Adobe Poised for Long-Term Growth Despite Recent Volatility

The share price of Adobe Inc. (NASDAQ:ADBE) has experienced significant volatility over the past three years. It reached a peak of $672 per share in mid-November 2021. After that, it lost nearly 59% of its value, plummeting to approximately $278 per share by September 2022. Subsequently, it rebounded to nearly $600 per share at the time of writing. Despite the market price fluctuations, Adobe's strong market position and consistent financial performance suggest resilience in its business model, contributing to investor confidence over the long term.

Key business segments

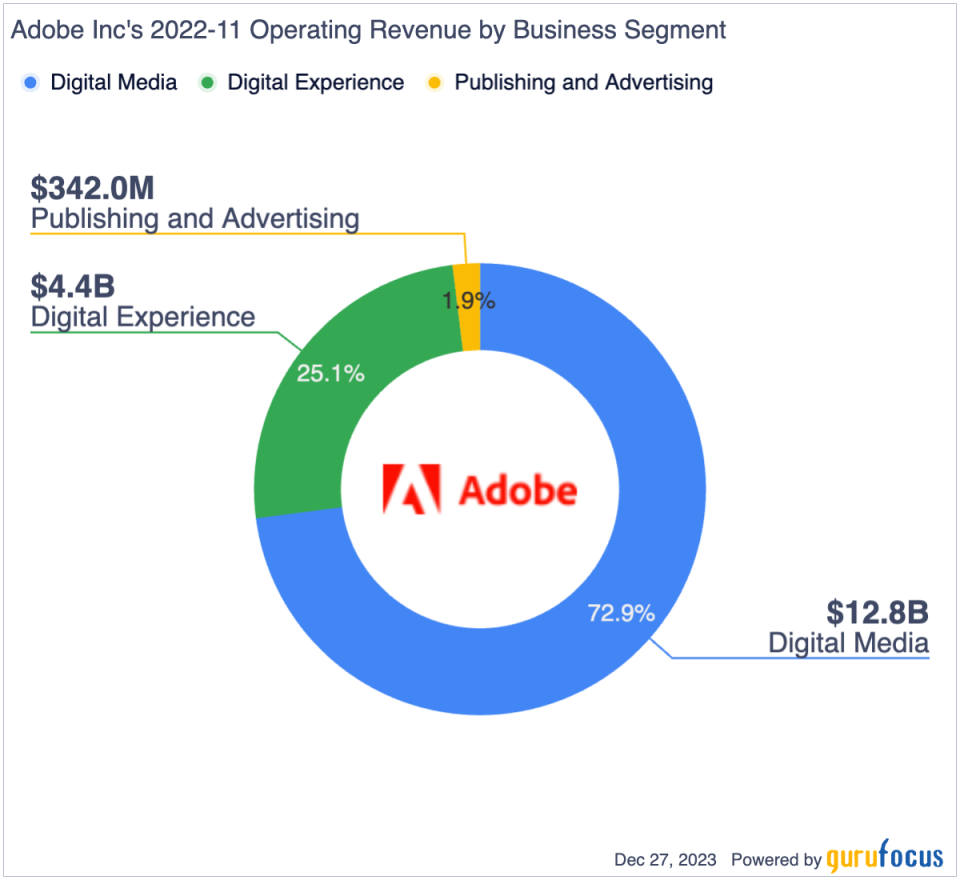

Adobe operates through three primary segments: Digital Media, Digital Experience and Publishing and Advertising.

The Digital Media segment, recognized as a leader in creativity and digital document solutions, prominently features Adobe Creative Cloud as its flagship product. This product is a subscription-based service that provides members with access to a comprehensive suite of creative tools. These tools are fully integrated with cloud-delivered services, ensuring a seamless and cohesive user experience across various platforms.

The Digital Experience segment offers a range of products, such as Adobe Analytics, Adobe Experience Platform and Customer Journey Analytics, that are designed to personalize experiences and deliver valuable business intelligence.

Lastly, the Publishing and Advertising segment includes e-learning solutions, web conferencing tools and high-end printing products, notably Adobe PostScript and Adobe PDF.

The Digital Media business generates the most revenue, which amassed $12.8 billion in 2022. This figure constitutes 72.9% of the total revenue. The Digital Experience segment ranked second with $4.4 billion in revenue, making up 25.1% of the overall sales. Though smaller, the Publishing and Advertising segment still added around $342 million to 2022 sales, accounting for 1.9% of the total sales.

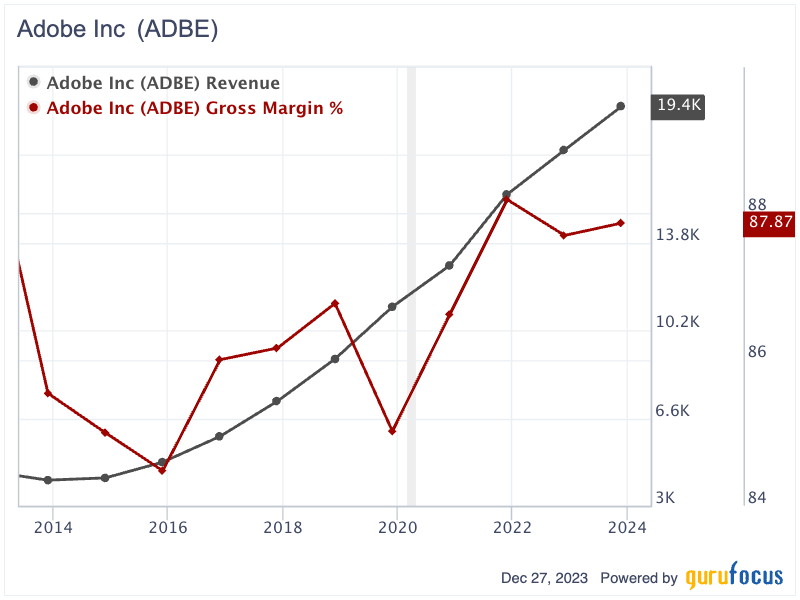

Sustained revenue growth with a high and stable gross margin

Adobe has demonstrated remarkable business growth over the past decade, consistently increasing its top- and bottom-line performance. Since 2013, its revenue has shown impressive resilience, climbing steadily each year, even after the surge in demand that was induced by the pandemic subsided. From just over $4 billion in 2013, Adobe's revenue escalated to $19.4 billion by 2023. This consistent growth underscores the robust and enduring demand for its products.

A standout aspect of Adobe's financial performance is its ability to maintain consistently high gross margins. Its gross margins have fluctuated minimally over the last 10 years, ranging between 84.48% and 88.19%. In 2023, the gross margin was recorded at 87.87%. This stability is largely attributed to Adobe's successful subscription model, which features popular products like Adobe Acrobat, Illustrator and Photoshop. These products have secured user acceptance for its high recurring subscription fees, contributing significantly to the company's gross margin.

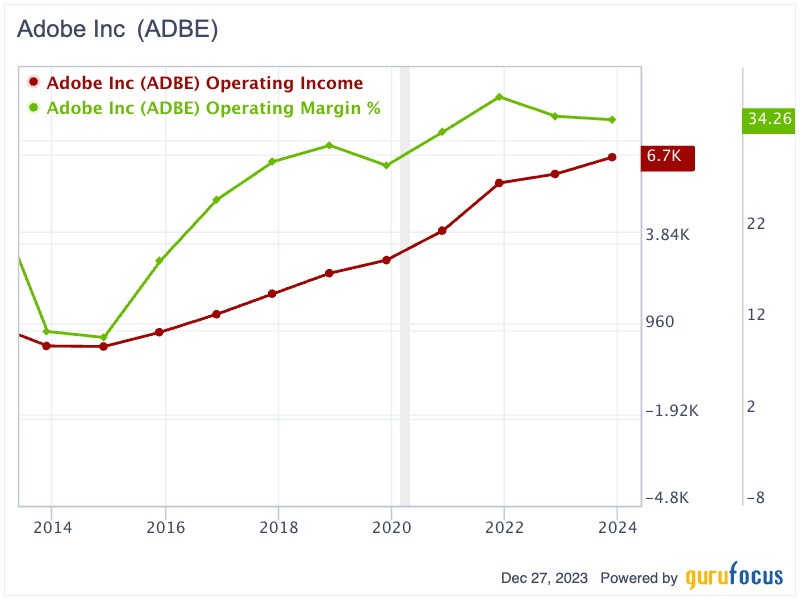

Expanding operating margins

Further, Adobe's operating income has grown substantially, increasing in nine out of the past 10 years. From $449 million in 2013, it soared to $6.65 billion in 2023, marking a 30.9% compounded annual growth rate. This growth in operating income, alongside the high gross margins, highlights Adobe's efficiency and profitability.

Another critical area of improvement for Adobe has been its operating margins. These have significantly risen from 11.1% in 2013 to 34.26% in 2023. This improvement can be attributed to the company's revenue growth outpacing the increase in operating expenses, including selling, general and administrative expenses and research and development costs. Over the span of a decade, while Adobe's revenue increased by approximately 4.85 times, its operating expenses only jumped by nearly 3.5 times, showcasing effective cost management and operational efficiency.

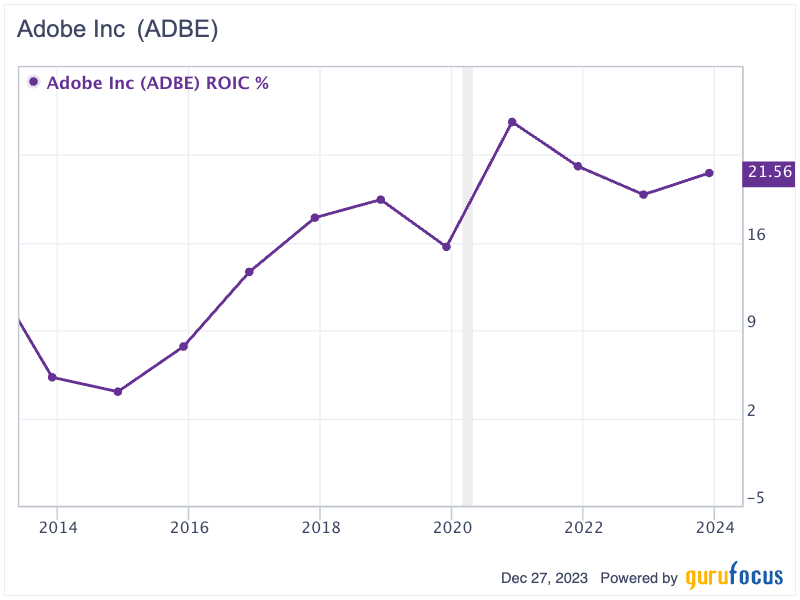

Efficient capital allocation

In addition to its growing top line, robust bottom line and high margins, Adobe has been remarkably efficient in managing capital allocation. A notable aspect of its financial management is the consistent improvement in its return on invested capital over time. Starting from a modest 5.26% in 2013, Adobe's ROIC has experienced a steady increase, peaking at 25.64% in 2020 before stabilizing at 21.56% in 2023. This high return on capital aligns with the preferences of legendary investor Warren Buffett (Trades, Portfolio), who once said:

"The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine."

Strong balance sheet

Adobe boasts a solid balance sheet as well. As of the end of 2023, the company held over $7.14 billion in cash and $701 million in short-term investments, which include U.S. Treasury securities, corporate debt and asset-backed securities. Its long-term debt stood at only $3.63 billion, representing 46.3% of its combined cash and short-term investments. This results in a net cash position of $3.51 billion, underscoring Adobe's solid financial stability.

Fair valuation

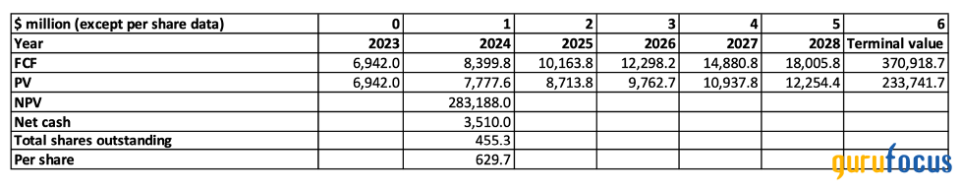

Over the past decade, Adobe has consistently generated increasing free cash flow, exhibiting a 10-year compounded annual growth rate of 21.8%. Assuming that Adobe's free cash flow will expand at a projected rate of 21% for the next five years and then settle into a terminal growth rate of 2%, with the application of an 8% discount rate, the valuation of its shares could reach close to $630 each.

Source: Author's table

Key takeaway

While Adobe's share price may reflect a fair valuation, the company's strong financial fundamentalsincluding consistent revenue growth, high profitability and robust cash flowindicate its intrinsic value is poised to increase. This trend, coupled with Adobe's solid balance sheet and efficient capital management, suggests that Adobe could be a strategic investment choice for those looking to capitalize on the company's potential for sustained long-term growth.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance