5 Big Retailers Likely to Gain on Earnings Beat This Month

The first-quarter 2024 earnings season is approaching its end. So far, results have come in better than expected. As of May 17, 467 companies on the S&P 500 Index reported their financial numbers. Total earnings for these 467 index members increased 4.6% from the same period last year on 4% higher revenues, with 77.7% beating EPS estimates and 60.2% beating revenue estimates.

At present, total earnings of the S&P 500 Index in first-quarter 2024 are expected to be up 6.3% on 4.3% higher revenues. This follows the 5.3% earnings growth on 4.3% higher revenues in fourth-quarter 2023 and 3.8% earnings growth on 2.2% higher revenues in third-quarter 2023.

Most of the sectors have completed the results declaration, with a notable exception of the retail sector. This month, five retail bigwigs are set to beat on earnings results. The combination of a favorable Zacks Rank and a possible earnings beat should drive their stock prices in the near term.

Retail Sector in Q1 at a Glance

The U.S. economy remains resilient even though the interest rate is currently at its 23-year high. The Fed is yet to give any information on the date of its first rate cut. Despite a tough scenario, personal consumption expenditure remains strong. Consequently, the retail sector remained strong in first-quarter 2024.

Retal sales declined in January missing the consensus estimate primarily due to strong sales in the November-December 2023 holiday season. However, the metric returned to growth trajectory, beating consensus estimates in both February and March.

Industry participants have been focused on product innovations, active promotions, store expansion and enhancing e-commerce capabilities to gain market share. Favorable health and wellness trends have inspired footwear manufacturers to expand their product portfolios.

The companies continue to innovate styles, materials and colors, and incorporate functional designs to grab a large share of the fast-growing market. Multi-functional shoes, which cater to casual and formal looks, have been gaining popularity.

E-commerce has been playing a crucial role in the athleisure market’s growth. The companies in the segment are looking to build a customer base through websites, social media and other digital channels.

Stocks in Focus

We have narrowed our search to five large-cap retail stocks that are poised to beat on earnings results this month. Each of these stocks carries either a Zacks Rank #2 (Buy) or 3 (Hold) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

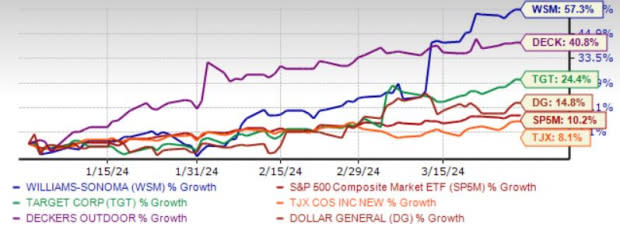

The chart below shows the price performance of five stocks in the last quarter.

Image Source: Zacks Investment Research

The TJX Companies Inc.’s TJX off-price business model, strategic store locations, impressive brands and supply-chain management are working well. TJX has been benefiting from robust performance in its Marmaxx and HomeGoods segments, a trend that continued in fourth-quarter fiscal 2024. TJX’s Comparable store sales saw a rise, indicating sustained momentum.

TJX anticipates a 2-3% rise in comparable store sales for fiscal 2025. With a solid pre-tax margin, TJX is poised for steady profitability, supported by improved merchandise margins and expense leverage. Also, management is on track with expansion efforts.

Zacks Rank #2 The TJX Companies has an Earnings ESP of +3.47%. It has an expected earnings growth rate of 9% for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last seven days.

The TJX Companies recorded earnings surprises in the last four reported quarters, with an average beat of 6.3%. The company is set to release earnings results on May 22, before the opening bell.

Target Corp. TGT is poised to capture market share over time, driven by its compelling value proposition and a spectrum of initiatives. These encompass TGT’s expansion of new stores, innovations in owned brands, partnerships with popular brands, and the enhancement of same-day services to drive traffic.

TGT is likely to register margin expansion thanks to clean inventory as well as lower supply chain and freight costs. We anticipate a gross margin expansion of 60 basis points and 20 basis points in fiscal 2024, respectively.

Zacks Rank #3 Target has an Earnings ESP of +6.39%. It has an expected earnings growth rate of 5.4% for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

TGT recorded earnings surprises in the last four reported quarters, with an average beat of 27.1%. The company is set to release earnings results on May 22, before the opening bell.

Williams-Sonoma Inc. WSM is benefiting from its e-commerce business, B2B initiative and expansion plans. WSM’s margins grew on the back of a solid operating model, which partially offset the prevailing macro-economic headwinds through its full-price selling, supply-chain efficiencies and top-tier customer service. For 2024, WSM expects its operating margin to be between 16.5% and 16.8%, up from 16.4% in fiscal 2023.

Zacks Rank #3 Williams-Sonoma has an Earnings ESP of +2.66%. It has an expected earnings growth rate of 3.6% for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days.

WSM recorded earnings surprises in the last four reported quarters, with an average beat of 10.3%. The company is set to release earnings results on May 22, before the opening bell.

Deckers Outdoor Corp. DECK has the potential for further expansion and market resilience. Key strategic initiatives, including product innovation and brand assortment expansion, coupled with a robust focus on direct-to-consumer channels, drive DECK’s growth trajectory. Successful international market penetration and a strong wholesale segment contribute to DECK’s market diversification.

Additionally, proactive consumer engagement strategies and omni-channel distribution bolster its competitive edge. DECK’s commitment to elevating renowned brands like UGG and HOKA into global lifestyle icons enhances brand equity and market reach. We expect net sales increases of 12% and 24.6% for the UGG and HOKA brands, respectively, in fiscal 2024.

Zacks Rank #3 Deckers Outdoor has an Earnings ESP of +11.68%. It has an expected earnings growth rate of 9.4% for the current year (ending March 2025). DECK recorded earnings surprises in the last four reported quarters, with an average beat of 32.1%. The company is set to release earnings results on May 23, after the closing bell.

Dollar General Corp. DG remains a compelling growth story in the retail space, despite immediate margin pressure and a tough consumer environment. Thanks to its value-creating initiatives, a defensive product mix and real estate growth strategy, DG has the capabilities to gain market share. DG’s commitment to better pricing, private-label offerings, effective inventory management and merchandise initiative should drive sales.

We remain encouraged by the host of initiatives such as DG Fresh, SKU rationalization, digitization and the expansion of private fleet that should yield same-store sales improvements and margin expansion. DG emphasizes maintaining and improving cash flow in 2024. Mirroring this optimism is our expectation of same-store sales growth of 2.5% and 2.3% for the current and next fiscal year, respectively.

Zacks Rank #3 Dollar General has an Earnings ESP of +0.24%. The company is set to release earnings results on May 30, before the opening bell.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Williams-Sonoma, Inc. (WSM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance