Aluminum Prices Face Downward Pressure Amid Oversupply Concerns

Via Metal Miner

Overall, the Aluminum Monthly Metals Index (MMI) rose 4.09% from May to June.

Aluminum prices outperformed all other base metals throughout May, with a 5.28% rise. Prices found a peak at their highest level since June 2022 on May 29 before losing all of May’s gains during the first three weeks of June.

Aluminum Prices Follow Copper Prices Lower

Months ago, fears of copper shortages sparked renewed interest in the market. This had knock-on effects across the base metal category, triggering roughly three months of uptrends. However, the global market showed no signs of tangible copper shortages by May, even as copper prices spiked past their previous all-time high. Meanwhile, the Fed made no moves to unravel interest rates, which remain a pressure on demand. And while inflation started to cool, it continued to trend higher than the Fed’s 2% target rate.

Investors appeared to take note of the current reality of the market by late May, and the speculative rally began to unravel as copper prices found a peak on May 20. Meanwhile, aluminum prices continued to rise before eventually echoing the downtrends among base metal prices by the close of the month. Since peaking, prices have fallen nearly over 9% to where they currently stand at their lowest levels since April 9. They also remain in search of a new bottom.

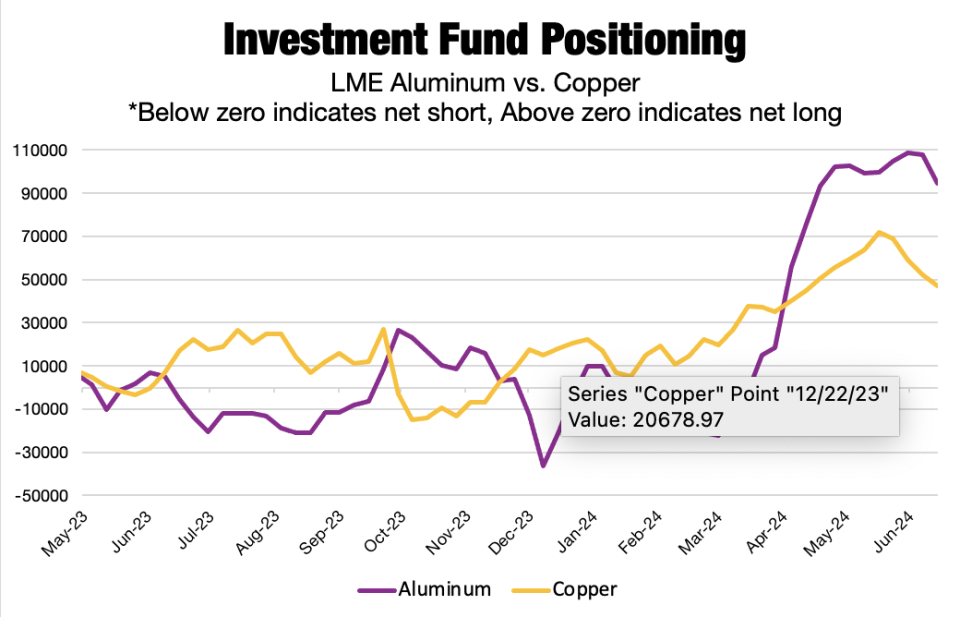

The delayed response by aluminum prices, which peaked nine days after copper, resulted from the continued build-up in long positions among investment funds. Their large positions hold outsized sway over price direction. However, a sell-off began by June as funds pulled away from the market, resulting in an ongoing decline in their net long bias.

China Ramps Up Production Amid Bearish Outlook

As aluminum prices continue their decline, the end of China’s dry season could create even more problems. Hydro-powered Yunnan experienced heavy rains, which brought smelters back online. Data from China’s National Bureau of Statistics showed output hit a two-year high in May, rising 7.2% from 2023. According to Bloomberg Intelligence, those gains appear likely to hold, with production forecasted to rise by an additional 330,000 tons in June amid the return of more smelters.

News of China’s production boom comes after a sharp jump in LME inventories. Reports indicate that Trafigura dumped over 400,000 metric tons of aluminum into warehouses, mostly of Indian origin. While the trader likely aimed to profit off rent-sharing deals as the massive delivery saw load-out queues jump, the ability of Trafigura to dump such significant amounts of product indicates there are large volumes of aluminum floating around the market. In short: global oversupply.

Protectionist Measures Target China, But Chinese Imports Remain High

China’s ability to consume increased aluminum supply remains in question. Between its beleaguered property sector and disappointing factory output data, there are more than a few red flags regarding China’s appetite. Meanwhile, Western countries continued to ramp up protectionist measures against Chinese overcapacity, adding another challenge for Chinese producers.

In mid-May, the White House increased tariff rates on certain Chinese products, including aluminum and EVs. The White House Fact Sheet noted, “China is also flooding global markets with artificially low-priced exports.” The commentary went on to state that “China’s policies and subsidies for their domestic steel and aluminum industries mean high-quality, low-emissions U.S. products are undercut by artificially low-priced Chinese alternatives produced with higher emissions.”

Tariffs on certain aluminum products, including sheets, plates, and foils, will increase from 0-7.5% to 25% in 2024. It’s also important to note that these new duties will come on top of Section 232 tariffs. Meanwhile, tariffs on EVs, which also require a considerable volume of aluminum, will increase from 25% to 100%. In June, the European Commission followed suit, imposing tariffs up to 38.1% on Chinese EVs beginning July 4.

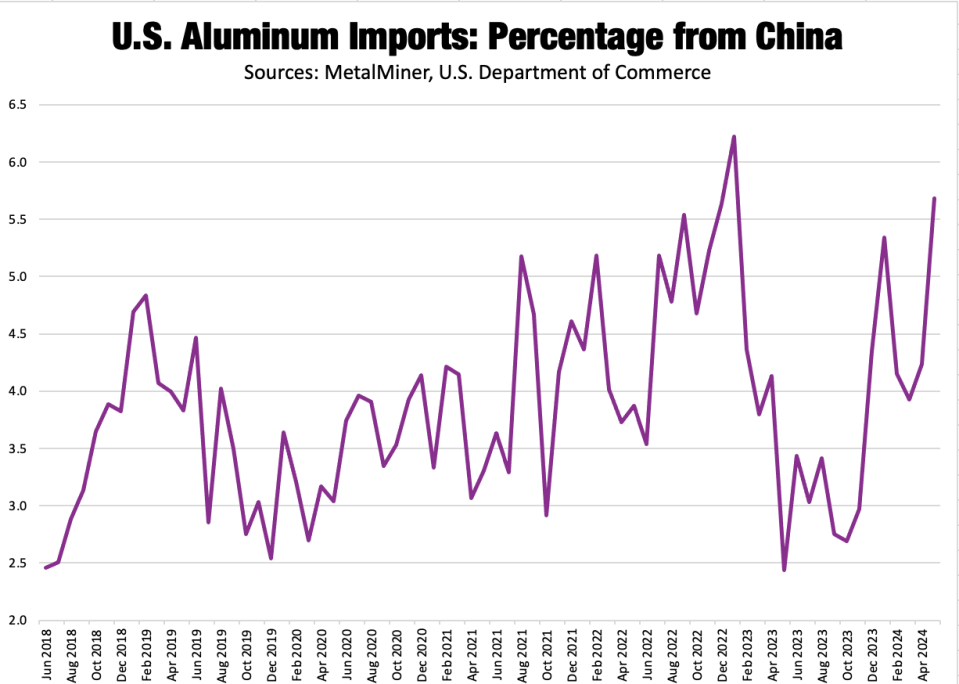

The extent to which the new tariffs will impact aluminum imports from China remains to be seen. While Chinese aluminum represents a relatively small percentage of total U.S. imports, that percentage saw a sharp increase alongside the rise in aluminum prices in recent months.

By Nichole Bastin

More Top Reads From Oilprice.com:

Yahoo Finance

Yahoo Finance