These 3 Stocks Popped Following Quarterly Results

Earnings season continues its rapid pace this week, as we’ve got another full slate of companies scheduled to report. So far, we’ve seen many positive surprises, helping to keep sentiment in check amid a recent FOMC announcement and other economic data readings.

Concerning positive surprises, the shares of three companies – Shopify SHOP, Roku ROKU, and DraftKings DKNG – all saw notable buying pressure following their respective releases, with their quarterly results pleasing the market.

Given the positivity surrounding their results, the post-earnings momentum could easily continue. Let’s take a closer look at each.

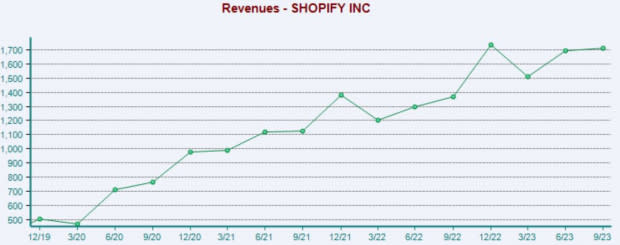

Shopify

Shopify provides a multi-tenant, cloud-based, multi-channel e-commerce platform for small and medium-sized businesses. Concerning headline numbers, Shopify exceeded the Zacks Consensus EPS Estimate by a sizable 130% and reported revenue 4% ahead of expectations, both well above year-ago figures.

The company’s top line strength has been remarkable.

Image Source: Zacks Investment Research

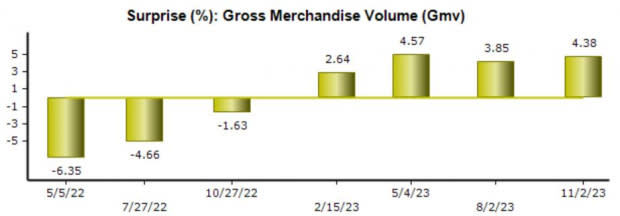

Concerning key metrics, Gross Merchandise Volume (GMV) is commonly focused on among investors within Shopify’s quarterly results. For the quarter, GMV totaled $56.2 billion, reflecting growth of 22% or $10 billion from the same period last year.

The company has consistently exceeded consensus expectations surrounding GMV, as shown below.

Image Source: Zacks Investment Research

On a year-over-year basis, operating income climbed from a loss of -$346 million to $122 million, free cash flow improved to $276 million compared to -$148 million, and the company’s gross margin improved to 52.6% vs. 48.5%. All these metrics reflect improved financial health, helping to explain the post-earnings pop in shares.

Investors will have to fork up a premium for shares, reflective of the company’s high-growth trajectory. Currently, SHOP shares trade at an 11.3X forward price-to-sales (F1), undoubtedly expensive but below the 22.7X five-year median.

Image Source: Zacks Investment Research

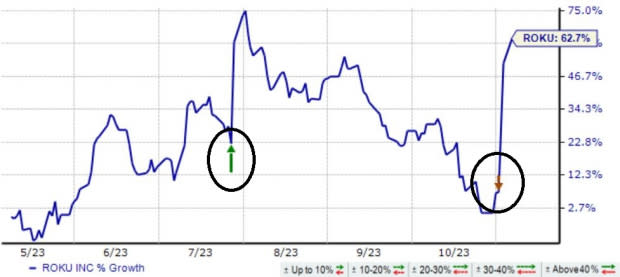

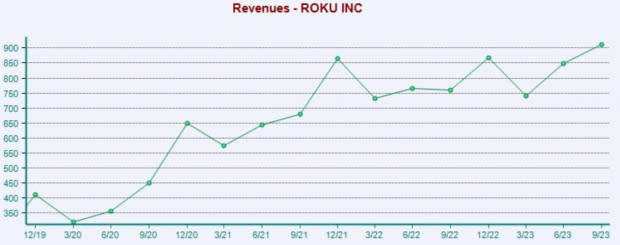

Roku

Roku pioneered streaming on TV, connecting users to content, enabling content publishers to build and monetize large audiences, and providing advertisers with unique capabilities to engage consumers. Shares have seen a boost post-earnings in back-to-back releases, as we can see illustrated below.

Image Source: Zacks Investment Research

Concerning headline numbers, Roku fell short of the Zacks Consensus EPS Estimate but delivered a 6.4% revenue beat, with sales showing year-over-year growth of 20%. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Active Accounts, a key metric for ROKU, showed solid growth, climbing 16% year-over-year to 75.8 million. Consumers have also been streaming more relative to the same period last year, with Streaming Hours seeing a 22% increase. And to put the cherry on top, cost reductions implemented by the company allowed it to deliver positive adjusted EBITDA, reported at $43 million.

DraftKings

DraftKings is a digital sports entertainment and gaming company with products that range across daily fantasy, regulated gaming, and digital media. The company posted results well above expectations, beating the Zacks Consensus EPS Estimate by nearly 30% and delivering a 15% revenue surprise.

DraftKings’ revenue growth has remained visibly strong.

Image Source: Zacks Investment Research

Continued growth in Monthly Unique Payers (MUPs) helped drive the better-than-expected results, growing 40% to 2.3 million. And they’ve extracted more cash from each customer, with Average Revenue per Monthly Unique Payer growing 14% year-over-year.

Following the robust results, DraftKings upped its FY23 revenue guidance and improved its FY23 adjusted EBITDA outlook – DraftKings now expects FY23 revenues in a band of $3.67 - $3.72 billion (vs. $3.46 - $3.54 billion previously), and expects adjusted EBITDA in a band of ($95) – ($115) million, up from the previously expected ($190) – ($220) million.

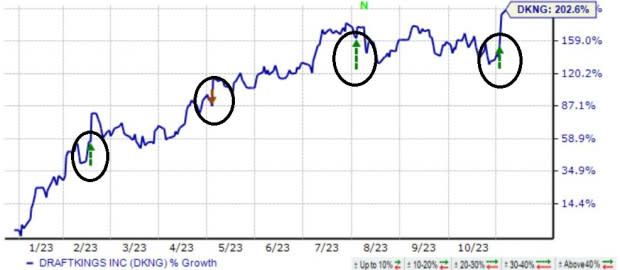

Shares have primarily seen buying pressure post-earnings in 2023, as shown below. Up 200% year-to-date, it goes without saying that DKNG shares have been big winners.

Image Source: Zacks Investment Research

Bottom Line

We’ll continue chugging through earnings season for some time, as many companies have yet to reveal quarterly results.

Still, concerning positive reactions, all three companies above – Shopify SHOP, Roku ROKU, and DraftKings DKNG – enjoyed precisely that post-earnings, with shares of each popping.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance