Can Abercrombie & Fitch Continue Being One of the Best-Performing Stocks?

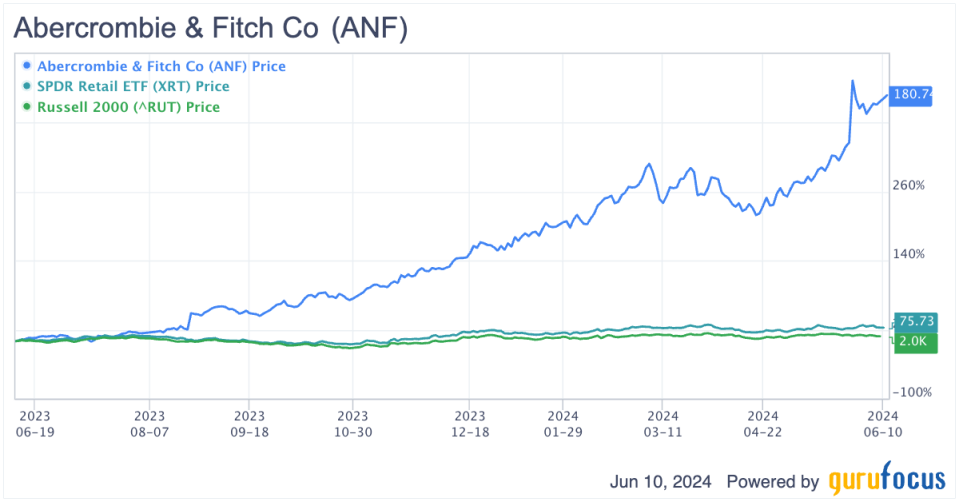

When investors had thoughts about what the best performing stocks were going to be, a clothing retailer like Abercrombie & Fitch Co. (NYSE:ANF) was probably not on many lists. However, it has significantly outperformed the Russell 2000 and S&P retail sector.

Why is the stock up so much?

Back in May 2023, Abercrombie & Fitch was trading around $22 per share and reached a high of $196 a year later. It has since come back down to trading around $175 per share. Even with the recent pullback, the stock is up a huge amount in the last 12 months. So what happened?

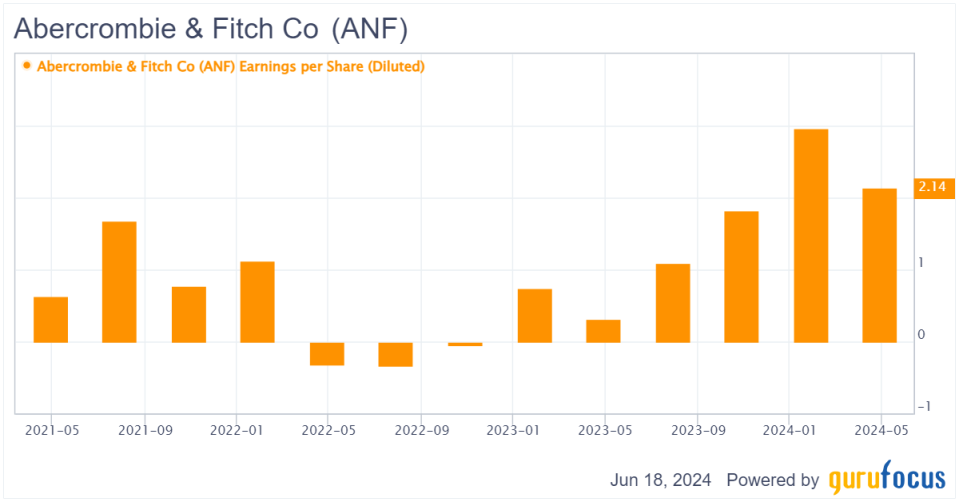

Earnings per share shot up

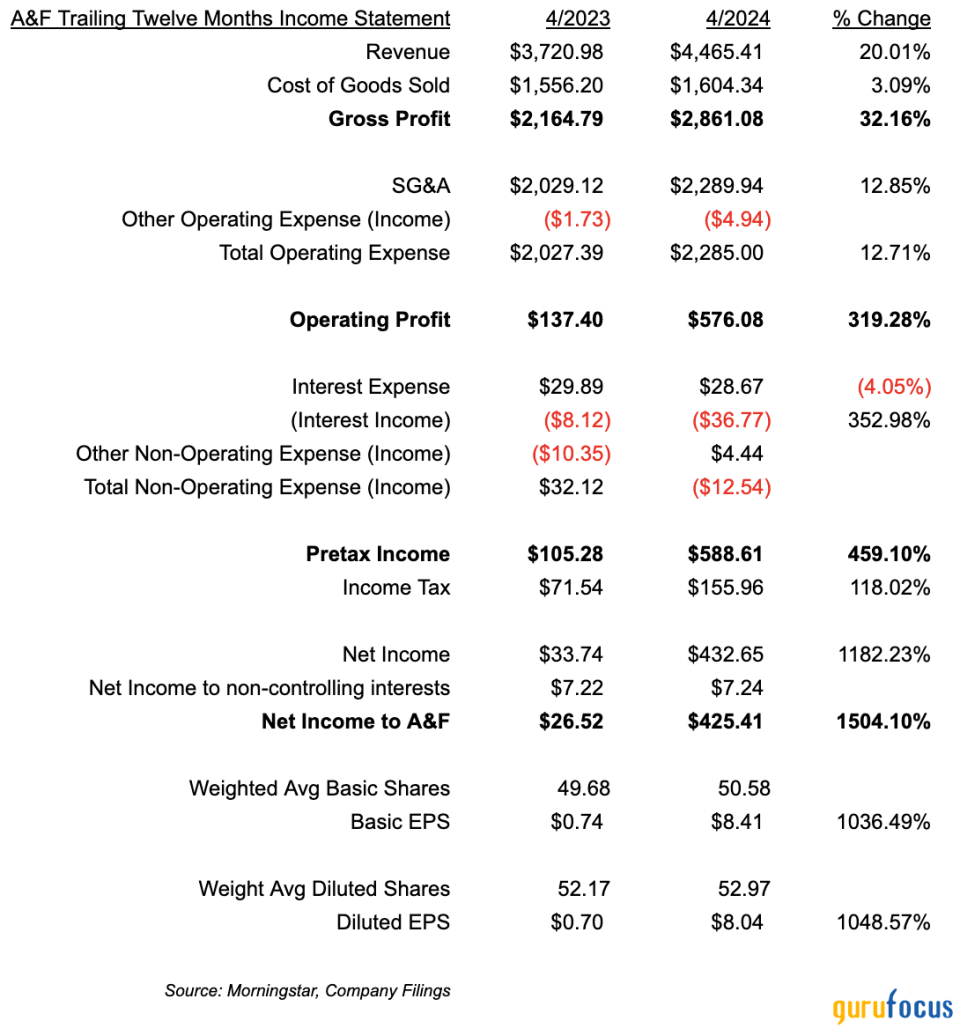

In May 2023, when the share price was in the low $20s, Abercrombie & Fitch had trailing 12-month diluted earnings of 70 cents per share. Since then, earnings have increased significantly to over $8 per share in May 2024.

What caused the large increase in earnings per share? Below is a comparison of the income statements between April 2024 and the year prior. It uses trailing 12-month numbers to showcase the increase throughout the year rather than that specific quarter.

The area that really stands out is right at the top. Revenue increased over 20%, but did so without a proportional increase in the main operating expenses: cost of goods sold and selling, general and administrative expenses. To determine if this is sustainable, we need to dig in further.

Revenue is rising faster than costs

Revenue rose over 20% from 2023 to 2024 while cost of goods sold and SG&A only rose 3% and 13%, respectively. This increased gross profit by almost 33% and more than tripled the operating profit.

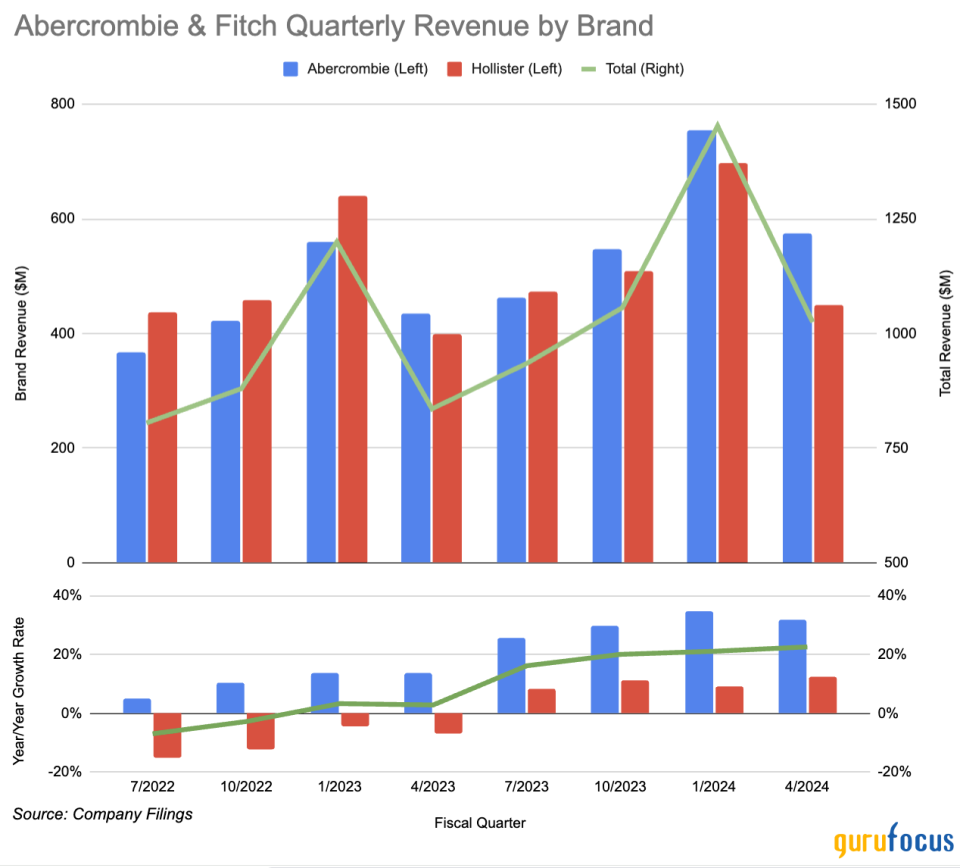

Abercrombie & Fitch's revenue has grown significantly over the past 12 months. The company mainly operates two brands: Abercrombie and Hollister. Abercrombie includes all of the Abercrombie & Fitch stores as well as Abercrombie Kids. Hollister has everything else, including Hollister stores as well as lesser-known brands Gilly Hicks and Social Tourist. The quarterly revenue for each brand are shown below.

Over the last two years, Hollister has really taken off. Revenue growth was negative in fiscal 2022, but turned around in 2023 to be positive and accelerating. The Abercrombie brand has also experienced accelerated growth rates over the last few quarters. What is driving this change?

Fran Horowitz-Bonadies, the retailer's current CEO, took over in 2017. One of the first things she did was a major rebrand for Abercrombie & Fitch. Rather than focus on the cool kids as former CEO Mike Jeffries said in 2006, the brand is now more inclusive.

What were the results of the rebranding? Abercrombie & Fitch stores are no longer dark with loud music, but instead brighter and more welcoming. The retailer also expanded the range of sizes and styles to reach more customers. Targeting a larger customer base has put more shoppers in its stores and visitors to its website.

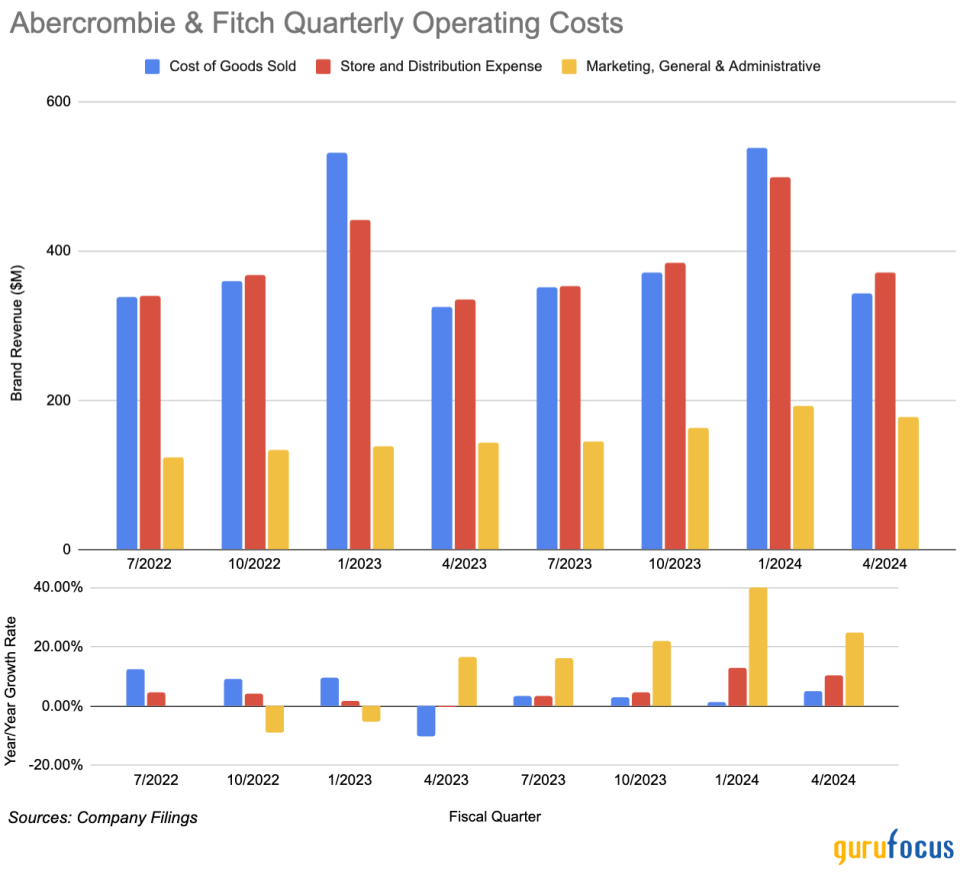

Costs are growing, but at a slower pace

The main operating expenses listed on the income statement are cost of goods sold, store and distribution expense and marketing, general & administrative expense. Here is how those costs have changed over the last few years.

Cost of goods sold and store and distribution expenses account for over 80% of the operating cost, but have grown slowly the last couple of years. Compared to 2023, first-quarter 2024 cost of goods sold only grew 3% while store and distribution expense grew about 8%. Cost of goods sold benefited from lower raw material costs (mainly cotton), while store and distribution expenses benefited from lower freight costs.

Marketing, general and administrative expenses grew significantly compared to 2023. This growth was primarily driven by Hollister. In 2023, Abercrombie & Fitch pulled back on marketing for Hollister as the company worked on changing the assortment of its products. Now that the branding has been figured out for Hollister, marketing expenses have ramped up to showcase the new products.

Going forward, management expects marketing expenses to grow at a similar rate to revenue.

Is this growth sustainable?

I will start off with some bad news: Abercrombie & Fitch stock is not going to grow another 5 times (nor its EPS 10 times) in the next 12 months. That type of growth is not sustainable. However, is double-digit growth foreseeable going forward?

Abercrombie & Fitch has issued guidance for the rest of fiscal year 2024. It is expecting around 10% growth in sales with a 14% operating profit margin. This would put 2024 revenue around $4.7 billion and operating income near $660 million, which is a 36% increase compared to 2023.

What about earnings per share? With operating income around $660 million and an expected tax rate around 25%, the expected earnings per share should be around $9.30 for 2024. That is a 50% bump compared to 2023.

Wall Street analysts are expecting earnings per share a little higher at $9.36, which is still a significant increase. However, analysts may not be too excited about the stock given the low price target in the $170s (which is below its current level):

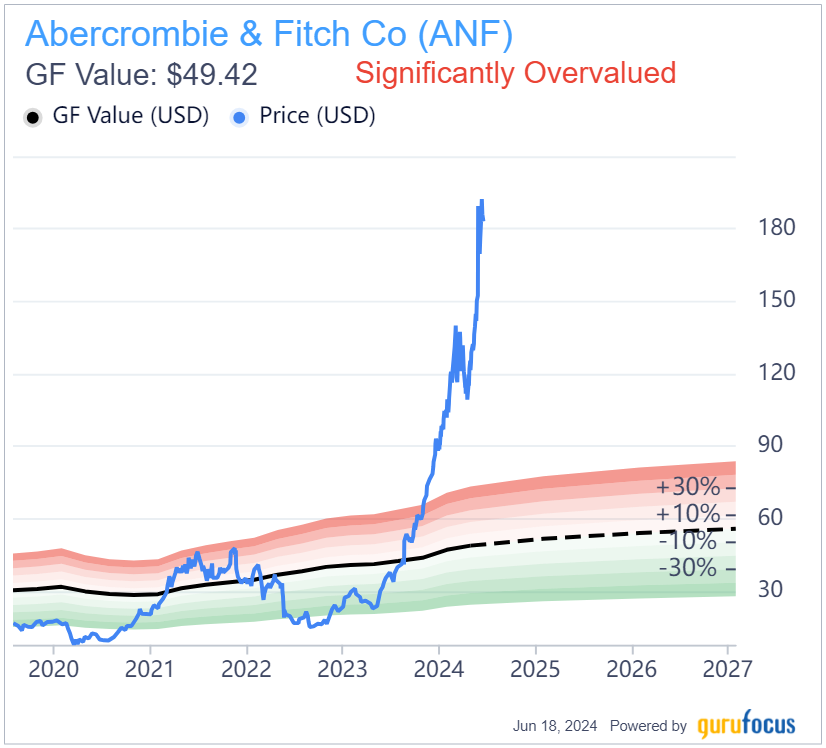

If you are concerned Wall Street analysts are pessimistic about the share price, then sit down before viewing the GF Value chart:

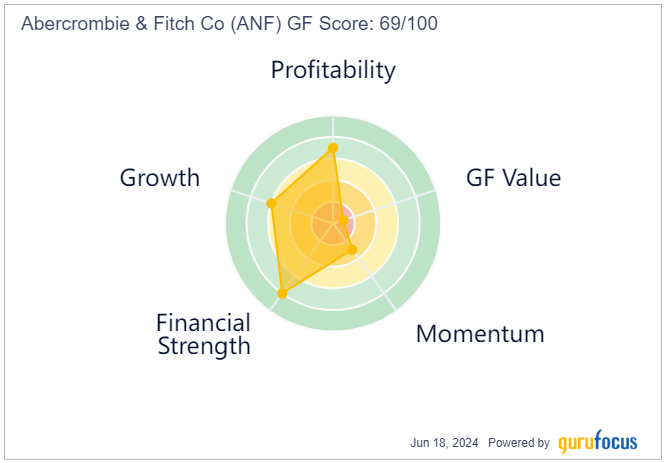

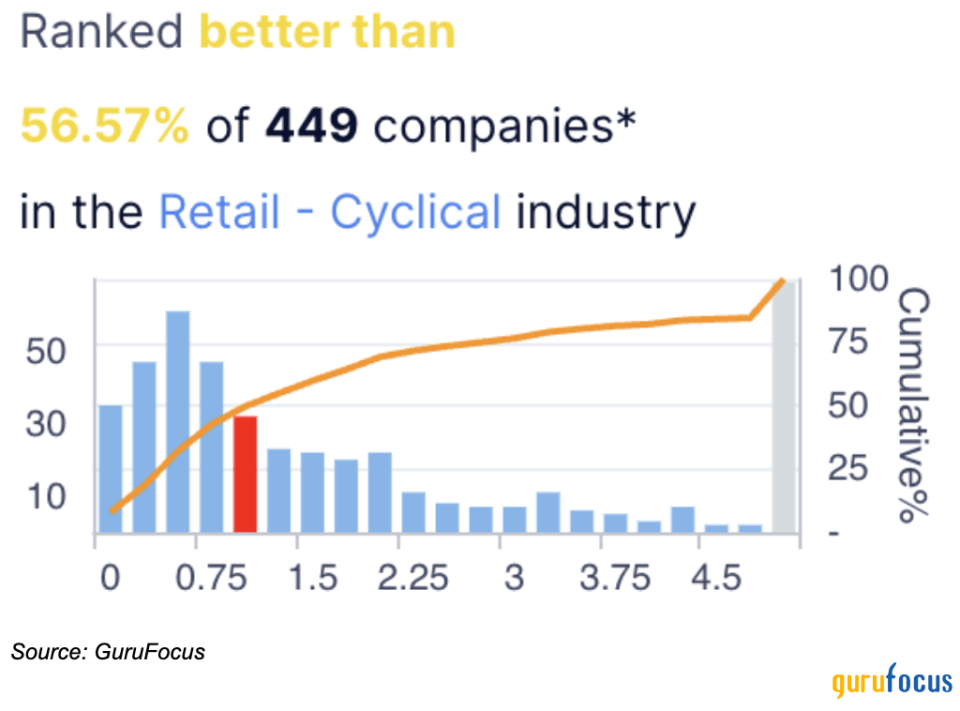

A GF Score of 69 is also not looking too good.

PEG ratio can shed some light

Whenever a stock grows rapidly like what Abercrombie & Fitch has done over the past 12 months, I like to look at the PEG ratio because it is more stable than the price-earnings ratio. The PEG ratio is the current price-earnings ratio divided by the long-term expected growth rate for the company.

Generally, a PEG ratio below 1 is considered undervalued. Abercrombie & Fitch is currently sitting at 1.09, which is right on the cusp. Compared to the retail- cyclical industry, Abercrombie & Fitch's is lower than most of the competition (industry median is 1.23):

This suggests Abercrombie & Fitch might be slightly undervalued relative to its peers, even at these elevated prices.

Final thoughts: Take some profits

If you do not own Abercrombie & Fitch, now is probably not the time to get in. The stock has increased significantly over the past 12 months and it is probably too late to build a position. However, if you feel a need to purchase some shares, at least wait until the PEG ratio goes below 1. This corresponds to a price in the mid-$160s based on current earnings and long-term growth rate.

If you already own some Abercrombie & Fitch - first off, congratulations! You picked one of the best stocks to own over the last 12 months. You currently own almost 5 times as much Abercrombie & Fitch as you did a year ago.

That is probably too much exposure to Abercrombie & Fitch, so I would take some profits and sell a portion of your shares. This allows you to maintain a position if growth continues while also locking in some gains in case the company underperforms.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance