Agriculture tech: next big opportunity in Southeast Asia?

Agriculture has become – pardon the pun – a lucrative field for technology companies.

A total of US$2.36 billion was invested into the global agriculture tech – or agtech – businesses in 2014, which put in on par with sectors like fintech, and ahead of clean tech, according to a recent report by agtech crowdfunding site AgFunder.

The bloom has just begun. AgFunder’s mid-2015 report says that global agtech investment have already hit $2.06 billion.

In its reports, the firm defines agtech broadly. It covers a set of companies directly involved with cultivating plants and other living organisms necessary to make food, biofuels, chemicals, medicines, and other materials. It also includes companies on other parts of the agriculture value chain, such as processing, transportation, and retail services.

The best-funded verticals in this year’s mid-term report are food ecommerce startups that change the way produce reaches consumers. The second most popular area was water-related startups. Third was precision agriculture – a term that lumps together big data from drones, satellites, sensors, and other smart equipment, with the goal of helping farmers make better decisions.

Beyond China and India

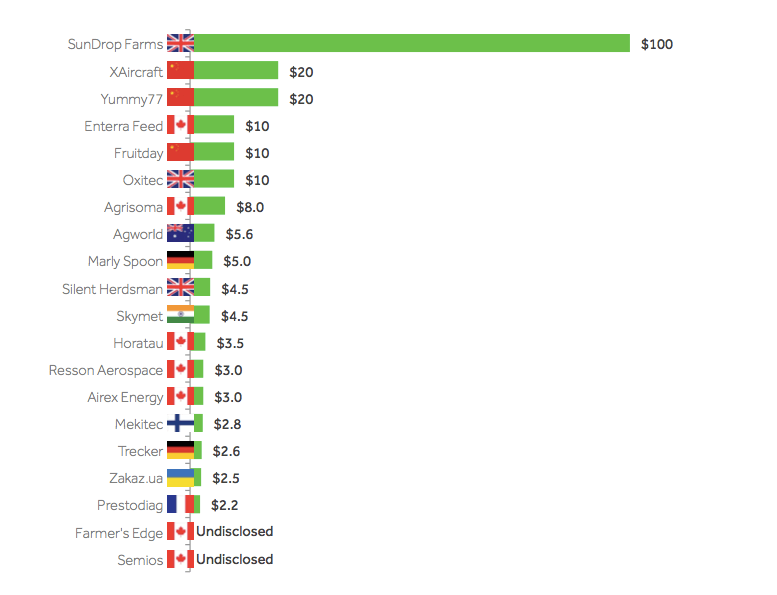

Both Chinese and Indian companies received notable chunks of global agtech investments. Three Chinese companies, XAicraft (drones), Yummy77, and fruitday (both fresh produce ecommerce sites), made the top 20 list in 2014 in terms of deal size. Indian weather forecaster Skymet also made the list.

Top 20 international deals in agtech, in US$ million. Source: AgTech Investing Report 2014

Rob Leclerc, co-founder and CEO of AgFunder, said he was only aware of one Southeast Asian agtech company so far: groceries delivery startup HappyFresh. The company bagged pre-series A funding of an undisclosed amount earlier this year, and just yesterday topped up with a US$12 million series A round.

However, it appears there was an oversight when it comes to HappyFresh competitors like Singapore’s Redmart. Becasue it already raised a huge series B round of US$23 million in 2014, it should have shot into the top 20 deals list in AgFunder’s report.

See: Agritech startups grow in India as more incubators sprout for support

Southeast Asia’s agtech startups are ripe for expansion

The absence of well-funded Southeast Asian agtech startups in AgFunder’s reports points to two things: one, investors do not see significant opportunity for this sector, perhaps because the market is still too immature, the region too fragmented, and in some areas too sparsely populated. Two, a problem could be that Southeast Asia-based startups lack exposure on the global level, compared to those from India and China, and are in danger of being overlooked. This seems to have been the case with Redmart.

It’s not like there isn’t potential or interest from local entrepreneurs to tackle Southeast Asia’s agricultural sector. Quite the opposite. If you look at startups emerging from countries like Indonesia that are wowing crowds at national and international competitions, many of them are in agtech. iGrow last year won Tech in Asia Jakarta’s Arena pitch battle. At this year’s Jakarta leg of the global Seedstars pitch competition, iGrow was one of the participants, as was precision agtech startup 100integrity.

Another prominent Indonesian agtech firm is smart shrimp and fish feeding system eFishery. It won the international Get in the Ring pitch competition in 2014. It also reeled in VC money in a pre-series A round earlier this month, though the amount was undisclosed.

Other noteworthy agtech startups which are not part of the recent pitch competition circuit include Ci-Agriculture in Indonesia (precision ag), Indonesia’s Terralogiq (mapping, tracking, and monitoring dashboard), and Singapore’s Garuda Robotics (drones and dashboard).

In any case, eFishery’s recent success in raising VC money could mean that agtech is turning the tide in Southeast Asia. VCs might prefer China and India due to their large population sizes and large-scale agriculture industries. But when it comes to global fisheries and aquaculture industry, five Southeast Asian countries are among the world’s top 18 producers, according to the Food and Agriculture Organization of the United Nations.

This should motivate stakeholders to investigate agtech in Southeast Asia more deeply. A massive untapped opportunity might await.

This post Agriculture tech: next big opportunity in Southeast Asia? appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance