Airbus (EADSY), Indigo Ink Historic Order for 500 A320 Jets

Airbus SE EADSY recently inked a major order to supply 500 of its A320 family aircraft at the Paris Air Show 2023 to Indigo, thereby marking the biggest order in the commercial aviation history. Indigo, a longstanding client of Airbus, has collective order of 1330 orders for Airbus, entailing strong revenue-generation prospects for Airbus in the days ahead. `

Growth Prospects of Airbus in India

The lucrative and one of the fastest growing Indian aviation market leverages commercial aircraft manufacturers’ positioning. The rising passenger market bears testimony to rising travel demand in the nation, which corresponds to an increasing demand for aircraft. Per the latest report from Directorate General of Civil Aviation, the number of passengers travelling through domestic carriers In India recorded a strong growth of 36.1% during January-May 2023 period.

With much room for further growth in the next decade, the Indian aviation market certainly holds opportunities for aircraft manufacturers like Airbus. Per the report from SP’s airbuzdomestic and international traffic is likely to be in the range of 130-140 million and 55-60 million in 2023, per the Centre for Asia Pacific Aviation (CAPA) India estimates.

Rapidly-expanding connectivity, growing population, increased investment on aviation market and its infrastructure, rise in disposable income and increased air travel demand are likely to stimulate growth of the Indian aviation market.

The factors mentioned above unfold immense potential in the Indian aviation market that could benefit industry forerunners in aircraft manufacturing like Airbus. The company’s already-established position in Indian aviation market, with its strong portfolio of jets, tend to provide competitive edge to the company and boost its growth trajectory.

Peers To Benefit

Another recognized aerospace giant, apart from Airbus, that holds a solid foothold in the Indian aviation market and may further gain from the nation’s growth potential is:

Boeing BA: The company has a large customer base in the growing Indian aviation market and its fleet are part of many major airlines in India. Recently, Air India announced its plans in February 2023 to invest in 190 737 MAX, 20 787 Dreamliner and 10 777X airplanes. The deal also entails potential orders for 50 additional 737 MAXs and 20 787-9s.

The long-term earnings growth rate of Boeing is pegged at 4%. Shares of Boeing have increased 60.8% in the past year.

Price Performance

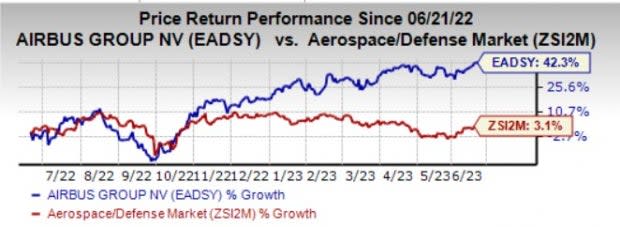

Shares of Airbus have rallied 42.3% in the past year compared with the industry’s growth of 3.1%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Airbus currenlty carries a Zacks Rank #3 (Hold). Two better-ranked stocks in the same industry are Spire SPIR and Safran SAFRY, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Spire’s 2023 sales suggests a growth rate of 32.9% from the prior-year reported figure. The Zacks Consensus Estimate for Spire’s 2024 sales calls for a growth rate of 34.3% from the prior-year estimated figure.

SPIR reported an earnings surprise of 16.67% in the last reported quarter. The four-quarter average earnings surprise for the company stands at 10.37%.

Safran boast a long-term earnings growth rate of 37.6%. The Zacks Consensus Estimate for its 2023 sales implies a growth rate of 36.7% from the prior-year reported figure.

The Zacks Consensus Estimate for SAFRY’s 2024 sales calls for a growth rate of 9.9% from the prior-year estimated figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Safran SA (SAFRY) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Spire Global, Inc. (SPIR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance