6 Things You Need to Know Before Buying a Used Car in 2024

The auto market in 2023 was marked by inflated sticker prices, high borrowing costs and poor inventory, so hopefully 2024 will be known for improvements in all of these areas, on both new and used cars.

Find Out: 10 New Cars to Avoid Buying in 2024

Learn: How To Get $340 a Year in Cash Back – for Things You Already Buy

Speaking to the Detroit Free Press in December, Cox Automotive Chief Economist Jonathan Smoke said, “For consumers looking to buy a vehicle, it’s the best year by far since 2019.”

“With supply normalizing and the economy stabilizing to hit a soft landing and not turn into a recession, it leads to an environment that is the most normal we’ve encountered since 2019,” Smoke continued.

Before you start shopping, here are a few things unique to 2024 to keep in mind before buying a used car.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

1. Cost: Are Used Car Prices Dropping?

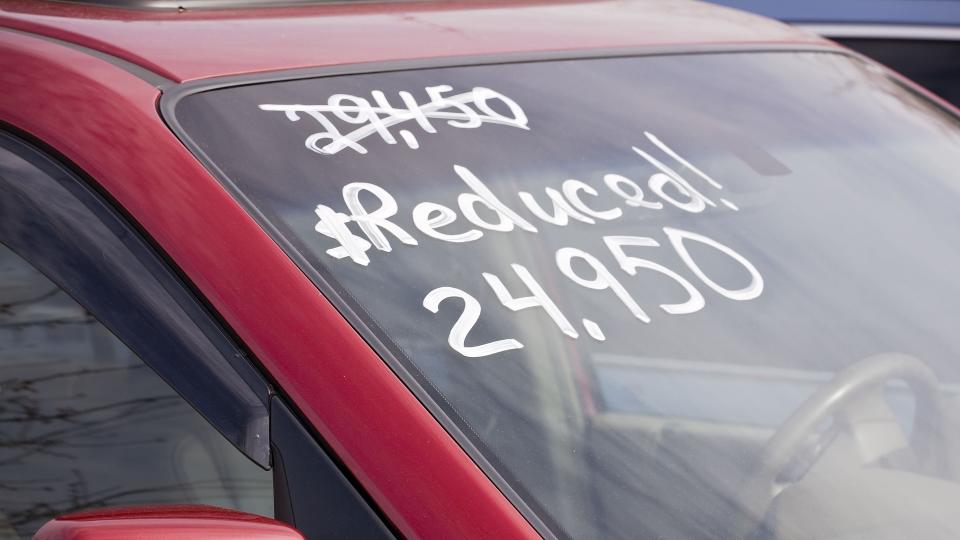

As Consumer Affairs notes, devoting 35% of your gross annual income to buying a car and putting down 15% of the price as a down payment are reasonable spending goals. That’s not a small sum when you consider the average price of a used car is still hovering above $25,000.

Despite predictions that used vehicle prices will drop in 2024, right now prices are still higher than ever, partly due to limited supply caused by lingering pandemic-era production disruptions. That is why it is more important than ever to have your financials in order. Having an accurate budget and down payment, plus a good idea of the true costs of driving every day, will help you build a good buffer and keep your head above water.

2. Certified Pre-Owned Cars (CPOs)

If you’re the type of person who enjoys researching and inspecting a new-to-you car, used car buying should be your time to shine. However, if you prefer mental calmness over the uneasiness that comes with making a daunting purchase, you should consider buying a certified pre-owned car (CPO).

Buying a worry-free CPO from a dealer will ensure you get a well-maintained car with good parts and a verified history. According to Car and Driver, CPO owners will most likely have to follow the manufacturer’s warranty maintenance schedule to keep the certification

3. Don’t Count Out Buying Online

Over the past decade, we’ve seen significant consumer behavior changes, driven from offline to online commerce. This trend has been slower to catch on with vehicles, but it’s gaining popularity as more Americans prefer to shop on trusted platforms like Carvana, TrueCar, Vroom and Autotrader for a seamless online purchasing experience.

Completing the entire used car buying process online might be unnerving, but the opportunity to test drive and inspect the car fully upon delivery is available and encouraged. Furthermore, if you still want to visit a dealer directly, you can do that, after using the online sites to research prices and listings.

Discover: 4 Electric Cars That Will Break Down Twice as Fast as the Average Vehicle

4. Test Drive Every Car You’re Interested In

Vehicles are among the biggest purchases Americans make and get driven vigorously every day, so you should research your purchase with an equal amount of vigor. After you’ve figured out what you can afford and what the true ownership costs will be, you’ll need to get a feel for your next ride.

Every dealer is different but it’s your right to schedule test drives, despite any reservations from the seller. In fact, any hint of hesitation from a dealer should be a red flag. Take your time and enjoy this part of the process; you can’t develop a connection with a car without testing it. Likewise, unless you trust your dealership with your wallet, get any car you’ve settled on inspected by an independent professional.

5. EV Tax Credits for Used Cars

In an effort to move away from electric vehicles (EVs) or components made or sourced in China, the Treasury Department has already changed cars eligible for the federal EV tax credit several times. However, rules about where the car or battery comes from don’t apply to used vehicles.

Used car buyers can receive a tax credit of $4,000 or 30% of the sale price of the vehicle, whichever is lower. If you’re thinking of jumping into used EV ownership, make yourself aware of the regulations regarding where you can buy from previous ownership rules and income thresholds.

6. Lease Buyouts

Given current market conditions, it could be a good financial decision to skip buying a used vehicle and buy out your lease instead. If the resale value of your car model is high and exceeds the buyout price, it could be a good financial decision.

Check the residual value of the car, which is the predetermined value at the end of the lease term. If the buyout price is lower than the current market value, it might be a good deal. Additionally, high mileage and excessive wear might be more cost-effective than returning the car or buying a new one, even if you plan to resell your current ride for profit.

More From GOBankingRates

I'm a Shopping Expert: 9 Items I'd Never Put in My Grocery Cart

Luxury Living on a Budget: 6 Tips for the Upper Middle Class

Experts: Make These 7 Money Resolutions If You Want To Become Rich on an Average Salary

4 Reasons You Should Be Getting Your Paycheck Early, According to An Expert

This article originally appeared on GOBankingRates.com: 6 Things You Need to Know Before Buying a Used Car in 2024

Yahoo Finance

Yahoo Finance