5 Stocks Likely to Gain on NVIDIA's Blockbuster Q1 Results

On May 22, NVIDIA Corp. NVDA reported blockbuster first-quarter fiscal 2025 results, smashing all expectations. Revenues of $26.04 billion soared 262% year over year, marking the third straight quarter of growth in excess of 200%.

The metric also exceeded the consensus estimate of $24.33 billion. Adjusted earnings per share came in at $6.12, ahead of the Zacks Consensus Estimate of $5.49. This compares to earnings of $1.09 per share a year ago.

The company’s data center revenues soared 427% year-over-year to $22.6 billion. Gaming revenues were up 18% year over year to $2.65 billion. Professional visualization revenues and automotive sales came in at $427 million and $329 million, respectively.

The AI market has gathered pace in the past few years buoyed by the rapid penetration of digital technologies and the Internet. These astonishing results were primarily due to sky-high shipments of NVIDIA’s Hopper graphics processors, especially H100 GPU.

Moreover, NVIDIA has given an impressive guidance even after three consecutive quarters of astonishing performances. Management expects sales of $28 billion in the fiscal second quarter, higher than the current consensus estimate of $26.6 billion.

NVIDIA has also ensured that the artificial intelligence (AI) frenzy is yet to unfold. Consequently, several companies closely associated with NVIDIA, are likely to gain in the near future.

Stocks in Focus

We have narrowed our search to five technology stocks that are closely associated with NVIDIA. These stocks have strong potential for 2024 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Taiwan Semiconductor Manufacturing Co. Ltd. TSM is one of the largest manufacturers of NVIDIA’s chipsets. TSM provides a range of wafer fabrication processes, including processes to manufacture complementary metal- oxide-semiconductor logic, mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and others.

TSM also offers customer and engineering support services, manufactures masks, and invests in technology start-up companies, it researches, designs, develops, manufactures, packages, tests, and sells color filters, and provides investment services. TSM’s products are used in high-performance computing, smartphones, the Internet of Things (IoT), automotive and digital consumer electronics.

Zacks Rank #3 Taiwan Semiconductor Manufacturing has an expected revenue and earnings growth rate of 22% and 18.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days.

Super Micro Computer Inc. SMCI makes servers using NVIDIA processors. SMCI designs, develops, manufactures and sells energy-efficient, application-optimized server solutions based on the x86 architecture.

SMCI’s solutions include a range of rack mount and blade server systems, as well as components. SMCI’s Server Building Block Solutions provide benefits across many environments, including data center deployment, high-performance computing, high-end workstations, storage networks and standalone server installations.

Zacks Rank #2 Super Micro Computer has an expected revenue and earnings growth rate of 60.1% and 44.6%, respectively, for next year (ending June 2025). The Zacks Consensus Estimate for next-year earnings has improved 14.1% over the last 30 days.

Dell Technologies Inc. DELL has expanded its AI offerings in partnership with NVIDIA with "new server, edge, workstation, solutions and services advancements." On May 20, DELL announced the new Dell PowerEdge XE9680L server, which "offers direct liquid cooling and eight NVIDIA Blackwell Tensor Core GPUs for fast processing in a compact form factor."

DELL is benefiting from strong demand for AI servers driven by the ongoing digital transformation and heightened interest in generative AI applications. DELL’s PowerEdge XE9680 AI-optimized server is very much in demand. Strong enterprise demand for AI-optimized servers is aiding DELL.

Zacks Rank #2 Dell Technologies has an expected revenue and earnings growth rate of 7.7% and 9%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 1.3% over the last seven days.

Meta Platforms Inc. META is set to receive initial shipments of NVIDIA’s new flagship AI chip later this year. NVIDIA’s CEO Jensen Huang said in a conference call that the company’s next-generation AI chip, called Blackwell, is the upcoming driver. META is set to get B200 Blackwell chips.

META is benefiting from steady user growth across all regions, particularly Asia Pacific. Increased engagement in its offerings like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver. META is leveraging AI to recommend Reels content, which is driving traffic on Instagram and Facebook.

Zacks Rank #3 Meta Platforms has an expected revenue and earnings growth rate of 17.8% and 35.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 60 days.

Micron Technology Inc. MU produces memory chips used in NVIDIA’s GPUs. The enormous growth of AI applications boosted demand for MU’s high bandwidth memory chips. MU is benefiting from improved market conditions, robust sales executions and strong growth across multiple business units.

MU anticipates the pricing of DRAM and NAND chips to increase, thereby improving its revenues. The pricing benefits will primarily be driven by rising AI servers, causing a scarcity in the availability of cutting-edge DRAM and NAND supply. Also, 5G adoption in IoT devices and wireless infrastructure is likely to spur demand for memory and storage.

Zacks Rank #2 Micron Technology has an expected revenue and earnings growth rate of 58.4% and more than 100%, respectively, for the current year (ending August 2024). The Zacks Consensus Estimate for current-year earnings has improved 6.3% over the last seven days.

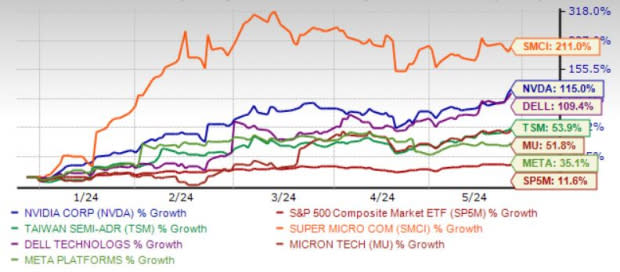

The chart below shows the price performance of six above-mentioned stocks year to date.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance