5 Reasons Chinese Equities Have Bottomed

Yesterday, I wrote a commentary explaining why I believe the next few months should be choppy for U.S. equities. However, just because trading in U.S. equities has become more difficult doesn’t mean opportunities abroad don’t exist. The old Wall Street adage goes, “There’s always a bull market somewhere.”

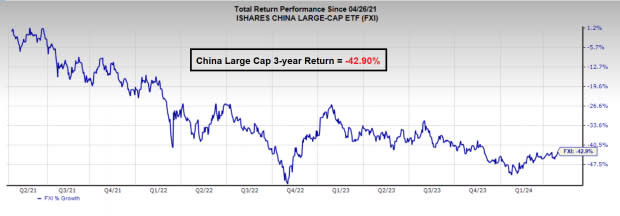

Over the past several years, Chinese stocks have been one of the most debilitating investments for bulls. The government’s anti-growth policies, stringent COVID-19 restrictions, and real estate crisis have led to a drawn-out bull market in Chinese equity proxies such as the iShares China Large-Cap ETF (FXI). FXI is down more than 40% over the past three years as investors have remained laser-focused on U.S. equities and other international markets.

Image Source: Zacks Investment Research

Nevertheless, 5 indicators strongly suggest that the worst is over for Chinese equities and a multi-year bull market is on the periphery, including:

Market Restructuring

As I mentioned earlier, for years, the Chinese government’s heavy-handed, non-free market stance has left a bearish cloud hanging over Chinese equities. However, UBS Group (UBS) and Goldman Sachs (GS), two highly respected banks, raised their outlooks on Chinese equities based on the government’s newest efforts to buoy the nearly $10 trillion Chinese equity market. More business-friendly reforms are poised to help China recover lost foreign investment due to regulation uncertainty.

Valuations are Dirt Cheap

Though Chinese stocks like Alibaba Group (BABA) have been classic “value traps,” lately, valuations have become simply too attractive to ignore. For example, the e-commerce juggernaut has a price-to-book ratio of 1.15, the lowest p/b ratio in its history (BABA went public roughly a decade ago.

Image Source: Zacks Investment Research

Kitchen Sink Already Thrown at Chinese Equities

The ailing real estate market has been a significant bearish headwind for the Chinese economy. Evergrande, once the world’s most valuable real estate company, collapsed amid the Chinese real estate crisis. Because markets are forward-looking, they often bottom when the news looks the bleakest. For example, Bitcoin bottomed within days of the collapse of the FTX crypto exchange.

Billions in Buybacks

Chinese tech leaders like Alibaba, Tencent Holdings (TCEHY), and JD.com (JD) have each announced billions in buybacks over the past few months. Buybacks are a bullish catalyst for these stocks because they drive investor confidence while simultaneously decreasing dilution (the shares available to be traded). The buybacks are especially bullish for the main domestic proxy for Chinese internet stocks, the Krane CSI Internet ETF (KWEB).

Price Action

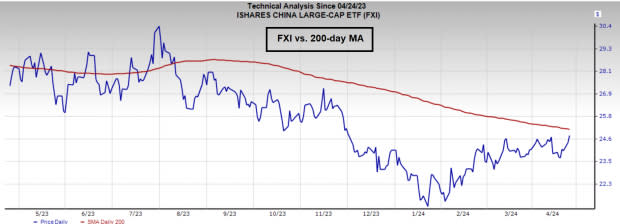

Chinese stocks have outperformed U.S. stocks and have exhibited classic relative strength clues. FXI and other Chinese proxies are on the brink of clearing the 200-day moving average. If the price can clear the 200-day, it signifies that the long-term trend has finally shifted in the bull’s favor.

Image Source: Zacks Investment Research

Bottom Line

A shift in government policy and four other bullish signals indicate that the bottom is likely in for Chinese stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

iShares China Large-Cap ETF (FXI): ETF Research Reports

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

KraneShares CSI China Internet ETF (KWEB): ETF Research Reports

Yahoo Finance

Yahoo Finance