5 Stocks to Watch That Recently Hiked Dividends

Wall Street suffered a volatile February but all three major indexes had an impressive run in March, which saw markets ending higher in the first quarter. The second quarter too has started on a high, with indexes trading mostly in the green.

The positive sentiment got a further boost after the Labor Department reported on Apr 12 that inflation cooled in March, with the Consumer Price Index (CPI) rising a meager 0.1%, beating expectations of a jump of 0.2%. Moreover, the CPI rose 5% year over year in March, which also beat analysts’ expectations of a jump of 5.1%.

Core CPI rose 0.4% month over month and 5.6% year over year in March. The March figures indicate that inflation may finally have started cooling. However, it is still at a multi-decade high and far from policymakers’ target of 2%.

The crisis is hence far from over. Responding to the current scenario, the Fed has been on an interest rate hike spree. The central bank increased interest rates by 25 basis points in its last monetary policy meeting in March.

The Fed has now hiked interest rates by 475 basis points since March 2022, the highest since 2008. Moreover, Fed Chair Jerome Powell gave a hawkish view and indicated continuing with its rate hike policy till the central bank gets complete control over sky-high inflation.

Also, the banking collapse in the United States which started with the Silicon Valley Bank, was followed by Signature Bank and raised fears of a liquidity crisis spilling over to other banks, rattled markets. The Fed finally had to intervene to assure investors that the U.S. banking sector is still on solid ground.

It now needs to be seen how the Fed goes ahead with its interest rate hikes in the near term.

Given the circumstances, a wise investor would keep an eye on dividend-paying equities at this time. Market turbulence can be handled by dividend stocks that have a solid business plan and a proven track record.

Dividend stocks further lessen the likelihood of market volatility while ensuring a steady profit flow. Also, dividend-paying companies have regularly outperformed non-dividend-paying companies during periods of market turmoil.

Five such companies are QUALCOMM Incorporated QCOM, H.B. Fuller Company FUL, GFL Environmental Inc. GFL, Constellation Brands, Inc. STZ and EMCOR Group, Inc. EME.

QUALCOMM Incorporated designs, manufactures and markets digital wireless telecom products and services based on the Code Division Multiple Access (CDMA) technology. QCOM’s products include CDMA-based integrated circuits and system software for wireless voice and data communications as well as global positioning system products. QUALCOMM Incorporated currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

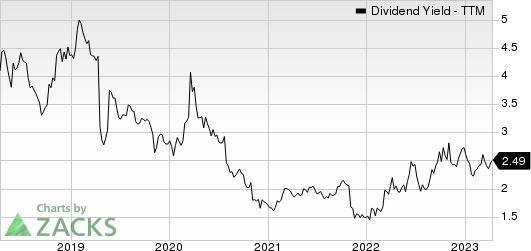

On Apr 12, QUALCOMM Incorporated announced that its shareholders would receive a dividend of $0.80 a share on Jun 22, 2023. QCOM has a dividend yield of 2.43%. Over the past five years, QUALCOMM Incorporated has increased its dividend five times, and its payout ratio at present sits at 30% of earnings. Check QUALCOMM Incorporated's dividend history here.

QUALCOMM Incorporated Dividend Yield (TTM)

QUALCOMM Incorporated dividend-yield-ttm | QUALCOMM Incorporated Quote

H.B. Fuller Company has been a leading global adhesives provider focusing on perfecting adhesives, sealants and other specialty chemical products to improve products and lives. FUL’s adhesives products are used in manufacturing common consumer and industrial goods, including food and beverage containers, disposable diapers, windows, doors, flooring, appliances, sportswear, footwear, multi-wall bags, water filtration products, insulation, textiles, automotives, solar energy systems and electronics.

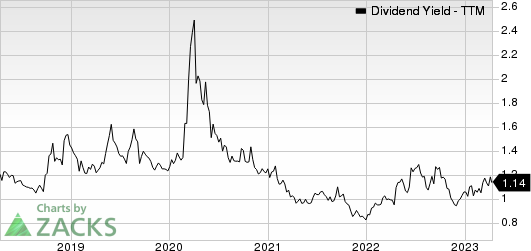

On Apr 6, H.B. Fuller Company announced that its shareholders would receive a dividend of $0.21 a share on May 4, 2023. FUL has a dividend yield of 1.13%. Over the past five years, H.B. Fuller Company has increased its dividend six times, and its payout ratio at present sits at 20% of earnings. Check H.B. Fuller Company’s dividend history here.

H. B. Fuller Company Dividend Yield (TTM)

H. B. Fuller Company dividend-yield-ttm | H. B. Fuller Company Quote

GFL Environmental Inc. provides environmental services principally in North America. GFL offers non-hazardous solid waste management, infrastructure & soil remediation and liquid waste management services.

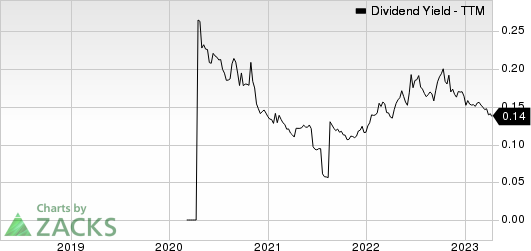

On Apr 6, GFL Environmentalannounced that its shareholders would receive a dividend of $0.01 a share on Apr 28, 2023. GFL has a dividend yield of 0.14%. Over the past five years, GFL Environmentalhas increased its dividend three times, and its payout ratio at present sits at 13% of earnings. Check H.B. GFL Environmental’sdividend history here.

GFL Environmental Inc. Dividend Yield (TTM)

GFL Environmental Inc. dividend-yield-ttm | GFL Environmental Inc. Quote

Constellation Brands, Inc. produces and markets beer, wine and spirits. STZ is the third-largest beer company and a leading, high-end wine company in the United States. Constellation Brands has a strong portfolio of high-quality brands, including Corona, Modelo Especial, Robert Mondavi, Kim Crawford, Meiomi and SVEDKA Vodka.

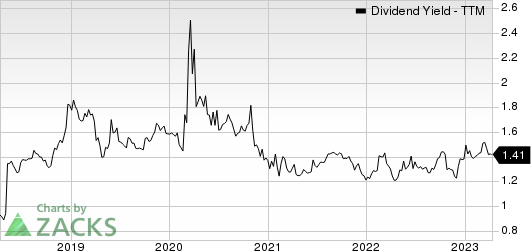

On Apr 5, Constellation Brands declared that its shareholders would receive a dividend of $0.89 a share on May 18, 2023. STZ has a dividend yield of 1.40%. Over the past five years, GFL Environmentalhas increased its dividend five times, and its payout ratio at present sits at 30% of earnings. Check Constellation Brands’ dividend history here.

Constellation Brands Inc Dividend Yield (TTM)

Constellation Brands Inc dividend-yield-ttm | Constellation Brands Inc Quote

EMCOR Group, Inc. is one of the leading providers of mechanical and electrical construction, industrial and energy infrastructure, as well as building services for a diverse range of businesses. EME serves commercial, industrial, utility and institutional clients.

On Apr 6, EMCOR Group announced that its shareholders would receive a dividend of $0.18 a share on Apr 28, 2023. EME has a dividend yield of 0.39%. Over the past five years, EMCOR Group has increased its dividend three times, and its payout ratio at present sits at 7% of earnings. Check EMCOR Group’s dividend history here.

EMCOR Group, Inc. Dividend Yield (TTM)

EMCOR Group, Inc. dividend-yield-ttm | EMCOR Group, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

H. B. Fuller Company (FUL) : Free Stock Analysis Report

GFL Environmental Inc. (GFL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance