3 Top Performing S&P 500 Banks in the First Half of 2023

The first half of 2023 turned out to be excellent for the stock markets. The S&P 500 and the Nasdaq recorded their best first half since 2019 and 1983, respectively. The Dow Jones relatively lagged, though finishing in the green.

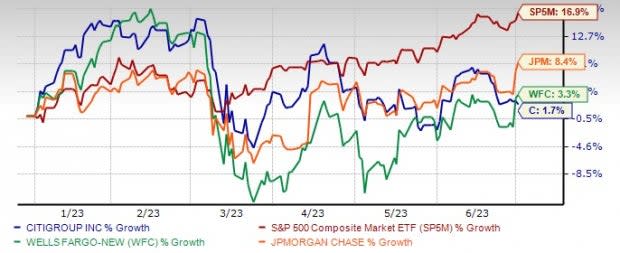

Despite a fabulous start to the year, the banking sector was a major laggard. The last six months were terrible for the sector. The S&P 500 Banks Industry Group Index was down 8%, while the S&P 500 Index gained 16.9%. Of the banks that are part of the S&P 500 Index, only – JPMorgan JPM, Wells Fargo WFC and Citigroup C – ended positively in the first half.

Here’s how these three big banks have performed in the first half of 2023:

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Reasons Behind Investor Apathy

The year started on a promising note as the Federal Reserve raised the interest rates to a 15-year high range of 4.25-4.50% in 2022. The higher interest rate regime immensely supported the banks’ top-line growth. However, as the year progressed, the fallout from the central bank’s ultra-aggressive monetary policy started emerging. None of the banks, big or small, were spared.

Several issues, including potential recession, waning loan demand, rising funding costs, high levels of fixed-rate mortgage and commercial real estate loans, huge exposure to uninsured deposits in the balance sheet and asset-liability mismatches, turned the situation out of favor for industry. These factors led to the banking crisis and collapse of three banks – Silicon Valley Bank, Signature Bank and First Republic Bank. These lenders were part of the S&P 500 Index.

Heavy deposit outflows, as customers got higher returns from other investment options, turned out to be a major headwind for banks. Though the situation has stabilized since then, investors remain concerned about the stringent capital regulations that might come from the regulators following the bank failures.

While the Fed paused the interest rate hike at the June FOMC meeting, the rates remain at a 15-year high of 5-5.25%. Also, the Fed officials left the door open for more hikes later in the year and signaled to keep the rates high for longer. They now see the Fed fund rates peaking at 5.6% in 2023, up from the previous March projection of 5.1%.

This is expected to take a further toll on the banks’ top-line performance because of rising funding costs and waning loan demand. Several banks lowered their full-year 2023 revenue guidance after taking into account these recent developments, as the operating environment isn’t likely to change much.

Fundamentally Solid Banks

JPMorgan: The largest U.S. bank, JPMorgan, is expected to keep benefiting from higher rates, loan growth, strategic buyouts, business diversification efforts, strong liquidity position and initiatives to expand the branch network in new markets.

In May, JPM took over the failed First Republic Bank for $10.6 billion after almost two months of joint efforts with other lenders to save the flagging institution. The deal added deposits of almost $92 billion, roughly $173 billion of loans and $30 billion of securities to the banking behemoth’s balance sheet. The company expects NII to jump nearly 26% to $84 billion this year.

This Zacks Rank #3 (Hold) lender has been an active acquirer of late. These efforts are expected to keep aiding its plan to diversify revenues and expand the fee income product suite and consumer bank digitally. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

By expanding its footprint in newer markets, JPMorgan will be able to improve cross-selling opportunities by increasing its presence in the card and auto loan sectors. The company also launched its digital retail bank Chase in the U.K. in 2021 and continues to expand investment banking and asset management operations in China.

JPMorgan has a solid capital deployment plan. Following the clearance of the 2023 stress test, the company intends to increase its dividend by 5% to $1.05 per share. This follows no change in the dividend payout last year. Also, it plans to continue with its previously announced share repurchase program worth $12 billion this year. Driven by a strong capital position and earnings strength, the company is expected to sustain current capital deployments.

Wells Fargo: One of the largest banks in the country, Wells Fargo has been grappling with numerous penalties and sanctions, including a cap on the asset position by the Fed subsequent to the revelation of the sales scandal in 2016. Though the bank has taken several steps to overcome these matters, it still has a long list of pending legal cases and remains under close supervision of the regulatory authorities.

Wells Fargo’s prudent expense management initiatives support its financials. Cost-saving efforts such as streamlining organizational structure, closing branches and reducing headcount have aided its bottom line. The company delivered gross expense savings aggregating $7.5 billion in 2021 and 2022. WFC expects to continue with these initiatives this year. Management expects non-interest expenses (excluding operating losses) to be $50.3 billion in 2023, down from $57.3 billion in 2022.

Wells Fargo, once one of the top mortgage players, is revamping its home lending operation by reducing its mortgage servicing portfolio and exiting the correspondent lending business. As the demand for mortgages and refinancing activities continue to wane due to higher rates, the company is executing this plan to “continue to reduce risk in the mortgage business.”

After passing the 2023 stress test process, this Zacks Rank #3 bank announced plans to increase its third-quarter dividend by 17% to 35 cents per share. It also noted that over the four-quarter period beginning third-quarter 2023, there is capacity to repurchase shares. In first-quarter 2023, it repurchased 86.4 million shares and 164 million shares remained under the buyback authorization.

Citigroup: As a globally diversified financial services holding company, Citigroup continues to increase its fee-based business mix and shrink non-core assets. The company has been investing in growth opportunities across wealth and commercial banking, treasury and trade solutions, and securities service businesses to grow fee revenues across the Institutional Clients Group segment.

C is streamlining operations internationally. In sync with this, the company announced a major strategic action in April 2021 to exit consumer banking across 14 markets in Asia, Europe, the Middle East and Mexico. Since then, it has signed deals to divest consumer businesses in nine markets and completed sales in seven markets, including Australia, Bahrain, Malaysia, the Philippines, Thailand, Vietnam and India.

This Zacks Rank #3 company is also winding down its consumer business in China and Korea, whereas, in Russia, it is wrapping up all its business. Further, this May, Citigroup revealed its plan to pursue an IPO of the Mexican business in 2025.

Such exits will free up capital and help the company pursue investments in wealth management operations in Singapore, Hong Kong, the UAE and London to stoke growth. These efforts will likely help augment the company’s profitability and efficiency over the long term.

Similar to JPM and WFC, Citigroup will continue to benefit from a higher interest rate regime and decent loan growth. For 2023, management expects revenues (excluding 2023 divestiture-related impacts) to be $78-$79 billion, up 3-5% year over year.

Following the clearance of the 2023 stress test, C announced plans to increase the quarterly dividend by 4% to 53 cents per share. Also, it was the only large bank whose stress capital buffer requirement will increase to 4.3% from 4% effective from Oct 1, 2023, through Sep 30, 2024. Moreover, the company repurchased shares worth $1 billion in second-quarter 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance