Should You Add Citigroup (C) Stock Ahead of Its Q2 Earnings?

Citigroup Inc. C is slated to report second-quarter 2024 results on Jul 12, before the opening bell.

With the C stock currently trading at almost a two-year high of $66.55, should you buy it before the release of its quarterly results? Before we analyze the stock’s investment worthiness, let’s first check out how it is expected to fare this time. A globally diversified financial services holding company is expected to register bottom- and top-line growth in the to-be-reported quarter.

The Zacks Consensus Estimate for second-quarter revenues is pegged at $19.97 billion, suggesting 2.8% growth from the year-ago quarter's reported figure.

However, escalating spending on technology and transformation expenses are likely to hamper growth. In the past 30 days, the consensus estimate for earnings for the to-be-reported quarter has been revised downward by 1% to $1.40. This suggests 2.2% growth from the $1.37 reported in the prior year quarter.

Image Source: Zacks Investment Research

Citigroup has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with the average beat being 20.03%.

Image Source: Zacks Investment Research

Earnings Whispers for Q2

Our proven model does not conclusively predict an earnings beat for Citigroup this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Citigroup has an Earnings ESP of -1.31% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Trends Leading Up to C’s Q2 Results

Loans & Net Interest Income (NII): A stabilizing macroeconomic backdrop, along with the expectations of the Federal Reserve easing interest rates later this year, is likely to have offered some support to the lending scenario in the second quarter. The demand for overall loans and leases, especially commercial and industrial loans, improved from the first-quarter 2024 end, per the Fed’s latest data.

This is likely to have driven Citigroup’s lending activities, thereby improving average interest-earning assets balance. The Zacks Consensus Estimate for average interest-earning assets is pegged at $2.27 trillion, indicating a 0.7% increase from the prior-year quarter’s reported figure.

As the Fed kept the interest rates at a 22-year high of 5.25-5.5% during the quarter, the company is less likely to have recorded solid improvement in net interest income (NII). Also, the inverted yield curve in the June-ended quarter and high funding costs are expected to have put pressure on NII.

The Zacks Consensus Estimate for NII of $13.52 billion suggests a 2.7% decline from the prior-year quarter’s reported figure.

Fee Income: Global mergers and acquisitions bounced back in the second quarter of 2024, after discouraging performances in the past couple of years. Both deal value and volume witnessed a remarkable comeback driven by solid financial performance, fading recession risks, buoyant markets and expected rate cuts this year. Yet, tough scrutiny by antitrust regulators and persistent geopolitical tensions continue to be headwinds.

At an Investor’s Day conference in June, management provided solid projections for merger advisory and debt and equity underwriting businesses. Management expects investment banking ("IB") fees to surge by 50% in the second quarter of 2024.

Client activity was decent in the second quarter. The expectations of a soft landing of the U.S. economy, a gradual cool down of inflation and clarity on the Fed rate path drove the client activity. Nonetheless, volatility was lower in the equity markets and other asset classes, including commodities, bonds and foreign exchange. Considering this, Citigroup expects markets revenues to be ‘flat to down marginally’.

The consensus estimate for income from commissions and fees of $2.57 billion suggests a 20.6% increase from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for administration and other fiduciary fees of $1.04 billion indicates a 4.7% increase from the prior-year quarter’s reported figure.

The consensus estimate for income from principal transactions of $2.66 billion suggests a 5.2% plunge from the year-ago quarter’s reported figure.

Expenses: Management is focused on revamping its underlying technology, risk management and internal controls as part of remediation highlighted by the Office of the Comptroller of the Currency and the Fed.

Also, increased spending, specifically on severance costs related to its organizational overhaul and divestiture expenses, is likely to have inflated expenses in second-quarter 2024.

Asset Quality: Citigroup is likely to have set aside a substantial amount of money for potential delinquent loans (mainly commercial loan defaults), given the expectations of an economic slowdown.

The Zacks Consensus Estimate for non-accrual loans is pegged at $3.50 billion, indicating an increase of 26.5% from the prior quarter's reported figure.

Price Performance & Valuation

In terms of price performance, Citigroup showcased an impressive upward trend. Citigroup was among the top three performing banks on the S&P 500 index in the first half of 2024, with the other two lenders being JPMorgan JPM and Wells Fargo WFC. All three stocks have outperformed the S&P 500 index.

First Half 2024 Price Performance

Image Source: Zacks Investment Research

JPM and WFC are scheduled to announce second-quarter results on the same day as C.

Now, let’s look at the value Citigroup offers investors at current levels.

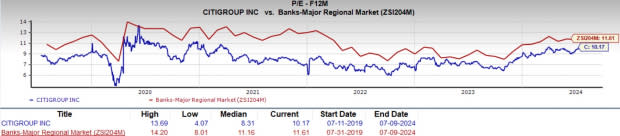

Currently, C is trading at 10.17X forward 12 months earnings, above its five-year median of 8.31X and below the industry’s forward earnings multiple of 11.61X. The company’s valuation looks somewhat cheaper compared with the industry average.

Price-to-Earnings (forward 12 Months)

Image Source: Zacks Investment Research

Investment Thesis

Citigroup is well poised to benefit from its efforts to simplify operations via organizational restructuring. The company remains on track to exit the consumer banking business in international markets and focus on growth in the wealth management and commercial banking space.

Citigroup performed better than expected in the stress test this year. Among the major banks, Citigroup was the only one to witness a decrease in its capital ratio requirement for the upcoming year, from 12.3% to 12.1%. The company plans to increase the quarterly dividend by 6% to 56 cents, beginning third quarter of 2024.

However, high interest rates will weigh on Citigroup’s top-line growth. Further, escalating spending on technology and transformation expenses is expected to limit bottom-line growth.

Final Thoughts

As Citigroup prepares to announce its second-quarter 2024 earnings, the resurgence of capital markets business (especially IB business), decent loan demand and low volatility in the capital market paint a favorable picture for the bank.

While C’s organizational realignment to simplify its governance structure and emphasizing growth in core businesses by divesting noncore units provide a solid foundation for growth, the increased expenses and high interest rate environment justify a neutral stance on its investment potential.

Moreover, the Fed’s expectation of a rate cut later this year might provide much-needed support to the bank’s NII in the upcoming period. Investors should closely monitor the company's ability to navigate these challenges and capitalize on emerging opportunities to assess its long-term viability. We suggest investors wait for a more appropriate entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance