Acomo And 2 Other Top Dividend Stocks On Euronext Amsterdam

As global markets navigate through a landscape of modest gains and cautious consumer behavior, the Netherlands' stock market remains a point of interest for investors looking for stable returns. In this context, dividend stocks like Acomo offer potential resilience and steady income streams, aligning well with current economic signals that favor prudent investment choices.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.68% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.91% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.40% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.57% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.20% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.65% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Acomo

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. is a company based in the Netherlands that specializes in sourcing, trading, processing, packaging, and distributing both conventional and organic food ingredients for the food and beverage industry across Europe, North America, and other global markets, with a market capitalization of approximately €0.51 billion.

Operations: Acomo N.V. generates revenue through various segments, including €120.62 million from Tea, €257.29 million from Edible Seeds, €24.07 million from Food Solutions, €429.96 million from Spices and Nuts, and €436.38 million from Organic Ingredients.

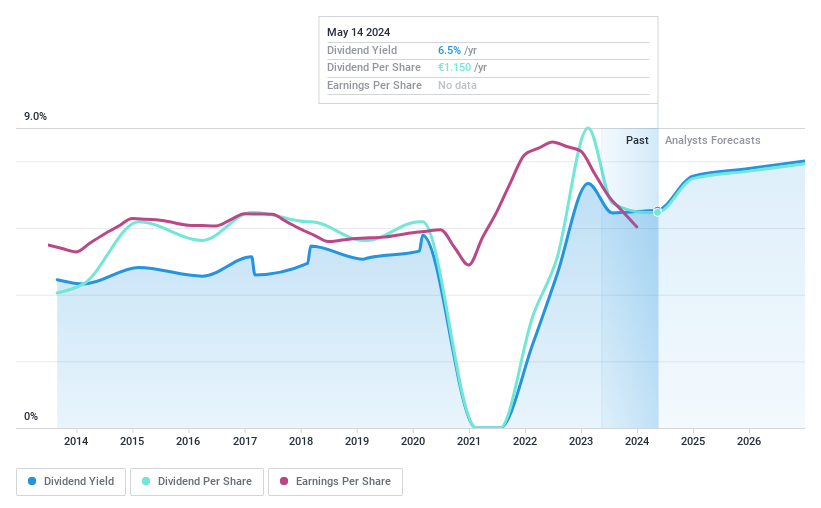

Dividend Yield: 6.7%

Acomo's dividend yield of 6.68% ranks well above the Dutch market average of 5.61%, indicating a strong position among peers for dividend attractiveness. The company has managed to increase its dividends over the past decade, despite some volatility and an unstable track record in its annual payouts, with significant fluctuations exceeding 20%. Dividends are supported by earnings with a payout ratio of 85.7% and a more comfortable cash payout ratio at 26.1%, suggesting that cash flows are sufficient to sustain current dividend levels. However, concerns about Acomo's high debt levels could pose risks to future dividend sustainability.

Unlock comprehensive insights into our analysis of Acomo stock in this dividend report.

Our valuation report here indicates Acomo may be undervalued.

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €14.02 billion.

Operations: Koninklijke KPN N.V. generates revenue primarily through three segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

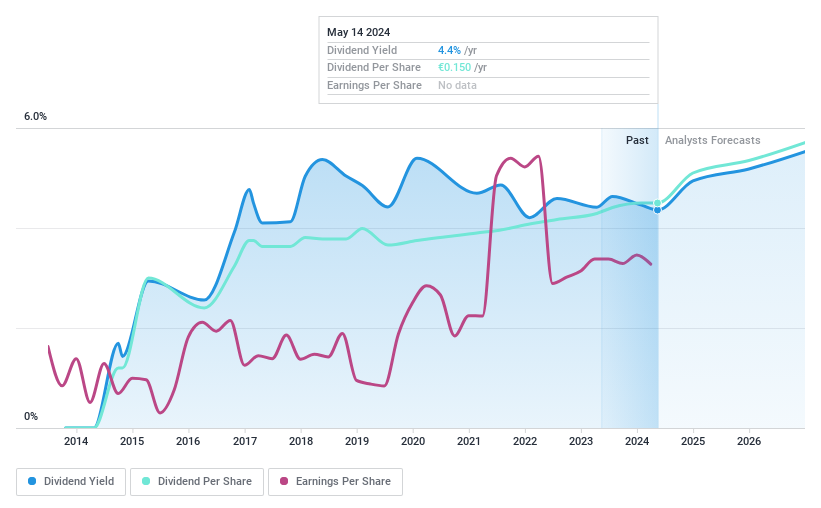

Dividend Yield: 4.2%

Koninklijke KPN's dividend yield at 4.2% is modest relative to the top Dutch dividend payers. While dividends have grown over the past decade, their volatility and an unstable track record present concerns. The current payout ratio of 78.4% and cash payout ratio of 59.6% indicate that earnings and cash flows adequately cover dividends, but high debt levels pose a potential risk to sustainability despite trading at a significant discount to fair value. Recent strategic moves, including a partnership with ABP to optimize infrastructure assets, could enhance long-term shareholder value but add complexity in assessing future dividend reliability.

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering a range of lighting products, systems, and services across Europe, the Americas, and other regions with a market capitalization of approximately €2.98 billion.

Operations: Signify N.V. generates revenue primarily from its conventional lighting segment, totaling €0.56 billion.

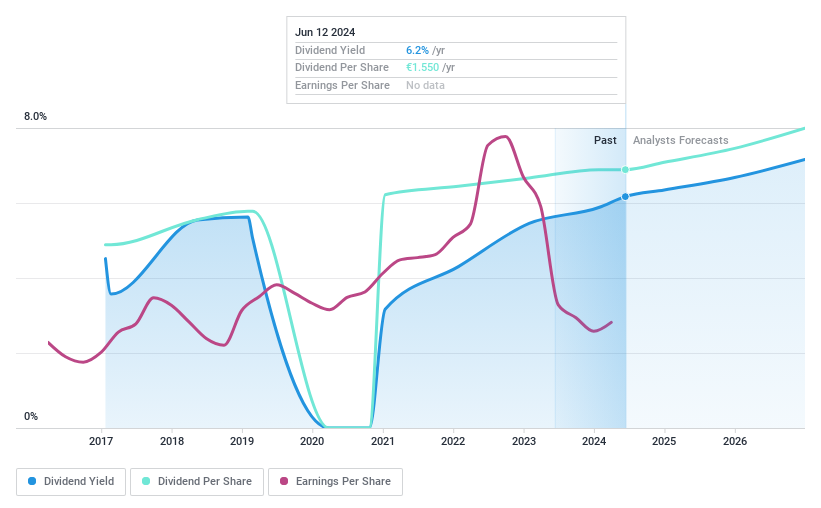

Dividend Yield: 6.6%

Signify's recent share buyback, completing €11.9 million for 450,000 shares, aligns with its strategy to manage long-term incentive plans despite a shaky dividend history and volatile payments over the past seven years. Trading 54.3% below estimated fair value and with dividends covered by a low cash payout ratio of 32.4%, the stock shows potential upside according to analysts' expectations of a 42.8% price increase. However, Signify's profit margins have dipped from last year, reflecting financial pressures that could impact future dividend stability.

Click to explore a detailed breakdown of our findings in Signify's dividend report.

The valuation report we've compiled suggests that Signify's current price could be quite moderate.

Make It Happen

Click this link to deep-dive into the 6 companies within our Top Euronext Amsterdam Dividend Stocks screener.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ACOMO ENXTAM:KPN and ENXTAM:LIGHT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance