AECOM (ACM) Gains From Infrastructural Spending Amid Challenges

AECOM ACM is well-poised to capitalize on record infrastructure funding. The company has been gaining strength from high-returning organic growth opportunities, proficient business collaborations to win transformation projects, a disciplined capital allocation policy and record design backlog.

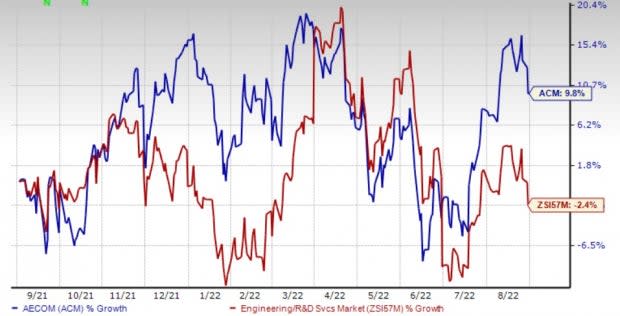

Shares of this leading solutions provider for supporting professional, technical and management solutions have gained 9.8% over the past year, outperforming the Zacks Engineering - R and D Services industry’s 2.4% decline.

However, the cyclical nature of the business and uncertain political and economic conditions are risks for this Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Image Source: Zacks Investment Research

Let us delve into the growth drivers.

Strong Wins and Backlog: AECOM’s solid backlog level depicts good visibility of growth and pipelines for the upcoming quarters. Contracted backlog, one of the best leading indicators for future growth, increased 17% in the third-quarter fiscal 2022, and the total backlog increased to $41.1 billion from $39.69 billion reported in the prior-year quarter, and the growth includes 10% growth in the design business.

ACM’s earnings growth is also a key factor in stock valuation. The Zacks Consensus Estimate for fiscal 2022 earnings of $3.46 per share calls for 22.7% year-over-year growth. The solid growth rate depicts the stock's promising future.

Higher Infrastructural Spending: Strengthening funding backdrop backed by the benefits from the $1.2-trillion infrastructure bill in the United States, AECOM expects backlog to grow continuously. In the United States, the $1.2-trillion Infrastructure and Jobs Act marks a generational investment in America's infrastructure. This bill provides the much-needed long-term funding certainty across the company’s strongest end markets, such as transit modernization, electrification, environmental remediation and climate resilience. Also, the U.S. government passed its fiscal 2022 Omnibus Budget in March, which creates optimism around the pace of growth for AECOM’s government clients in the country in the second half of fiscal 2022 and fiscal 2023.

The company’s net service revenues or NSR — defined as revenues excluding subcontractor and other direct costs — have been benefiting from strength across core transportation, water and environment markets. NSR for the third quarter of fiscal 2022 increased 6%, marking the sixth consecutive quarter of accelerating organic growth.

Superior ROE: AECOM’s superior return on equity (ROE) is also indicative of growth potential. The company’s ROE currently stands at 18.3%. This compares favorably with a ROE of 10.8% for the industry it belongs to. This indicates efficiency in using its shareholders’ funds and AECOM’s ability to generate profit with minimum capital usage.

Headwinds

AECOM’s business is affected by uncertain global political and economic conditions. For instance, the economic slowdown in China poses a major threat to the company’s growth. In Mainland China, the ongoing COVID-induced uncertainties and policies continue to impact AECOM.

Moreover, economic downturns affect client spending, which poses a major headwind for the company’s future. As the company operates across multiple geographies, factors like changes in the United States’ and other national governments’ trade policies, regulatory practices, tariffs and taxes, further devaluations and other conversion restrictions and logistical & communication challenges impact the company’s financials.

3 Better-Ranked Construction Stocks Hogging the Limelight

Better-ranked stocks, which warrant a look in the Construction sector, include Arcosa ACA, United Rentals URI and Dycom Industries, Inc. DY.

Arcosa — sporting a Zacks Rank #1 — is a manufacturer of infrastructure-related products and services which serves construction, energy and transportation markets.

ACA’s expected earnings growth rate for fiscal 2022 is 7.8%. The Zacks Consensus Estimate for current-year earnings has improved 13.7% over the past 30 days.

United Rentals — currently flaunting a Zacks Rank #1 — is the largest equipment rental company in the world.

URI’s expected earnings growth rate for 2022 is 43.8%. The Zacks Consensus Estimate for current-year earnings has improved 6.4% over the past 30 days.

Dycom — a Zacks Rank #1 company — a specialty contracting firm operating in the telecom industry. It has been gaining from higher demand, extended geographic reach and proficient program management and network planning services.

Dycom’s earnings for the current fiscal year are expected to grow by 134.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance