3 ways to simplify investing in stocks

By James Yeo

Admit it: Investing in shares is like crossing a minefield before you reach the treasure chest at the end.

People love to share their rags-to-riches stories, but the reality is that the game is much harder than it looks. What if I told you that you can build your wealth without investing directly in shares?

Yes, no more poring over individual companies’ annual reports and having to do extensive research on them.

Curious?

We’ve highlighted three simple investment methods that allow the average Joe to build his wealth and give himself the best chance at long-term growth.

Invest in ETFs

An ETF (exchange-traded fund), is an investment that tracks the performance of a given index, commodity, bonds, or a basket of assets like an index fund.

Want to own several blue chips like UOB, Singtel and Keppel Corp at one swoop?

You can do this just by investing in the SPDR Straits Times Index ETF (SGX: ES3), which aims to replicate the holdings in the Straits Times Index with similar weightings.

Bullish in a particular sector or asset like gold? There are also many overseas ETFs that focus on particular industries, resources or goods like the Vanguard REIT ETF or Amundi Hang Seng HK 35 Index ETF.

Buy into a Good-performing Fund

Whilst ETFs passively track an entire index, mutual funds aspire to achieve higher returns by investing in a group of stocks hand-picked by a fund manager.

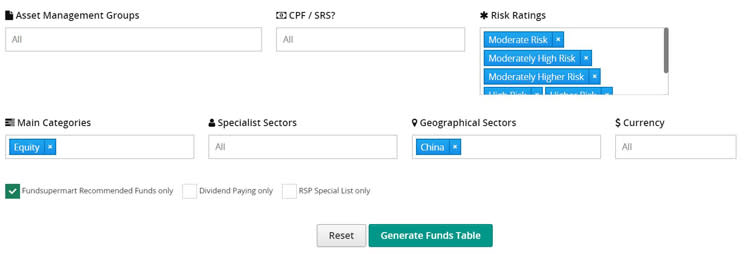

There are plenty of mutual funds listed under www.fundsupermart.com ranging from the low-risk, to the geographically-specific such as China-focused funds.

For illustration purposes, I searched for the criteria below and it highlighted a fund called “Neuberger Berman China Eqty A USD Acc”.

When you are investing in mutual funds, you are essentially placing your bets on someone who has proven themselves rather than trying to go into this game yourself. A word of advice: Choose a manager who has achieved resounding success at least for the past five years to ensure he can continue to do so going forward.

Robo-advisors on the rise

It should come as no surprise that what a human once did is now being done by a computer. In fact, you can check out this article where Google’s AI has defeated even the world’s best human ‘Go’ player.

And it seems that computers are now reigning supreme in many areas, even in the world of money management.

Meet Robo-Advisors – digital platforms that offer automated, algorithm-driven financial advice or portfolio management services with little to no human supervision.

Robo-advisors have surged in popularity as investors seek low-cost, automated investing opportunities. Some key players in Singapore include Stashaway, Smartly, Autowealth and more.

Personally, I am intrigued by how easy it is to invest my money with a few clicks, and wonder if robot-advisors will replace human financial advisers in future.

Conclusion

Performing analyses on individual stocks can be a daunting and tiring task given that there are hundreds of listed companies just in Singapore alone.

More often than not, retail investors also suffer from information paralysis due to the heavy “financial noise”, become sloppy and end up investing in less-than-ideal companies.

Thus, why not give the above mentioned methods a try? You may save yourself a lot more time and even achieve better returns!

James Yeo is a finance professional in the Asset Management industry for more than 6 years. He also founded an investment blog at www.smallcapasia.com which is dedicated to helping retail investors find winning stocks.

Related articles:

Yahoo Finance

Yahoo Finance