatives for decentralization and increasing alternative uses within the CBD, such as residential, hotel and retail, may also impact longer-term office supply".

These factors will have a positive impact on commercial office rents and capital values, and despite the headwinds faced by office demand in other geographic regions, office performance in Singapore has been resilient," says Tay, adding that the increase in prime office rents over the last 12 consecutive quarters demonstrates the resilience of the sector.

Read also: AM alpha’s timing-driven, value-add real estate play

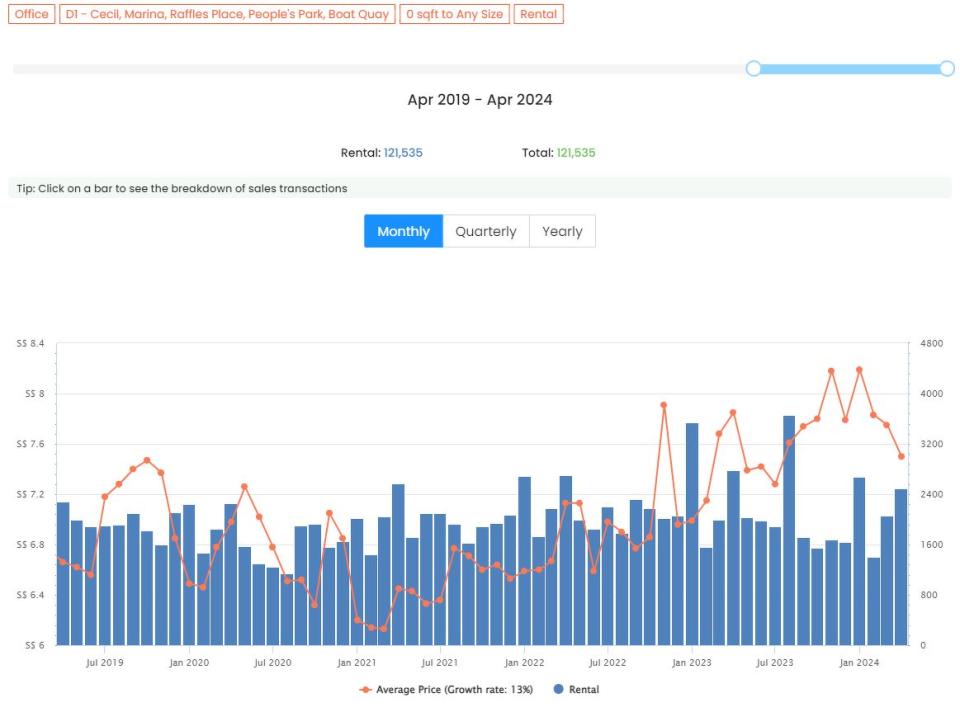

Office rents in District 1, displayed using EdgeProp's Market Trends tool. (Source: URA, EdgeProp Singapore)

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

AM alpha buys historic Edwardian-style office building in Manchester

[UPDATE] Munich-based family office AM alpha buys 112 Robinson for $269.7 mil

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance