AIG Optimizes Portfolio With Sale of Travel Insurance Business

American International Group, Inc. AIG recently entered into a definitive agreement to divest its global individual personal travel insurance and assistance business. It has agreed to sell the business for $600 million cash coupled with additional earn-out consideration to Zurich Insurance Group. The sale is expected to be completed by the end of 2024, pending closing conditions and regulatory approvals.

The sale agreement contains its Travel Guard line and servicing capabilities, barring Japan and its joint venture agreement in India. The agreement also excludes travel insurance offered through its Accident & Health line. This move bodes well for AIG as it will free up its capital and simplify its operations in the future.

AIG continues to streamline its operations to intensify its focus on its General Insurance business. This strategic approach is likely to improve profitability, bolster liquidity, and reduce portfolio volatility. Recent divestments from global insurance organizations, such as Validus Re, AlphaCat, Talbot Treaty, and Crop Risk Services, underscore this commitment to refocusing efforts on core operations.

Moves like these will enable the company to undertake shareholder value-boosting measures. It repurchased shares worth $1.7 billion in the first quarter of 2024 and $613 million in April. The company also increased its dividend by 11% in the first quarter of 2024. Moreover, excess capital might be used to pay back debt. Its debt to capital of 30.9% improved 510 basis points year over year in the first quarter. Hence, excess capital is also expected to strengthen AIG’s balance sheet and leverage ratios in the future.

AIG aims to become a pure-play Property and Casualty insurer, and this sale is a meaningful step in that direction. Its General Insurance, or its core business’s underwriting results, are improving, as signaled by a 210 basis point improvement in the combined ratio in the first quarter. Hence, focusing its resources on its core operations might prove to be beneficial for the organization.

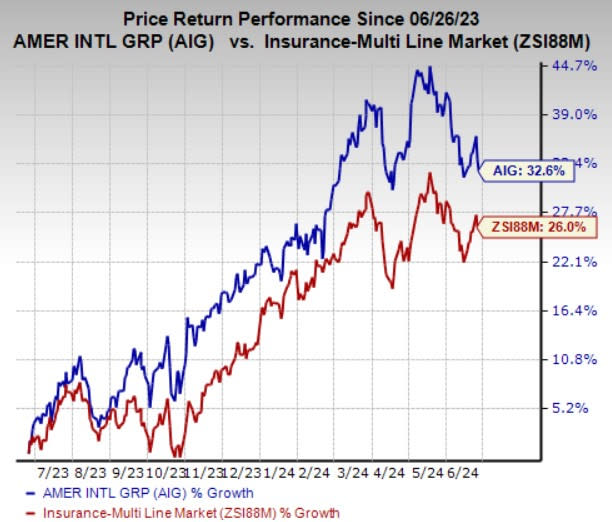

Price Performance

AIG shares have gained 32.6% in the past year compared with 26% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

AIG currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Finance space are StepStone Group LP STEP, Virtu Financial, Inc. VIRT and Axos Financial, Inc. AX. StepStone Group and Virtu Financial sport a Zacks Rank #1 (Strong Buy), while Axos Financial carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for StepStone Group’s 2024 earnings is pegged at $1.70 per share, which remained stable over the past week. STEP beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 15.7%.

The Zacks Consensus Estimate for Virtu Financial’s 2024 earnings is pegged at $2.48 per share. The consensus mark for VIRT’s revenues in 2024 is pegged at $1.3 billion.

The Zacks Consensus Estimate for Axos Financial’s 2024 earnings is pegged at $7.72 per share, which indicates a year-over-year increase of 52.3%. The estimate remained stable over the past month. AX beat earnings estimates in the past four quarters, with an average surprise of 12.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

StepStone Group Inc. (STEP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance