Take Advantage of Shopify's Dip

Shopify Inc. (NYSE:SHOP) is a fast-growing company with a rich valuation and small profit margins (for the moment). The stock has sold off over 20% following earnings, providing investors with an opportunity to buy at a discount.

The earnings were overall good, but some investors may have been spooked with the lack of GAAP profitability.

In this analysis, I explain why this is not a real concern, and three reasons I like the stock long term.

Earnings recap

Shopify exceeded both earnings and revenue estimates, yet the stock fell 20% following the announcement.

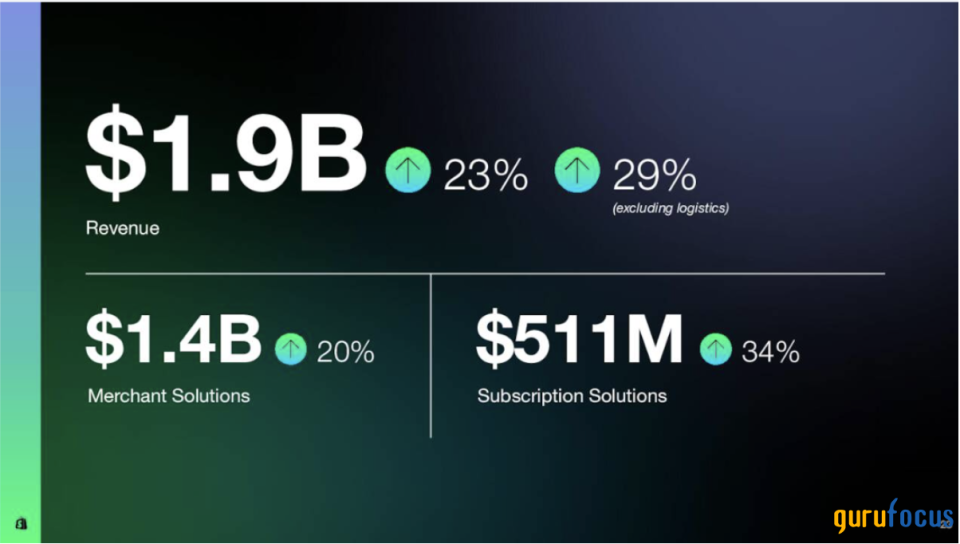

Revenue grew by 23%, or 29% if we exclude the logistics arm that Shopify is closing down. The growth in revenue was particularly strong in merchant solutions, aligning closely with the guidance provided by the company last quarter. As it noted in the release:

"Revenue to grow at a low-twenties percentage rate on a year-over-year basis, which translates into a year-over-year growth rate in the mid-to-high-twenties when adjusting for the 500 to 600 basis points impact from the sale of our logistics businesses."

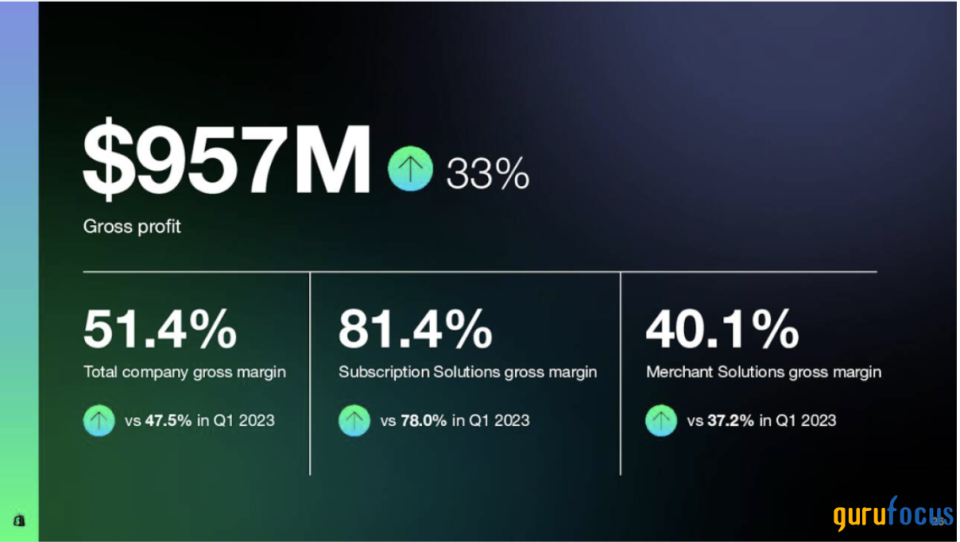

Gross margin, a key metric indicating Shopify's progress toward GAAP profitability, reached 49.80% in the last quarter of 2023. Management had projected a 150 basis point increase for the first quarter of this year.

Investors were pleased to learn the company exceeded expectations with a reported gross margin of 51.40%, slightly surpassing the earlier guidance.

Looking ahead, Shopify provided the following guidance:

Revenue growth in the high 20s

Gross margin to decrease by 50 basis points due to slightly higher operating expenses

Free cash flow margin expected to remain in line with the previous quarter

Based on these positive figures and guidance, the stock's decline was unexpected.

Why the sell-off?

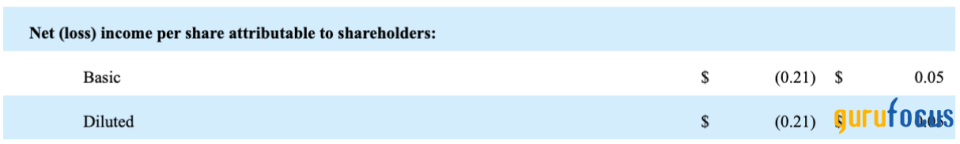

Although Shopify achieved higher revenue, margins and adjusted earnings per share, it still fell short of achieving actual GAAP profitability.

Shopify reported a loss of 21 cents per share this quarter, despite being profitable during the same period last year. This loss was primarily attributed to a $373 million loss on equity and other investments.

The actual loss in earnings likely raised concerns among investors, especially considering it is a high-growth stock. This triggered a decline in the stock price, reflecting broader market trends affecting even mega-cap stocks.

Three reasons to buy

I have always been a fan of Shopify's underlying fundamentals. Despite some short-term headwinds, the growth story remains robust and I find the valuation reasonably attractive.

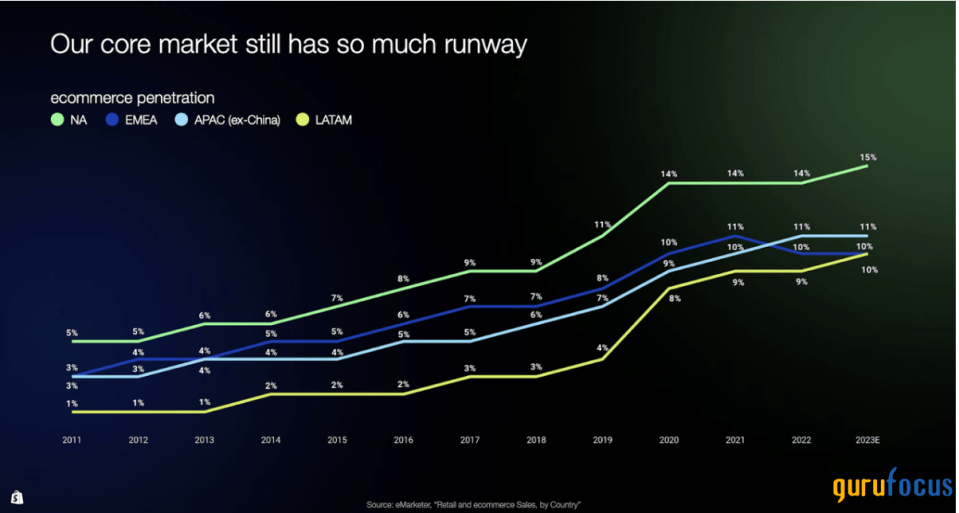

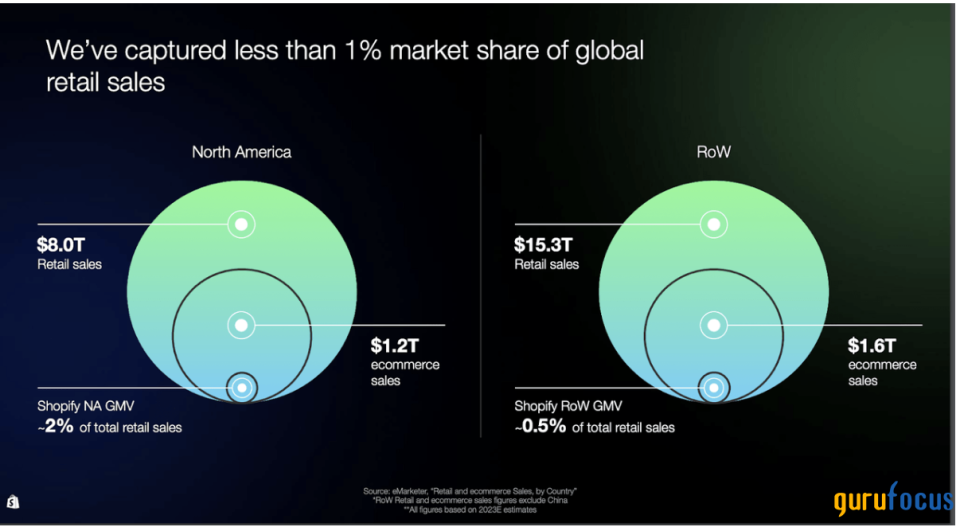

When it comes to growth, Shopify has a largely untapped market, especially internationally.

Further, its growth spans both online and offline channels.

While growth prospects seem promising, the question remains about its margins.

Overall, Shopify is benefitting from the growing move to e-commerce, which is not only taking place in the U.S. but accelerating overseas. The company has a dominant market position and is expanding value to its customers, which is ultimately going to translate in better growth.

In addition, Shopify has historically faced challenges in achieving profitability, but they appear to be moving in the right direction.

The company's technical unprofitability is largely attributed to its strategic investments, which I am not particularly concerned about at the moment. Unless there is a significant economic downturn, I believe the coming months and years could be favorablefor the markets, with many of Shopify's initiatives poised to yield positive results.

Shopify is ultimately a software platform, or at least it was before investing in logistics, which it is now divesting from. Therefore, I believe the company has the potential to achieve significant profitability in the coming years.

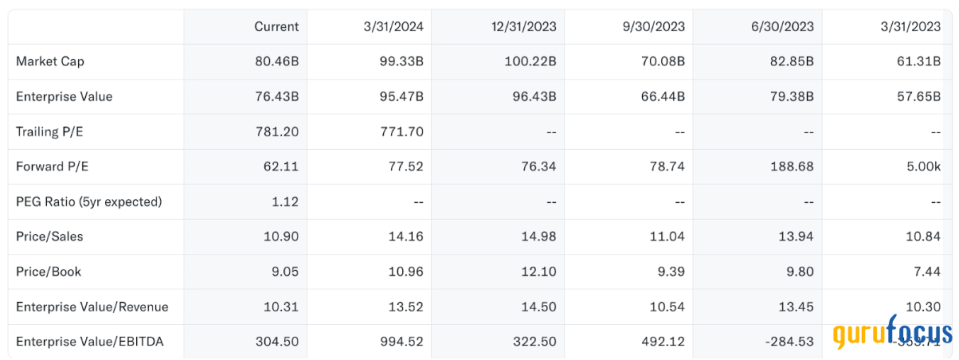

Finally, Shopify's valuation metrics like the price-earnings or price-sales ratio may appear quite rich. However, when considering the forward PEG ratio (five-year expected), which compares the price-earnings ratio to the expected earnings growth rate, Shopify trades at 1.12 times its forward earnings growth rate.

Shopify has always traded at a high valuation, but this is justified given its fast growth and market dominance. This makes the stock volatile, as seen after earnings, but also gives investors more upside potential.

Ultimately, Shopify's success will hinge on its ability to deliver on its earnings growth potential, a prospect that I am optimistic about.

Technical outlook

We have now reached a critical volume support area, as indicated by the Visible Range Volume Profile. Looking at it from an Elliott Wave perspective, it appears we may have completed a 1-2 pattern within the larger (1)-(2), which could pave the way for a rally in wave 3 towards the $200 mark. Additionally, the relative strength index is rebounding from oversold levels and showing a bullish divergence with the price.

While this projection might seem ambitious, keep in mind that Shopify previously traded as high as $175, and I anticipate surpassing those levels again.

Shopify's stock is known for its volatility, with rapid downward movements being as common as upward ones.

Conclusion

In summary, I believe this is a reasonable price point to acquire shares. The company holds strong long-term appeal and is making strides towards profitability, and the technical indicators suggest a favorable setup at this level.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance