3 Solid Dividend Stocks In The UK With Yields Ranging From 3.8% To 8.1%

The UK stock market is showing signs of resilience, with the FTSE 100 poised for a fourth consecutive day of gains after a prolonged slump. In such a recovering market environment, dividend stocks can be particularly appealing as they offer investors potential income stability and growth prospects.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.00% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.64% | ★★★★★☆ |

DCC (LSE:DCC) | 3.45% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.21% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.90% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.81% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.76% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.32% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.22% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.78% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

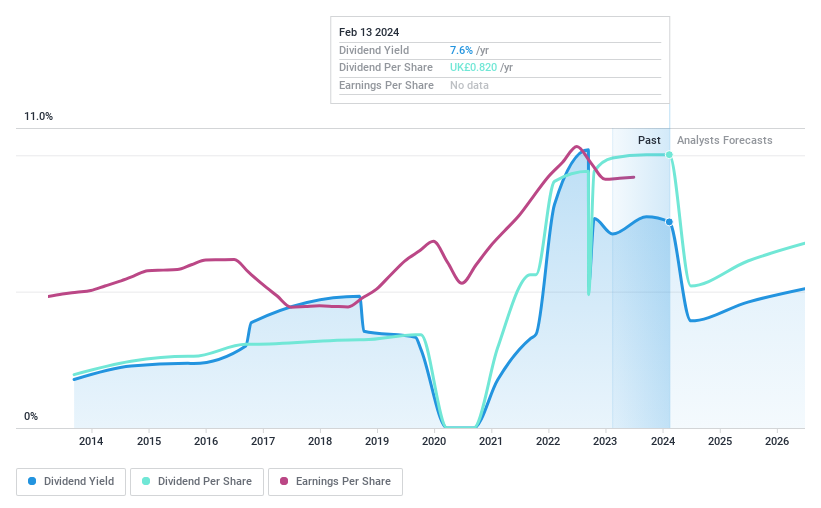

Dunelm Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a retailer specializing in homewares across the United Kingdom, with a market capitalization of approximately £2.19 billion.

Operations: Dunelm Group plc generates its revenue primarily through the sale of homewares, totaling £1.68 billion.

Dividend Yield: 7.2%

Dunelm Group's dividend yield of 7.21% ranks well above the UK market average, reflecting a robust income stream for investors. The company has consistently increased its dividend over the past decade and maintains a sustainable payout with an earnings coverage ratio at 58.1% and cash flow coverage at 74.8%. However, investors should note the volatility in dividend payments over the same period, indicating some level of unpredictability in future distributions. Recent trading updates show solid sales performance, with year-to-date revenues reaching £1.31 billion, supporting ongoing dividend affordability.

Navigate through the intricacies of Dunelm Group with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Dunelm Group's share price might be too pessimistic.

SThree

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SThree plc is a specialist recruitment firm operating in the STEM sectors across various countries including the UK, Austria, Germany, and the US, with a market capitalization of approximately £576.35 million.

Operations: SThree plc generates its revenue primarily from the USA (£328.29 million), DACH region (£524.73 million), Rest of Europe (£399.86 million), Middle East & Asia (£42.64 million), and the Netherlands including Spain (£367.64 million).

Dividend Yield: 3.8%

SThree plc approved a final dividend of 11.6 pence per share at its recent AGM, signaling ongoing commitment to shareholder returns despite historical volatility in dividend payments. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 39.1% and 32.6% respectively, suggesting sustainability from a financial perspective. However, the dividend yield stands at 3.83%, which is lower compared to the top UK dividend payers. Recent executive changes and auditor appointments indicate strategic adjustments that could impact future performance.

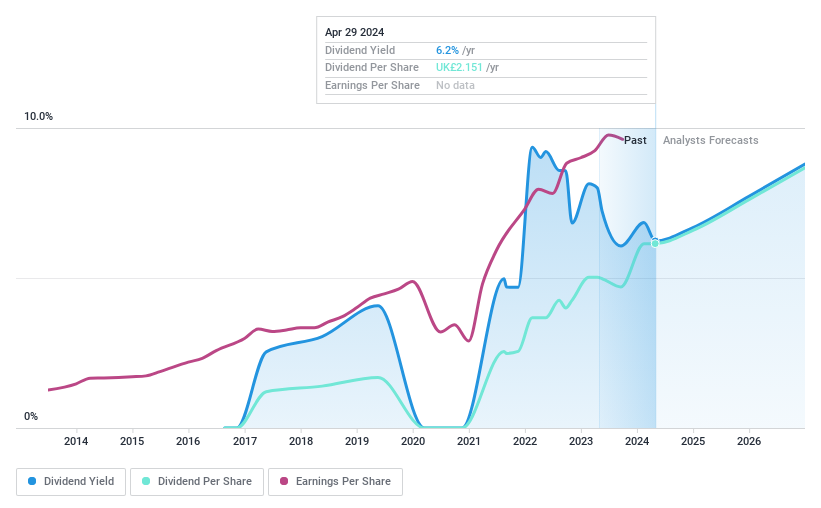

TBC Bank Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates in the financial sector, offering services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.35 billion.

Operations: TBC Bank Group PLC generates its revenue primarily from banking, leasing, insurance, brokerage, and card processing services across multiple countries.

Dividend Yield: 8.1%

TBC Bank Group's dividend sustainability is supported by a low payout ratio of 33.5%, with forecasts showing continued coverage over the next three years. Despite a relatively short history of dividend payments, the bank has increased its dividends consistently in its seven-year history. Recent financial performance shows robust growth, with net income rising to GEL 292.81 million in Q1 2024 from GEL 248.67 million the previous year, reinforcing its capacity to maintain dividends. However, concerns about a high bad loans ratio at 2.1% and insufficient allowance for these loans at 74% may pose risks to future payouts.

Take a closer look at TBC Bank Group's potential here in our dividend report.

Our valuation report here indicates TBC Bank Group may be undervalued.

Taking Advantage

Unlock more gems! Our Top Dividend Stocks screener has unearthed 53 more companies for you to explore.Click here to unveil our expertly curated list of 56 Top Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:DNLM LSE:STEM and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance