5 Insurance Stocks to Watch With Impressive Dividend Yield

The Zacks Property and Casualty Insurance industry is well-poised to benefit from better pricing, prudent underwriting, increased exposure, an improving rate environment and a solid capital position. The buoyancy in the industry is further confirmed by its Zacks Industry Rank #35, which places it in the top 14% of more than 250 Zacks industries.

However, industry players continue to grapple with issues like higher catastrophe events, both natural and man-made, which drag down underwriting profit.

Per reports in Aon, total economic losses were $380 billion in 2023, while insured losses were $118 million. According to AM Best, the total net underwriting loss was $38 billion in 2023, marking a 10-year high, largely attributable to weather-related losses, high inflation and reinsurance pricing pressure.

Despite these challenges surrounding the industry, the P&C insurance industry has risen 14.6% in the year-to-date period, outperforming the Zacks S&P 500 composite’s growth of 11.5% and the Finance sector’s 4.5% rise.

Image Source: Zacks Investment Research

Industry players that boast an impressive dividend history have always

attracted yield-seeking investors. Property and casualty insurers like The Allstate Corporation ALL, Cincinnati Financial Corporation CINF, CNA Financial Corporation CNA, First American Financial Corporation FAF and American Financial Group AFG have been investors’ favorites, driven by their solid fundamentals that ensure consistent dividend payments.

Global commercial insurance rates rose 1% in the first quarter of 2024, per Marsh Global Insurance Market Index.

Price hikes, operational strength, higher retention, strong renewal and the appointment of retail agents should help write higher premiums. Per Deloitte Insights, gross premiums are estimated to increase sixfold to $722 billion by 2030.

Per Fitch Ratings, personal auto is likely to deliver a better performance this year. This, coupled with better investment results and lower claims, should fuel insurers' performance in 2024. Analysts at Swiss Re Institute predict premiums to grow 5.5% in 2024.

The insurance industry is rate-sensitive. An improving rate environment is a boon for insurers, especially long-tail insurers. The Fed held interest rates unchanged at 5.25-5.5% at the December FOMC meeting. With a large invested asset base, investment income should remain healthy, even if the Fed cuts rates later this year.

A solid capital level supports insurers in pursuing strategic mergers and acquisitions to gain market share, expand in niche areas and diversify operations into new business lines and geography, as well as increase dividends, pay special dividends and buy back shares. Deloitte estimates more mergers and acquisitions in the reinsurance space in 2024.

The P&C insurance industry is witnessing increased use of technology like blockchain, artificial intelligence, advanced analytics, telematics, cloud computing and robotic process automation that expedite business operations and save costs. Insurers continue to invest heavily in technology to improve basis points, scale and efficiencies.

How to Pick the Right Dividend Stocks

To choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%, reflecting enough room for future dividend increases. These stocks also have a five-year historical dividend growth rate of more than 2% and a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Insurance Stocks for Dividend Investors

Allstate provides property and casualty and other insurance products in the United States and Canada and has a market capitalization of 43.50 billion. Allstate is the third-largest property-casualty insurer and the largest publicly held personal lines carrier in the United States. The insurer’s consistent sales growth stems from a diversified product portfolio, strategic acquisitions and disciplined pricing.

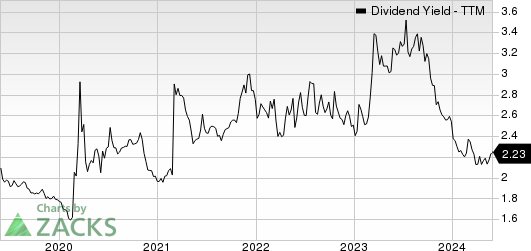

The insurer’s payout ratio is 50, with a five-year annualized dividend growth rate of 16.11%. Its current dividend yield of 2.2%. The insurer’s quarterly dividend payment witnessed a 10-year CAGR (2014-2024) of 12.6%. (Check Allstate’s dividend history here.)

The Allstate Corporation Dividend Yield (TTM)

The Allstate Corporation dividend-yield-ttm | The Allstate Corporation Quote

The company’s cash flow generating abilities are crucial to improve leverage and return capital to shareholders. It hiked dividends by 3.4% in the first quarter of 2024 to 92 cents per share. It paid a common stock dividend worth $233 million in the first quarter. It repurchased 3 million common shares in 2023.

Cincinnati Financial, with a market capitalization of 18.43 billion, provides property casualty insurance products in the United States. CINF remains poised to gain from price increases, a higher level of insured exposures and several growth initiatives, which include the expansion of Cincinnati Re and Cincinnati Global. This P&C insurer intends to grow the Commercial Lines and Excess and Surplus lines through additional agency appointments, expansion of local field presence, higher renewal written premiums and higher average renewal estimated pricing.

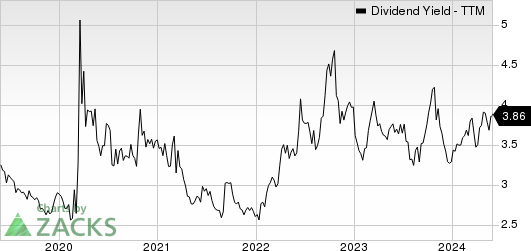

The insurer’s payout ratio is 47, with a five-year annualized dividend growth rate of 7.71%. The 2.7% dividend yield surpasses the industry average of 0.2%, making Cincinnati Financial an appealing choice for investors seeking stable returns. The insurer’s quarterly dividend payment witnessed a 10-year CAGR (2014-2024) of 6.3%. (Check Cincinnati Financial’s dividend history here.)

Cincinnati Financial Corporation Dividend Yield (TTM)

Cincinnati Financial Corporation dividend-yield-ttm | Cincinnati Financial Corporation Quote

Cincinnati Financial’s consistent cash flow continues to boost liquidity. In terms of capital management, Cincinnati Financial has returned capital to shareholders through share buybacks, regular cash dividends as well as special dividends. In January 2024, CINF’s board approved an 8% hike in the quarterly dividend. The board of directors increased the annual cash dividend rate for 64 consecutive years, a record which is believed to be matched by only seven other U.S. publicly traded companies. The dividend increases reflected strong operating performance and signaled management's and the board's positive outlook and confidence in outstanding capital, liquidity and financial flexibility.

CNA Financial, with a market capitalization of $11.95 billion, offers commercial P&C insurance products, mainly across the United States. The insurer’s focus on better pricing, increased exposure, higher new businesses and retentions across its Specialty, Commercial and International segments poise it well for growth.

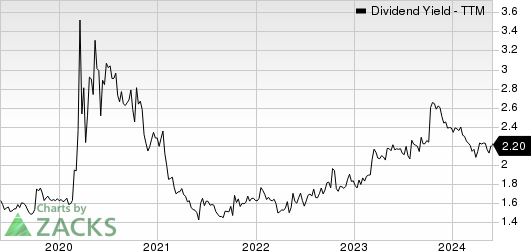

The insurer’s payout ratio is 37, with a five-year annualized dividend growth rate of 4.58%. Its current dividend yield of 4%. The insurer’s quarterly dividend payment witnessed a 10-year CAGR (2014-2024) of 5.8%. (Check CNA Financial’s dividend history here.)

CNA Financial Corporation Dividend Yield (TTM)

CNA Financial Corporation dividend-yield-ttm | CNA Financial Corporation Quote

A strong balance sheet and cash flows enable CNA Financial to engage in shareholder-friendly moves like dividend hikes. In February 2024, CNA Financial’s board approved a 5% hike in the quarterly dividend. Simultaneously, CNA announced a special dividend of $2 per share, marking the 10th special dividend. With disciplined execution, denoted by strong underwriting results and confidence in future earnings performances, the company has hiked its dividend over the past couple of years. Thus, CNA remains committed to returning more value to shareholders.

First American Financial, with a market capitalization of $5.69 billion, provides financial services and operates through the Title Insurance and Services and Home Warranty segments. FAF remains well-poised to capitalize on the increased demand among millennials for first-time home purchases. The insurer is poised to rise on growing leadership in title data, benefiting from proprietary data extraction, sturdy distribution relationships, prudent underwriting and continued investments in technology.

The insurer’s payout ratio is 57, with a five-year annualized dividend growth rate of 5.90%. Its current dividend yield of 3.8%. (Check First American’s dividend history here.)

First American Financial Corporation Dividend Yield (TTM)

First American Financial Corporation dividend-yield-ttm | First American Financial Corporation Quote

Banking on strong operational performance, FAF distributes wealth to its shareholders via dividends. It has been increasing its dividend payout each year and buying back shares. The board of directors increased the dividend by 2% to an annual rate of $2.12 per share in the first quarter of 2024, which translated into a nine-year (2016-2024) CAGR of 8.2%. Also, the payout ratio of 56.8 compares favorably with the industry average of 6.8. These make the stock an attractive pick for yield-seeking investors.

Also, the company has a buyback program with an authorization of up to $400 million worth of shares. It bought back $3.5 million worth of shares in the first quarter of 2024 and thus had $210.4 million remaining as of Mar 31, 2024.

American Financial, with a market capitalization of $10.82 billion, is an insurance holding company that provides specialty property and casualty insurance products in the United States. The insurer is set to benefit from business opportunities, growth in the surplus lines and excess liability businesses and higher retentions in the renewal business, which boost premium growth.

The insurer’s payout ratio is 27, with a five-year annualized dividend growth rate of 12.32%. Its current dividend yield is 2.2%. The insurer’s quarterly dividend payment witnessed a 10-year CAGR (2014-2024) of 12.4%. (Check American Financial’s dividend history here)

American Financial Group, Inc. Dividend Yield (TTM)

American Financial Group, Inc. dividend-yield-ttm | American Financial Group, Inc. Quote

American Financial has traditionally maintained moderate adjusted financial leverage of around 20%, with good cash flow and interest coverage ratio. In each of the last 18 years, the company has successfully increased its dividends. During the first three months of 2024, AFG did not repurchase any shares. During the quarter, the company returned $269 million to shareholders through the payment of regular quarterly dividends and a special dividend of $2.50 per share on Feb 28, 2024. The aggregate amount of this special dividend will be approximately $209 million.

The robust operating profitability at the P&C segment, stellar investment performance and effective capital management support effective shareholders’ return. The company expects its operations to continue to generate significant excess capital throughout the remainder of 2024, which provides ample opportunity for additional share repurchases or special dividends over the next year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance