AIA Group Ltd's Dividend Analysis

Exploring the Sustainability and Growth of AIA Group Ltd's Dividends

Introduction to AIA Group Ltd's Dividend Announcement

AIA Group Ltd (AAGIY) recently declared a dividend of $0.61 per share, set to be paid on 2024-06-24, with the ex-dividend date on 2024-05-30. As investors anticipate this upcoming payment, it's an opportune time to delve into the company's dividend history, yield, and growth rates. This analysis utilizes comprehensive data from GuruFocus to evaluate the performance and sustainability of AIA Group Ltd's dividends.

Overview of AIA Group Ltd

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

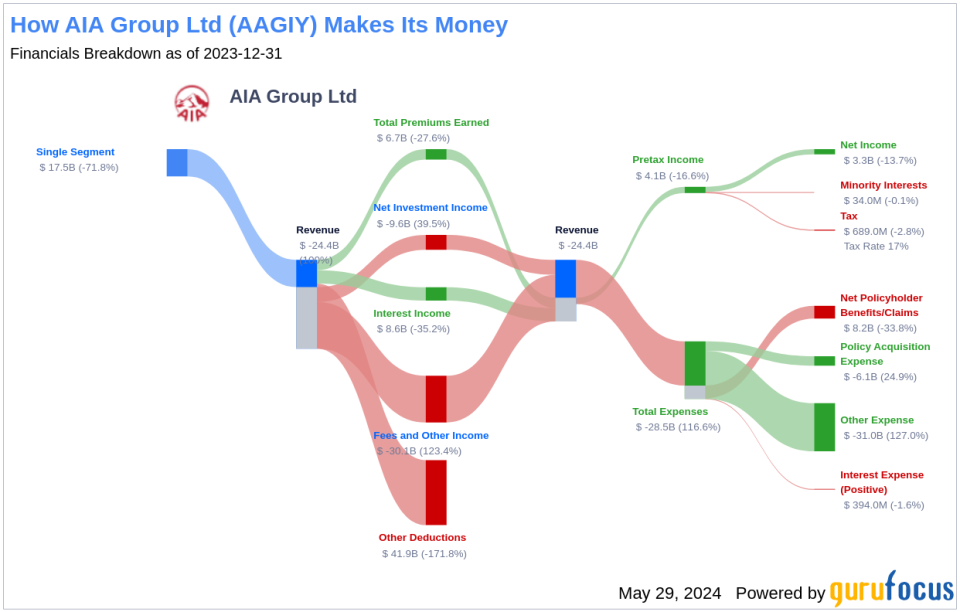

AIA Group Ltd, a major pan-Asian insurance provider, offers a diverse range of products including retirement savings plans, life insurance, and accident and health insurance. Headquartered in Hong Kong, AIA was once a part of AIG before its independent listing in Hong Kong in 2010. The company also caters to corporate clients through employee benefits, credit life, and pension services. With a presence in 18 markets, AIA serves over 30 million individual policyholders and more than 16 million group insurance members.

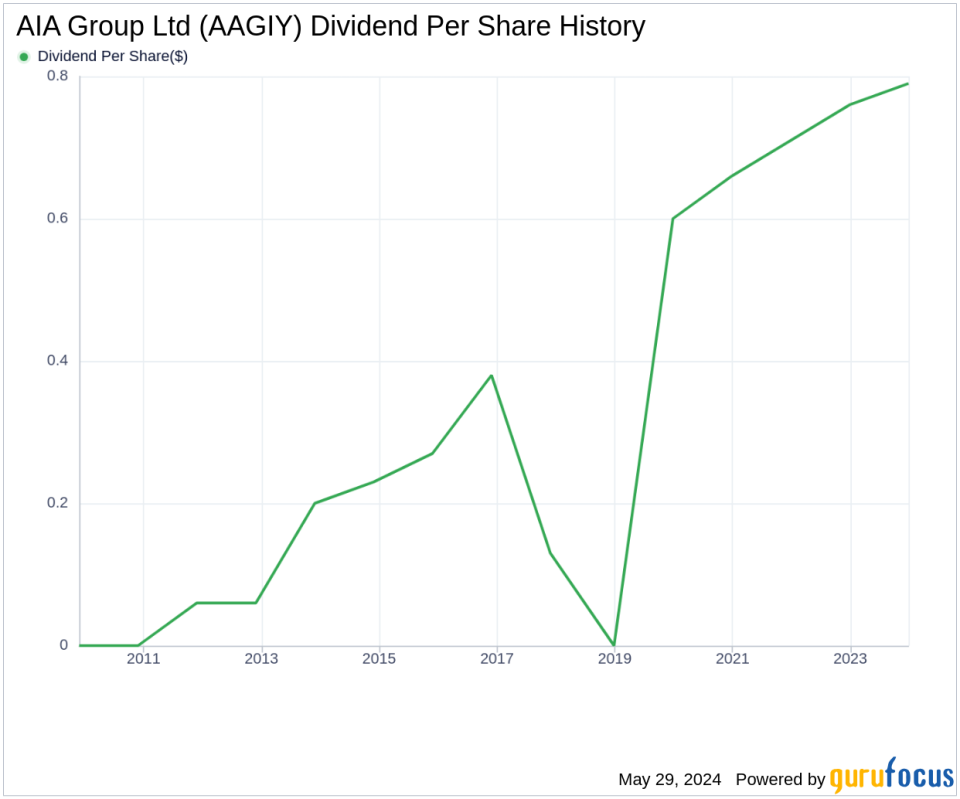

A Look at AIA Group Ltd's Dividend History

Since 2011, AIA Group Ltd has upheld a steady record of dividend payments, distributed bi-annually. Below, a chart illustrates the annual Dividends Per Share to track historical trends.

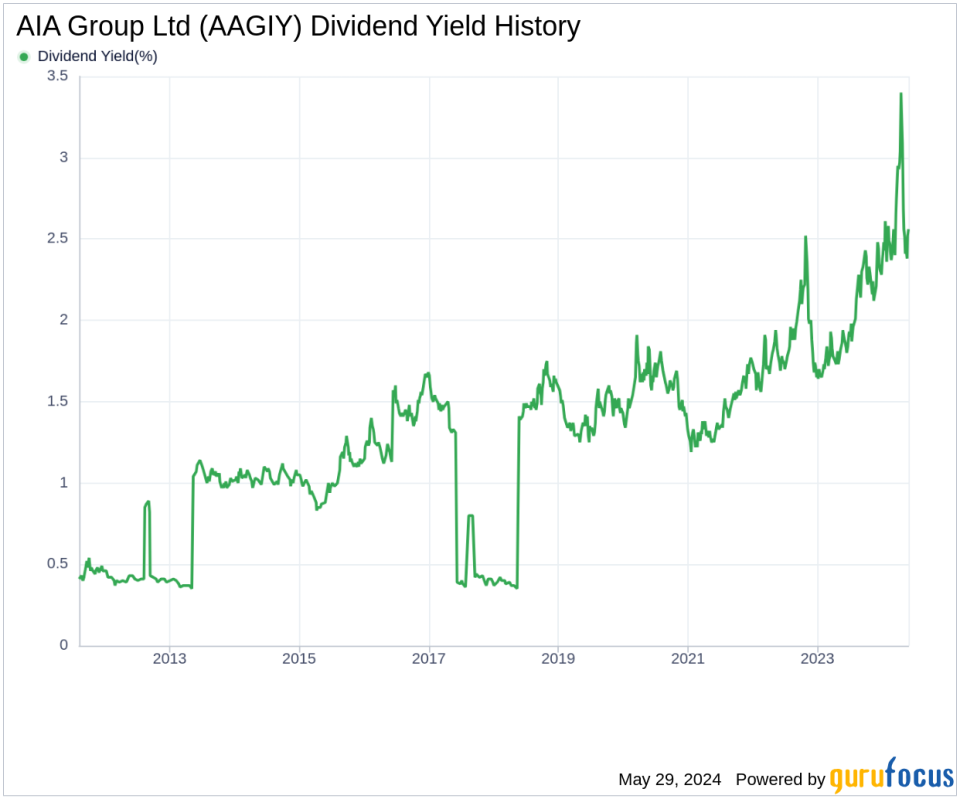

Assessing AIA Group Ltd's Dividend Yield and Growth

Currently, AIA Group Ltd boasts a 12-month trailing dividend yield of 2.51% and a forward dividend yield of 2.60%, indicating anticipated increases in dividend payments over the next 12 months. Over the past three years, the annual dividend growth rate was 6.60%. The 5-year yield on cost of AIA Group Ltd stock is approximately 2.51%.

The Sustainability of Dividends: Payout Ratio and Profitability

The dividend payout ratio of AIA Group Ltd, which stands at 0.37 as of the end of 2023, reveals the portion of earnings allocated to dividends. A lower ratio indicates substantial earnings retention, essential for future growth and resilience against downturns. The company's profitability rank is 5 out of 10, reflecting fair profitability. Consistent positive net income over the past decade further underscores its financial health.

Future Growth Prospects of AIA Group Ltd

AIA Group Ltd's growth rank of 5 suggests modest future growth. Its revenue per share and 3-year revenue growth rate indicate a robust revenue model, despite a -24.40% average annual decrease. The 3-year EPS growth rate and 5-year EBITDA growth rate further reflect challenges and underperformance relative to global competitors.

Concluding Insights on AIA Group Ltd's Dividends

Considering AIA Group Ltd's consistent dividend payments, growth in dividend rates, prudent payout ratios, and fair profitability metrics, the company presents a compelling case for dividend investors. However, the observed underperformance in revenue and earnings growth rates suggests a cautious approach. Investors are encouraged to weigh these factors carefully to make informed decisions.

GuruFocus Premium users can explore potential high-dividend opportunities using our High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance