3 SME Sectors That Expanded The Most In Third Quarter Of 2022 (And One That Contracted)

It’s been six months since the safe management measures (SMMs) imposed during the coronavirus pandemic were relaxed in Singapore. Since then, most businesses have gone back to normal, and Singapore is once again hosting international events like the F1 Singapore Grand Prix.

This has benefited many industries and businesses, as shown by the broad-based seventh consecutive quarter increase in the OCBC SME Index since 1Q2021. Additionally, the advanced estimates from the Ministry of Trade and Industry (MTI) also show that Singapore’s GDP grew by 4.4% on a year-on-year basis in the third quarter of 2021.

The OCBC SME Index is based on the transactional data of SMEs and aims to serve as a gauge of SME business health and performance. A Score above 50 represents improved health, while a score below 50 shows a deterioration compared to the same period a year ago.

Based on the OCBC SME Index, we find out which SME sectors have done the best and worst in the third quarter of 2022.

Read Also: OCBC SME Index: How Small Businesses Can Use Data To Forecast Their Industry Direction

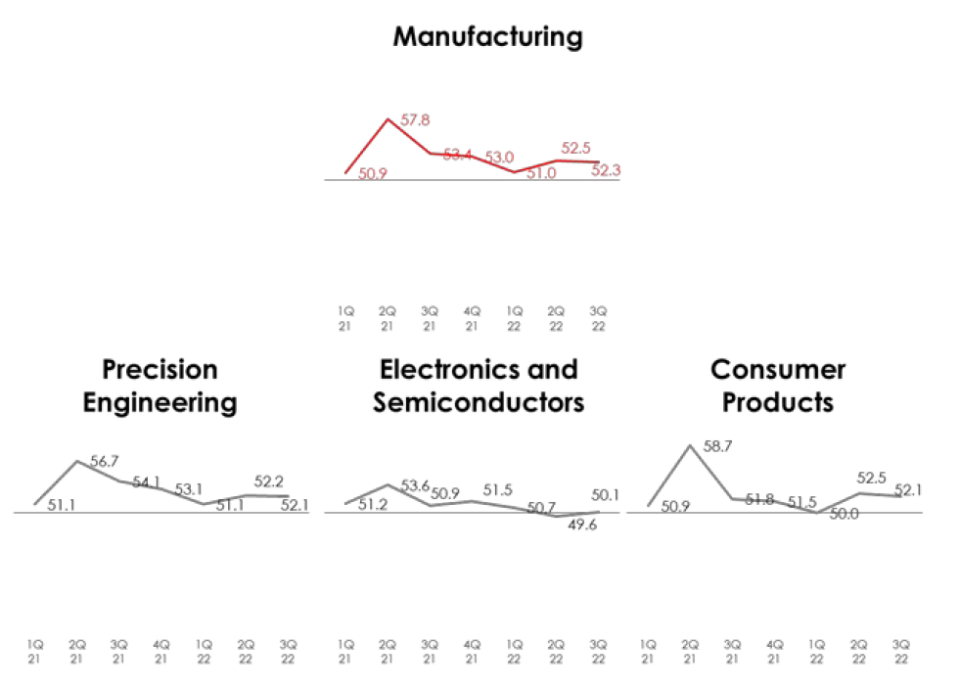

Most Expanded Sector: #3 Manufacturing

OCBC SME Index Score: 52.3

The manufacturing sector, which is the largest component of Singapore’s economy, making up around 21% of our GDP, is one of the three sectors that performed strongly in the third quarter of 2022.

OCBC SME Index score for Manufacturing dropped slightly by 0.2 points from the previous quarter’s score of 52.5, but the sector’s growth was maintained by the strong demand from the precision engineering and consumer segments.

Even though the electronics and semiconductors segment also did better in 3Q, businesses are remaining cautious about the second half of 2022 as demand for electronics slows along with the persistent supply chain issues affecting the industry’s growth.

Read Also: Guide To Jurong Innovation District – Singapore’s Advanced Manufacturing Hub

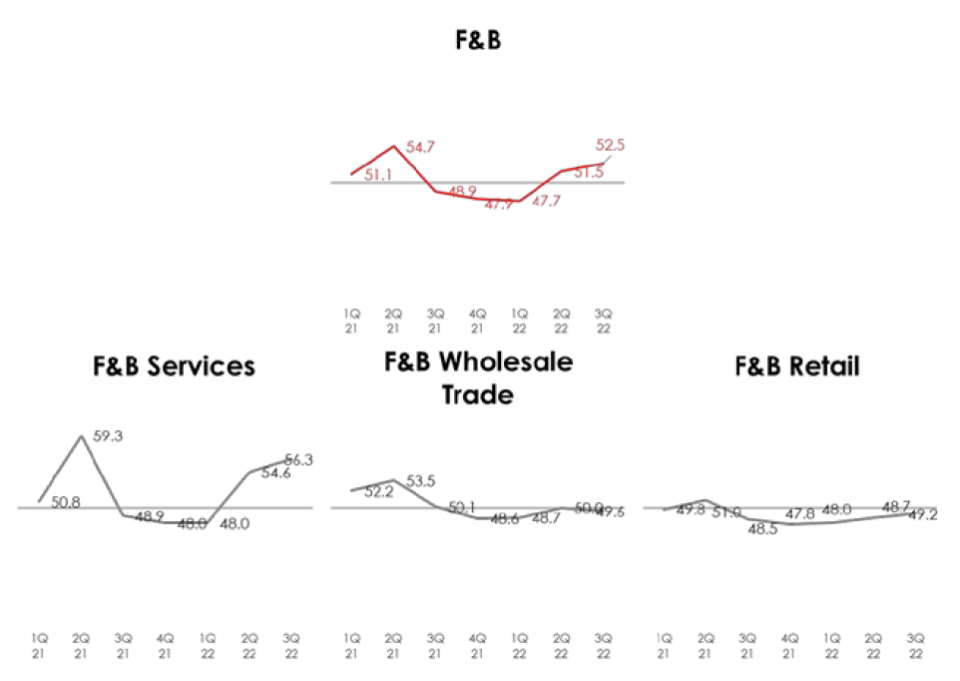

Most Expanded Sector: #2 F&B

OCBC SME Index Score: 52.5

The F&B is the most improved sector in 2022 after recording a low 47.7 score in 1Q2022.

The rebound is not surprising given the lifting of the SMMs and capacity limits for F&B settings since April, which have benefited the F&B services segment the most. This is the second consecutive quarter of a significant increase for the F&B services segment, which has contributed the most to the overall growth of the F&B industry.

Other segments like the F&B wholesale trade and F&B retail, have scored below 50, which indicates a poorer performance compared to a year ago.

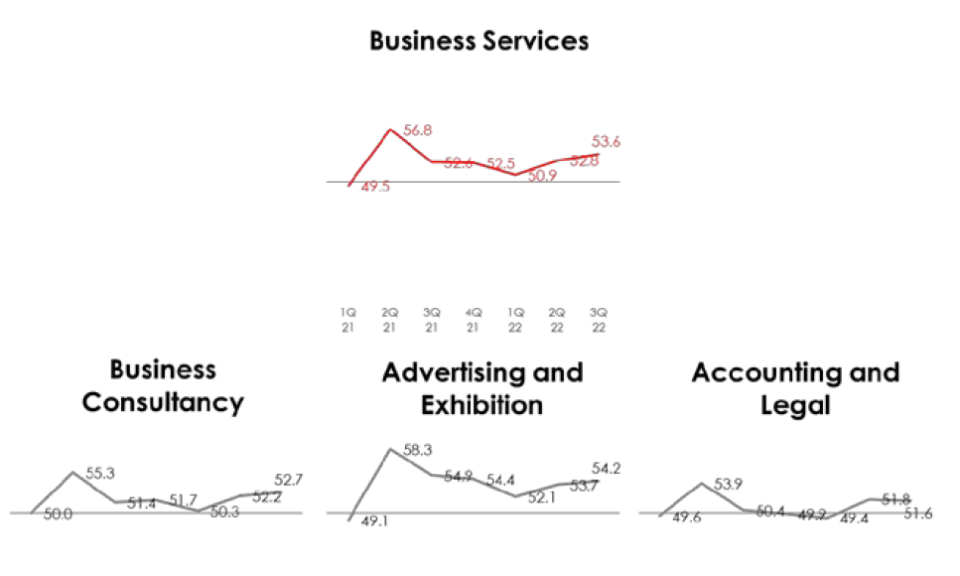

Most Expanded Sector: #1 Business Services

OCBC SME Index Score: 53.6

The sector that grew the most in 3Q2022 was business services, which make up about 5.8% of our GDP and employ a lot of skilled workers and professionals.

In the industry, the business consultancy and advertising and exhibition segments lifted the sector with consecutive quarters of growth. In particular, the advertising and exhibition segments are boosted by the resumption of meetings, incentives, conferences, and exhibitions (MICE) activities and major tourism events. As businesses in all sectors reopened after the SMMs were eased, there has also been a rise in demand for business consulting.

Though the accounting and legal segment produced a flat performance, it’s worth noting that they are still in expansionary territory compared to a year ago.

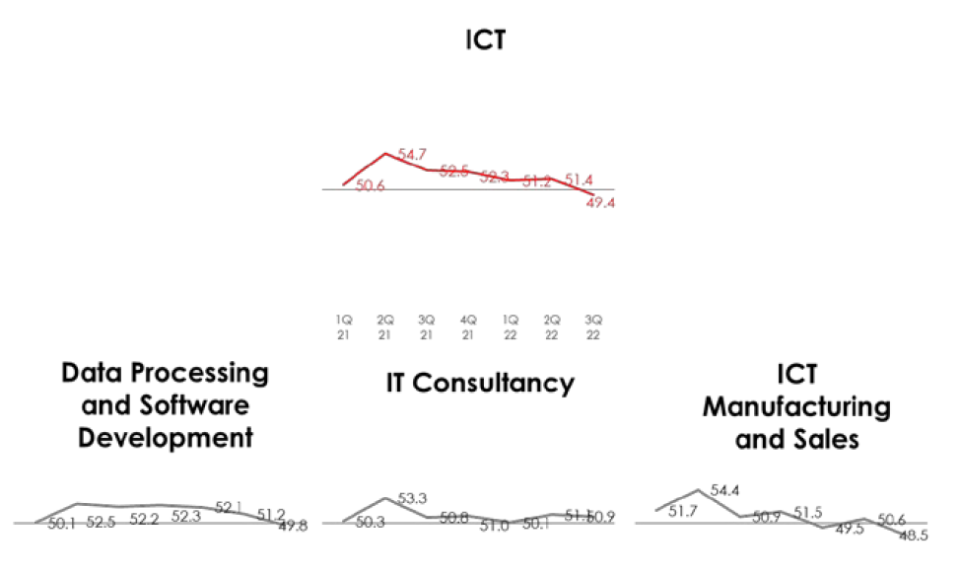

Contracted Sector: Information, communication and technology (ICT)

OCBC SME Index Score: 49.4

Among the eleven industries that the OCBC SME Index tracks, only the Information, communication and technology (ICT) sector went into contraction territory with a Score of 49.4. The ICT sector contributed to around 5.6% of our nominal GDP in 2021.

The ICT sector was dragged down by the poorer performance from the data processing and software development segment, which dropped from a score of 51.2 in 2Q2022 to 49.8 in 3Q2022, and the ICT manufacturing and sales segment, which dropped from a score of 50.6 in 2Q2022 to 48.5 in 3Q2022.

The OCBC SME Index report says that a global shortage of chips and uncertainty in the supply chain have slowed growth in the ICT manufacturing and sales sectors. Meanwhile, only the IT consultancy segment continues to remain above the 50-Score baseline in 3Q2022.

4Q2022 Might See Slower Growth Due To Sustained Global Uncertainties

The OCBC SME Index report expects Singapore’s GDP to continue growing in the 4Q2022, but at a moderate pace. This is also backed by the lower forecast revision by the MTI for 2022 from “3.0 to 5.0%” to “3.0 to 4.0%”.

Many of the headwinds, like geopolitical tensions, high inflation, and rising interest rates, could slow growth in Singapore’s major trading partners, which could have a spillover effect here.

Additionally, MAS has also tightened its monetary policy for the fifth time this year, by allowing the Singapore dollar to appreciate in relation to the elevated inflation. This may have implications for SMEs involved in cross-border transactions for 4Q2022.

The post 3 SME Sectors That Expanded The Most In Third Quarter Of 2022 (And One That Contracted) appeared first on DollarsAndSense Business.

Yahoo Finance

Yahoo Finance