AIMS APAC REIT reports 10.2% higher 3QFY2023 DPU of 2.59 cents

For the 9MFY2023, the REIT’s DPU came to 7.29 cents, 2.7% higher y-o-y.

The manager of AIMS APAC REIT (AA REIT) has reported a distribution per unit (DPU) of 2.59 cents for the 3QFY2023 ended Dec 31, 2022. The quarter’s DPU is 10.2% higher than the DPU of 2.35 cents for the 3QFY2022.

For the 9MFY2023, the REIT’s DPU came to 7.29 cents, 2.7% higher than the 9MFY2022 DPU of 7.10 cents.

During the 3QFY2023, distributions to unitholders grew by 11.7% y-o-y to $18.7 million thanks to the higher quarterly gross revenue and net property income (NPI).

The REIT’s gross revenue for the 3QFY2023 grew by 14.1% y-o-y to $42.0 million while NPI grew by 14.0% y-o-y to $30.9 million. The increases were mainly due to the higher rental income from the REIT’s properties in Singapore and Australia as well as from the full quarter revenue contribution from the acquisition of Woolworths Headquarters. The acquisition was completed on Nov 15, 2021.

For the 9MFY2023, the REIT’s distributions to unitholders grew by 4.1% y-o-y to $52.4 million.

Gross revenue for the nine-month period increased by 22.7% y-o-y to $125.2 million while 9MFY2023 NPI increased by 23.0% y-o-y to $92.0 million.

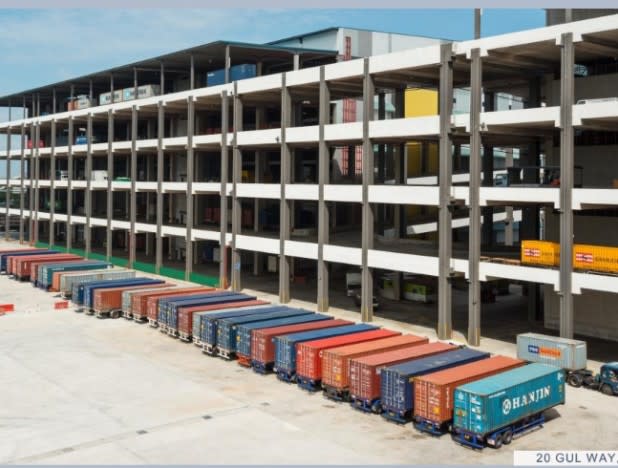

As at Dec 31, 2022, the REIT’s portfolio occupancy stood at 97.8%, up by 0.3 percentage points q-o-q. The REIT saw “strong” leasing momentum for the quarter with the manager successfully executing 11 new and 16 renewal leases representing 52,658 sqm or 6.7% of total net lettable area (NLA).

The REIT’s weighted average lease expiry (WALE) stood at 4.5 years as at Dec 31, 2022, down from the previous quarter’s 4.8 years. Rental reversion for the quarter came in at 21.2%, up from the 8.1% seen in the 1HFY2023, which was mainly contributed from its logistics and warehouse segment which represented 81.6% of the leases renewed. Its tenant retention rate, however, fell to 79.0% from the 1HFY2023’s 85.4%.

For the rest of the FY2023, only 4.6% of leases are due for expiry. More of than half of them are related to the logistics and warehouse segment.

According to Russell Ng, CEO of the manager, the REIT’s 3QFY2023 performance reflects the “successful execution of our focused asset and lease management strategy”.

“We have delivered consistently high occupancy rates alongside sustained positive rental reversion amid ongoing economic headwinds and inflationary environment. Notably, our logistics and warehouse segment, which contributes to 43% of AA REIT’s gross revenue, continues to record strong rental reversions against a backdrop of tight supply,” he says.

He adds: “While we are mindful of the macro uncertainty and market volatility ahead, we believe the near-term outlook for Singapore’s industrial market will continue to be supported by the favourable demand and supply dynamics. Our priorities remain unchanged, with particular focus on tenant retention and strengthening our portfolio through active asset enhancement, redevelopment, divestment and capital recycling.”

The manager’s chairman, George Wang continues: “We have been steadfast in the execution of a prudent management strategy to build a high-quality, resilient portfolio, which has positioned us well to navigate challenging market conditions. Even as we remain vigilant to anticipate and adapt to the evolving market conditions, we are continually looking at initiatives and opportunities to future proof our portfolio to drive sustainable long-term performance.”

The record date for the DPU is on Feb 3 while the payment date will be on March 24.

Looking ahead, the REIT manager says it expects to see favourable supply-demand dynamics continuing to support healthy occupancy rates in Singapore’s industrial market.

“The tight supply conditions and resilient long-term demand from the life science and high-value manufacturing sectors will continue to support rental rates for high-quality assets, in particular the prime logistics segment,” it says.

In Australia, the outlook is also positive with the the flight to quality assets and infrastructure improvements continuing to drive demand for high-quality spaces and new developments in Sydney.

“In the Gold Coast, strong population growth, a fast-growing economy and major infrastructure improvements, coupled with a chronic undersupply of industrial space will continue to keep vacancy rates at low levels,” says the REIT manager.

It adds: “Against the backdrop of an uncertain global outlook, inflationary pressures and rising interest rates, the manager remains focused on tenant retention to maintain its high occupancy while pursuing opportunities for asset enhancements, redevelopment, and divestments to improve the overall portfolio quality and drive organic growth.”

Units in AA REIT closed 2 cents higher or 1.55% up at $1.31 on Jan 20.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Fortress Minerals reports 3.6% higher 3QFY2023 earnings of US$2.9 mil

Analysts slash target prices for AIMS APAC REIT, but still maintain ‘buy’ calls

AIMS APAC REIT posts 1HFY2023 DPU of 4.70 cents, down 1.1% y-o-y

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance