3 SGX Dividend Stocks Offering Up To 6.7% Yield

In recent developments, BNP Paribas has strengthened its technological capabilities through a significant partnership with Mistral AI, highlighting a growing trend of integrating advanced artificial intelligence within the financial sector. This move underscores the broader market's embrace of innovative technologies to enhance efficiency and customer service. In this context, selecting dividend stocks that demonstrate robust business models and potential for steady performance could be particularly prudent for investors looking at opportunities in the Singapore market.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.02% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.15% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.78% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.76% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.74% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.68% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.52% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 6.79% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.70% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

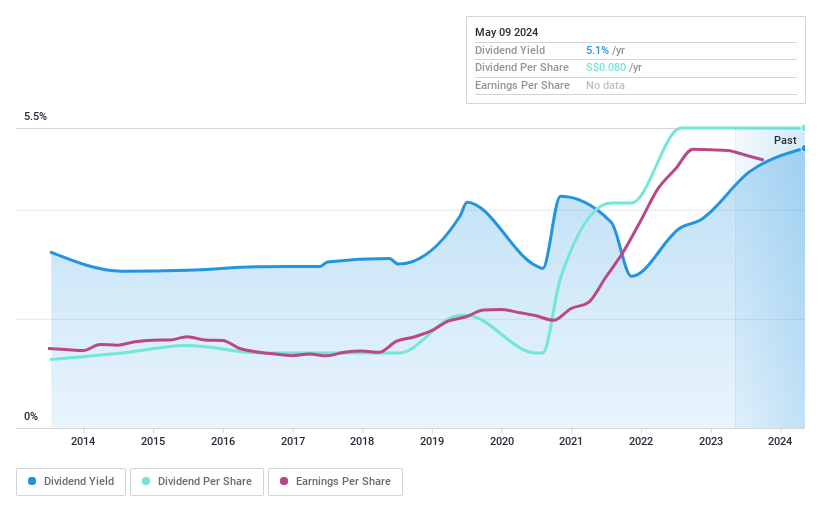

Hour Glass

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited operates as an investment holding company specializing in the retail and distribution of watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of approximately SGD 1.04 billion.

Operations: The Hour Glass Limited generates SGD 1.13 billion primarily through the retail and distribution of luxury watches and jewelry across multiple Asian-Pacific markets.

Dividend Yield: 5%

Hour Glass has shown inconsistent dividend reliability over the past decade, with significant annual fluctuations exceeding 20% drops. Despite this, the dividends are well-supported by earnings and cash flows, with a payout ratio of 33.5% and a cash payout ratio of 46.3%. Recently, Hour Glass maintained its annual dividend at SGD 0.06 per share for FY2024, totaling approximately SGD 39 million. However, its dividend yield at 5% remains below the top quartile in Singapore's market.

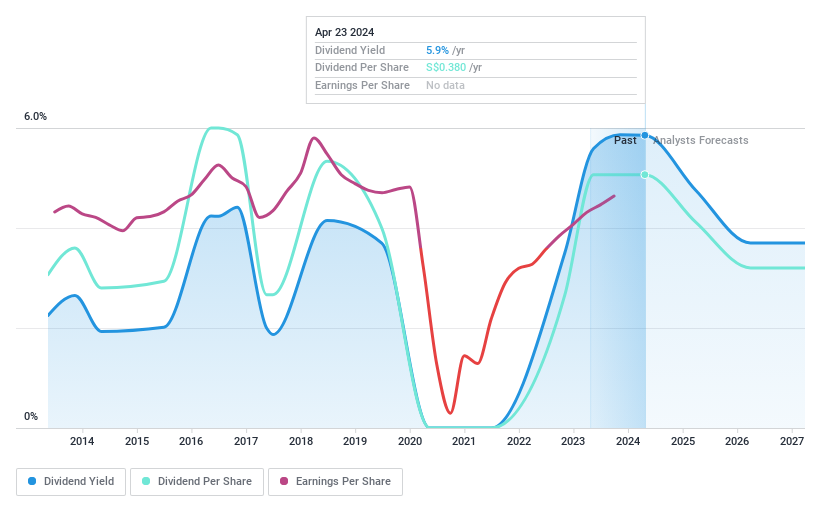

Singapore Airlines

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Airlines Limited operates in passenger and cargo air transportation under the Singapore Airlines and Scoot brands across various regions including East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa, with a market capitalization of SGD 25.21 billion.

Operations: Singapore Airlines Limited generates revenue primarily through its Full Service Carrier segment at SGD 16.18 billion, followed by its Low-Cost Carrier operations at SGD 2.45 billion, and Engineering Services contributing SGD 1.09 billion.

Dividend Yield: 6.8%

Singapore Airlines has a volatile dividend history, with payments not consistently growing over the past decade. Despite this, its dividends are reasonably covered by earnings and cash flows, with a payout ratio of 75.9% and a cash payout ratio of 45.9%. The company's dividend yield stands at 6.79%, positioning it in the top quartile of Singapore market payers. However, earnings are projected to decline by an average of 21.3% annually over the next three years.

Get an in-depth perspective on Singapore Airlines' performance by reading our dividend report here.

Our expertly prepared valuation report Singapore Airlines implies its share price may be too high.

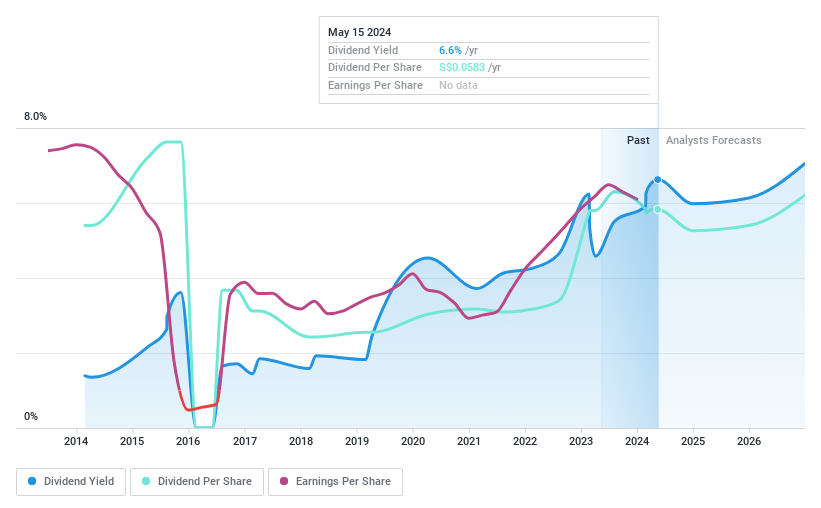

Delfi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that specializes in manufacturing, marketing, distributing, and selling chocolate and chocolate confectionery products across Indonesia, the Philippines, Malaysia, Singapore, and other international markets with a market capitalization of SGD 528.65 million.

Operations: Delfi Limited generates revenue primarily through its operations in Indonesia, which brought in SGD 370.41 million, and its regional markets contributing SGD 185.07 million.

Dividend Yield: 6.7%

Delfi Limited, despite a high dividend yield of 6.74%, faces challenges with its dividend sustainability. The cash payout ratio is significantly high at 17.77 times, indicating dividends are not well covered by free cash flows. Additionally, the company's dividends have shown volatility and unreliability over the past decade, with no consistent growth pattern observed. Analysts expect a potential stock price increase of 28.6%, but earnings forecasts remain modest at an annual growth rate of 3.07%.

Click here to discover the nuances of Delfi with our detailed analytical dividend report.

Our valuation report unveils the possibility Delfi's shares may be trading at a discount.

Turning Ideas Into Actions

Investigate our full lineup of 21 Top SGX Dividend Stocks right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AGS SGX:C6L and SGX:P34.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance