Alpine Immune Sciences Inc (ALPN) Reports Q1 2024 Financials Amid Pending Acquisition by Vertex ...

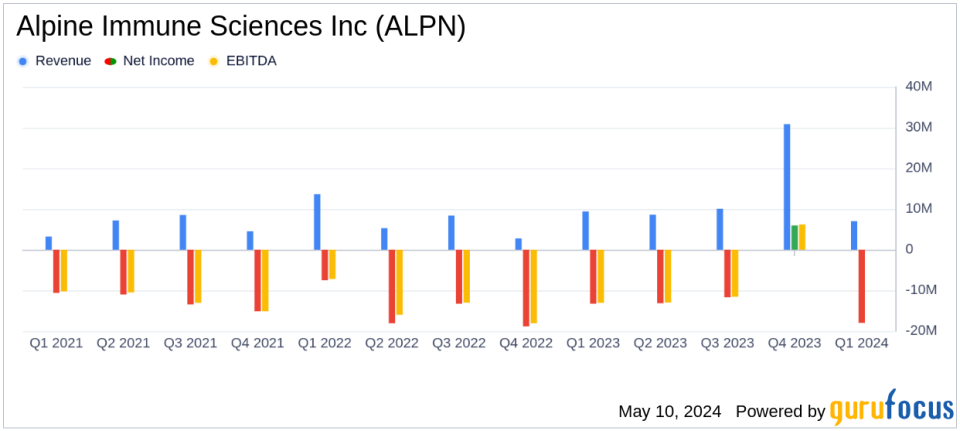

Revenue: Reported Q1 2024 collaboration revenue of $7.0 million, down from $9.4 million in Q1 2023, and exceeded the estimate of $3.52 million.

Net Loss: Q1 2024 net loss widened to $17.9 million from $13.3 million in Q1 2023, below the estimated net loss of $23.95 million.

Research and Development Expenses: Increased to $22.5 million in Q1 2024, up from $19.6 million in the same period last year, driven by higher clinical trial and manufacturing costs.

General and Administrative Expenses: Rose to $7.3 million in Q1 2024, from $5.4 million in Q1 2023, primarily due to increases in personnel costs and professional services.

Cash Position: Cash and investments totaled $362.4 million as of March 31, 2024, compared to $368.2 million at the end of 2023, with sufficient funding anticipated into 2026.

Earnings Per Share: Basic and diluted net loss per share remained constant at $0.28 for both Q1 2024 and Q1 2023, above the estimated loss per share of $0.41.

On May 9, 2024, Alpine Immune Sciences Inc (NASDAQ:ALPN), a prominent player in the field of immunotherapy for autoimmune and inflammatory diseases, disclosed its financial outcomes for the first quarter ending March 31, 2024. The details were released through an 8-K filing. This announcement comes in the wake of a significant development where Vertex Pharmaceuticals Incorporated agreed to acquire Alpine for $65 per share in cash, a deal set to conclude in Q2 2024.

Financial Highlights and Operational Insights

Alpine Immune Sciences reported a collaboration revenue of $7.0 million for the quarter, a decrease from the $9.4 million recorded in the same period last year. This decline was primarily attributed to a reduction in revenue from Amgen, as key research programs neared completion. The company's research and development expenses saw an increase to $22.5 million, up from $19.6 million in Q1 2023, driven by escalated costs in clinical trials and manufacturing related to its RUBY studies.

General and administrative expenses also rose to $7.3 million from $5.4 million, reflecting higher personnel costs and professional services. Consequently, Alpine's net loss widened to $17.9 million from $13.3 million year-over-year. Despite these challenges, the company maintains a robust cash position, with cash and investments totaling $362.4 million as of March 31, 2024, deemed sufficient to support planned operations into 2026.

Strategic Acquisition and Future Prospects

The impending acquisition by Vertex Pharmaceuticals marks a pivotal phase for Alpine, promising to enhance its capabilities and expand the reach of its innovative therapies. This strategic move is expected to provide Alpine with the resources needed to accelerate its clinical programs and potentially bring new treatments to market more swiftly.

Analysis of Financial Stability and Investor Outlook

Alpine's substantial cash reserves and the strategic acquisition by Vertex suggest a positive outlook for the company's future, despite the current operational losses. The acquisition not only underscores the intrinsic value and potential of Alpines proprietary technologies but also enhances the financial stability of the company, providing a clearer path towards advancing its clinical programs and potential market entries.

For investors, the acquisition deal represents a significant premium on Alpine's current stock value, indicating potential lucrative outcomes for current shareholders pending the closure of the transaction.

Conclusion

Alpine Immune Sciences continues to navigate the complexities of biopharmaceutical development with strategic acumen, backed by robust financial management and promising strategic alliances. As the company moves towards a new chapter under Vertex's umbrella, stakeholders can anticipate a strengthened focus on innovation and market presence in the immunotherapy space.

For more detailed insights and ongoing updates on Alpine Immune Sciences Inc (NASDAQ:ALPN) and the biotechnology industry, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Alpine Immune Sciences Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance