5 Soaps & Cleaning Materials Stocks to Gain in a Prospering Industry

Players in the Zacks Soap and Cleaning Materials industry have been benefiting from continued solid demand for consumer products and brands, cost-saving efforts, and strong execution. Pricing actions have played a key role in uplifting the sales trends for industry participants. The companies focused on transforming operations, digital commerce growth, innovation and brand building have been gaining amid macro hardships.

Nevertheless, the companies continue to toil with headwinds related to higher manufacturing and logistic costs, increased commodity costs, and lower volume. Also, elevated advertising and sales promotion spending is expected to dent margins in the near term. Some of the players have been undertaking cost-curtailment actions to support margins, while coming up with the latest products and improved marketing efforts. Players like The Procter & Gamble Company PG, Colgate-Palmolive CL, Reckitt Benckiser Group RBGLY, Church & Dwight Co., Inc. CHD and The Clorox Company CLX have focused on these efforts despite the continued cost inflation.

About the Industry

Companies involved in the manufacturing and supply of fast-moving consumer goods, including personal care, household and specialty products, primarily make up the Zacks Soap and Cleaning Materials industry. The personal care segment comprises skin and hair care products, deodorants, and oral care items. The household category covers home care products, including laundry care, house cleaning agents, bleaching products, air care, dishwashing liquids and other cleaning items. Laundry detergent is one of the largest markets among the above-mentioned ones. A few players in this space also offer baby and feminine care items. Some companies offer pet care products. These companies market and sell products through supermarkets, mass merchandisers, grocery stores, distributors, wholesalers, department stores, drugstores, specialty stores, dollar stores and pet stores, and websites.

Major Trends Shaping the Future of the Soaps & Cleaning Materials Industry

Favorable Demand Trends & Pricing Actions: The soaps and cleaning materials industry has been experiencing revived demand trends across markets. Solid demand for its products and brands, owing to continued brand relevance, and a favorable price mix have been boosting industry participants’ performance. Industry players have also been witnessing improved organic sales trends mainly on gains from robust pricing actions and revenue management initiatives. The companies have been adopting bold pricing initiatives across markets to combat rising costs due to the persistence of inflation, higher freight and currency woes. Some companies have resorted to cost-based pricing actions, which have proved beneficial.

Product Innovation & Strategic Efforts: Investments in product development to suit consumers’ changing needs have been supporting the companies in the soaps and cleaning products space. Investments in innovation, product portfolio and digital capabilities have been the key to driving sales of companies. Players have been undertaking pricing, packaging and marketing initiatives, along with restructuring actions, including acquisitions and divestitures. Companies are also looking to expand into new markets and channels. Developing products with eco-friendly and natural ingredients is another area of focus among industry players, as consumers increasingly prefer environment-friendly ingredients in their daily use items. The online availability of products has been another key sales driver across various markets due to convenience and ease of shopping. Consumer goods companies are undertaking productivity and cost-saving plans to boost margins.

Elevated Costs: The soaps and cleaning materials industry players have been grappling with escalating raw material and logistic costs, particularly transportation, due to supply-chain issues and current industry dynamics. These have been hurting the industry participants’ margins. Elevated manufacturing and distribution costs, as well as increased advertising and sales promotion expenses, are other factors impacting margins. Additionally, the companies have been incurring higher SG&A expenses on account of increased operational costs related to salaries and bonuses, as well as planned investments in digital capabilities and productivity enhancements. To overcome these shortcomings and improve margins, some players are focusing on cost-containment initiatives, including streamlining the supply chain and minimizing overhead costs. Most companies are resorting to price increases to cushion their margins.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Soap and Cleaning Materials industry is housed within the broader Zacks Consumer Staples sector. The industry currently carries a Zacks Industry Rank #37, which places it in the top 15% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gaining confidence in this group’s earnings growth potential.

We here present a few stocks that one can retain in their portfolio, given their solid growth endeavors. But before that, it is worth taking a look at the industry’s performance and current valuation.

Industry Vs. Broader Market

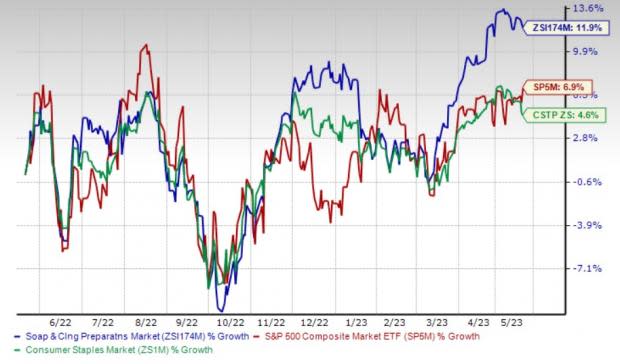

The Zacks Soap and Cleaning Materials industry has outperformed the broader Zacks Consumer Staples sector and the S&P 500 index in the past year.

The industry has rallied 11.9% in the past year compared with the broader sector and the S&P 500’s growth of 4.6% and 6.9%, respectively.

One-Year Price Performance

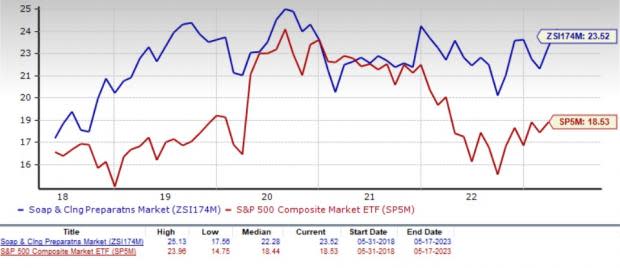

Industry's Current Valuation

On the basis of forward 12-month price-to-earnings (P/E), which is commonly used for valuing Consumer Staples stocks, the industry is currently trading at 23.52X compared with the S&P 500’s 18.53X and the sector’s 18.77X.

Over the past five years, the industry has traded as high as 25.13X and as low as 17.56X, the median being 22.28X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Stocks to Keep a Close Watch

Procter & Gamble: The Cincinnati, OH-based consumer goods giant has been benefiting from strength across all segments, coupled with robust volume, pricing and mix. Procter & Gamble’s products play a key role in meeting the daily health, hygiene and cleaning needs of consumers worldwide. Increased consumer demand for its hand soaps, detergents and surface cleaning products has been a key catalyst. The company has been witnessing strong growth in two of its largest markets, the United States and Greater China. The company’s e-commerce sales have been growing globally.

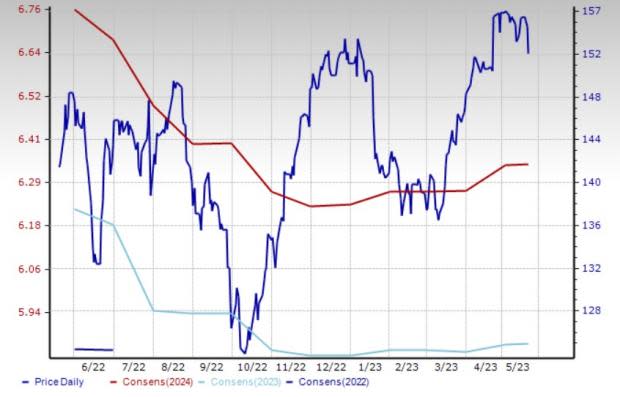

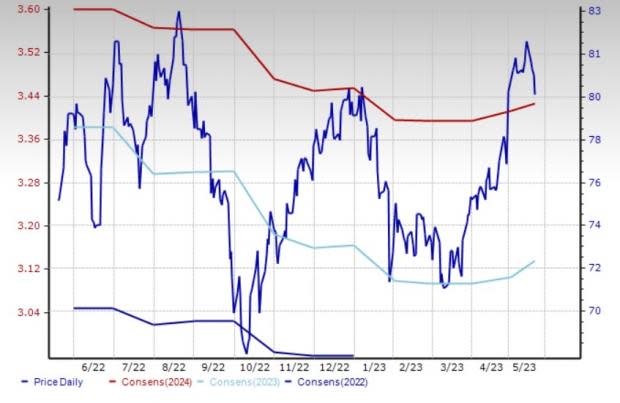

Procter & Gamble is focused on productivity and cost-saving plans to boost margins. The company’s continued investments in business, alongside efforts to offset macro cost headwinds, and balance top and bottom-line growth, underscore its productivity efforts. It has been witnessing SG&A expense leverage, owing to savings from overhead and marketing expenses, and cost leverage gains due to higher sales and real estate. The Zacks Consensus Estimate for PG’s fiscal 2023 sales and earnings indicates year-over-year increases of 1.5% and 0.9%, respectively. The consensus mark for earnings has moved up 0.3% in the past 30 days. Shares of the Zacks Rank #2 (Buy) company have declined 7.6% in the past year.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: PG

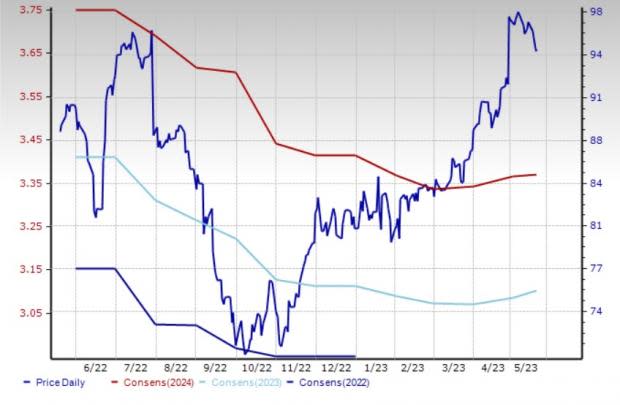

Clorox: Clorox is on track with the IGNITE strategy, its latest and integrated strategy, formulated on a sturdy foundation of its 2020 Strategy. Management announced a streamlined operating model to create a faster, simpler company through the Reimagine Work under its IGNITE strategy. The operating model implemented in the first quarter of fiscal 2023 will help increase efficiencies and transform the company's operations in the areas of the supply chain, digital commerce, innovation and brand building in the long term. The company has undertaken some strategic initiatives, including pricing actions, cost-reduction efforts, increased focus on building supply-chain resiliency, and enhanced productivity to counter the ongoing cost headwinds. CLX is on track with its cost-saving and productivity initiatives.

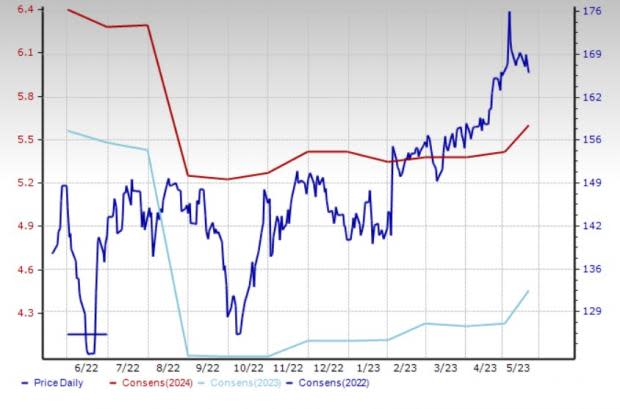

Clorox has been undertaking digital investments to transition to a cloud-based platform. It earlier announced plans to invest $500 million in the next five years in transformative technologies and processes. The Zacks Consensus Estimate for Clorox’s fiscal 2023 sales and earnings suggests year-over-year growth of 1.7% and 8.3%, respectively. The consensus mark for earnings has moved up 4.7% in the past 30 days. Shares of CLX have rallied 20.1% in the past year. The company has a Zacks Rank #2 at present.

Price and Consensus: CLX

Reckitt: The consumer goods company engages in health, hygiene and nutrition products in the U.K., the United States, China, India and internationally. The U.K.-based company’s resilient business is driven by a strong earnings model. Its earnings model has been gaining from a positive mix and outstanding performance from its productivity program, as well as responsible pricing, all of which have been contributing to operating margin growth. The company is on track with its transformation and innovation efforts.

Shares of the Zacks Rank #2 company has gained 3.4% in a year. The Zacks Consensus Estimate for RBGLY’s 2023 earnings indicates flat year-over-year results, while the same for sales suggests growth of 0.3%. The consensus mark for earnings has moved up 5% in the past 30 days.

Price and Consensus: RBGLY

Colgate: The company’s business strategies comprise efforts to increase its leadership in key product categories through innovation in core businesses, tracking adjacent categories’ growth, and expansion into new markets and channels. Due to the shift of consumer preference to organic and natural ingredients, the company has been expanding its Naturals range, including Naturals toothpaste. Growth in volumes, higher pricing and investments in premium innovation and digital transformation have been key drivers in recent years.

Expanding the availability of products via enhanced distribution to newer markets and channels is one of Colgate’s priorities to improve organic sales. The company is aggressively expanding into faster growth channels, while extending the geographic footprint of its brands. We note that the Zacks Consensus Estimate for CL’s 2023 sales and earnings indicates year-over-year growth of 6.1% and 5.7%, respectively. The consensus mark for earnings has moved up by a penny in the past seven days. Shares of the leading oral care company have risen 6% in the past year. The company currently has a Zacks Rank #3 (Hold).

Price and Consensus: CL

Church & Dwight: The well-known specialty products company has been gaining from its prudent buyouts, solid innovation and favorable consumption demand. Church & Dwight is optimistic about its 2023 performance on category growth and impressive brand performance. The company is on track with its pricing and productivity efforts to counter cost inflation. The Ewing, NJ-based company is focused on product innovation for further growth.

Church & Dwight is focused on making capital investments to expand its factory and supplier network capacity, courtesy of the constant strength in consumer demand for its products. Its regular innovation helps in improving brand positions and market share in the consumer categories. Shares of the Zacks Rank #3 company have gained 6.5% in a year. The Zacks Consensus Estimate for CHD’s 2023 sales and earnings indicates year-over-year growth of 7.2% and 4.4%, respectively. The consensus mark for earnings has moved down by a penny in the past seven days.

Price and Consensus: CHD

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

The Clorox Company (CLX) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Reckitt Benckiser Group PLC (RBGLY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance