AIG to Divest 20% Corebridge Stake to Nippon Life for $3.8B

American International Group, Inc. AIG announced that the company has agreed to divest around 120 million common stocks of its Corebridge Financial, Inc. CRBG subsidiary to Nippon Life Insurance Company. The deal has a total price tag of $3.8 billion, pricing each share at $31.47.

The divestment is expected to be finalized by the first quarter of 2025. The shares being sold equate to a 20% ownership stake in CRBG. Per the deal, AIG has committed to holding a 9.9% ownership stake in CRBG for a period of two years following the transaction's completion.

The move is crucial as it will enable Corebridge to onboard a major investor. At the first quarter's end, it had more than $390 billion in assets under management and administration. The deal is expected to enhance Japan’s largest insurer, Nippon Life’s footprint in the U.S. market.

AIG closed the IPO of Corebridge, the holding company of its Life and Retirement unit, in September 2022. Through secondary offerings, it further reduced its ownership in CRBG and generated cash.

AIG continues to streamline its operations to intensify its focus on its General Insurance business. This strategic approach is likely to improve profitability, bolster liquidity and reduce portfolio volatility. Recent divestments from global insurance organizations, such as Validus Re, AlphaCat, Talbot Treaty, and Crop Risk Services, underscore this commitment to refocusing efforts on core operations.

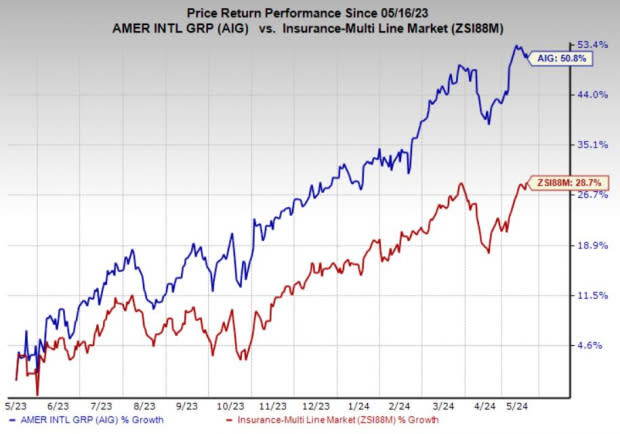

Price Performance

AIG shares have gained 50.8% in the past year compared with the 28.7% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

AIG currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Finance space are Brown & Brown, Inc. BRO and Root, Inc. ROOT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. It has witnessed six upward estimate revisions against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%.

The consensus mark for ROOT’s current-year earnings indicates a 35.6% year-over-year improvement. It beat earnings estimates in all the past four quarters, with an average surprise of 34.1%. Furthermore, the consensus estimate for Root’s 2024 revenues suggests 125.3% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Corebridge Financial, Inc. (CRBG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance